The Bitcoin sign has ostensibly persisted down in its bearish route, which started within the second week of October. After slipping under the psychological $100,000 give a steal to, worries maintain surfaced amongst Bitcoin market participants referring to the broader market construction. Curiously, the most novel on-chain evaluate justifies this bother, because the map back bias for the Bitcoin sign appears to be on the upward thrust.

Binance Taker Imbalance Falls Into Unfavorable Territory

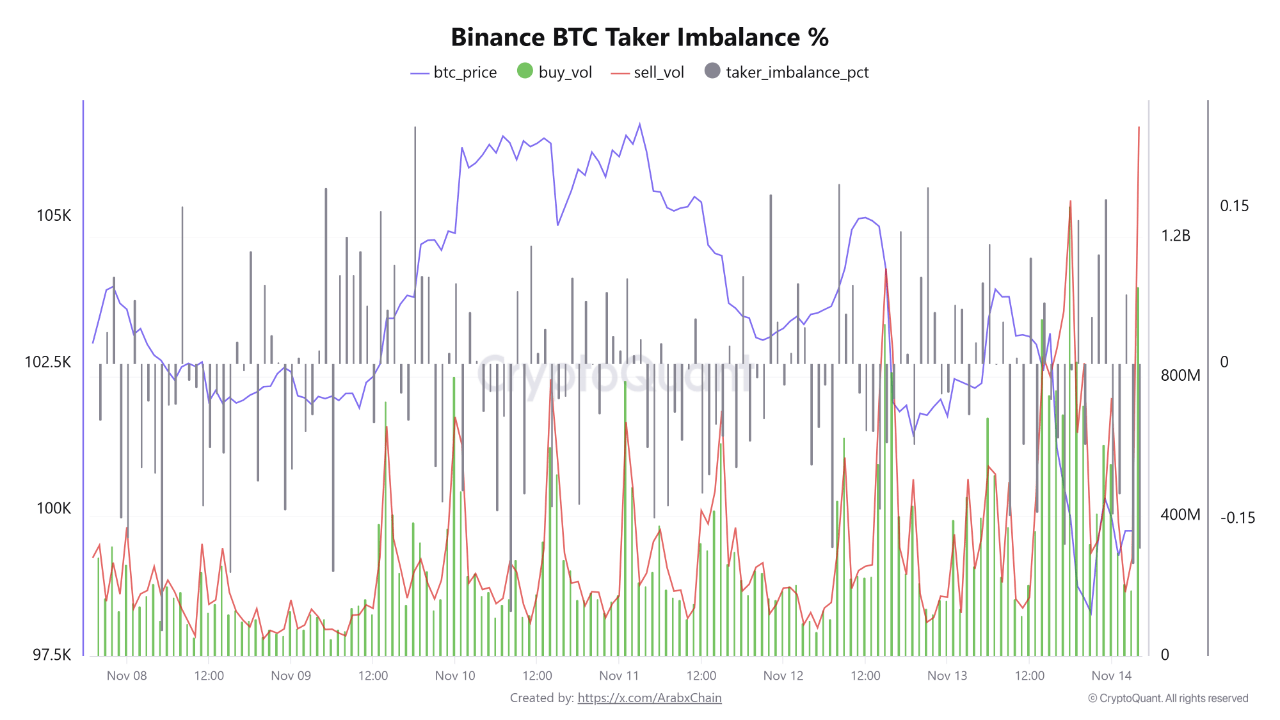

In a Quicktake post on the CryptoQuant platform, on-chain compare firm Arab Chain printed an lengthen in promote-aspect momentum for Bitcoin on Binance, the area’s excellent substitute by buying and selling quantity.

This revelation revolves right throughout the BTC Taker Imbalance % metric, which tracks whether the market is dominated by aggressive traders or sellers. Narrowing it down, this metric supplies insights into taker advise on Binance.

Since the metric works by revealing the proportion difference between taker aquire quantity and taker promote quantity, readings with certain values point out the dominance of traders available within the market. On the different, unfavorable readings expose a vendor-dominated market.

As Arab Chain reported, there became as soon as an evident spike within the quantity of promoting strain in recent hours. A Taker Imbalance % learning of -0.17%, which customarily shows persisted bearish motion, helps this observation.

Moreover, the compare firm pointed out that there became as soon as an evident difference between the selling and procuring for volumes now not too long within the past. The Quicktake post printed a file of $1.517 billion in selling quantity against $1.058 billion dedicated to procuring for energy, making it obvious what celebration is currently a hit this Bitcoin sign tussle.

Is $92,000 The Subsequent Bitcoin Ticket Purpose?

What’s attention-grabbing is, the recent vendor-dominated market has triggered the BTC sign to repeatedly hover right throughout the main $94,000 stage. Arab Chain smartly-known that every strive by the Bitcoin sign to upward thrust has confronted better amount of promote resistance, dousing any extreme bullish momentum.

The gray bars within the above chart point out that this increasing bearish strain would possibly maybe now not proper be a market correction; as a replace, it shows a recurrent injection of promote-strain, one which Arab Chain implied would at last defeat the weaker aquire-aspect liquidity at the recent give a steal to.

In the seemingly space where more bearish momentum is injected to push the market to the map back, the following stage, which would possibly maybe act as a cushion for sign, lies spherical $92,000.

If a main amount of liquidity is now not launched to neutralize the dominance of Bitcoin’s sellers, the Bitcoin sign would possibly maybe discover deeper bearish correction. At press time, Bitcoin is valued at $96,241, reflecting a virtually 2% loss within the past day.