The Bitcoin label has these days confirmed signs of restoration, mountaineering help to the $58,000 stage after hitting a 5-month low of $Fifty three,500. Then all over again, technical prognosis means that the digital asset would per chance unbiased battle to surpass an crucial indicators, presumably revisiting decrease label ranges.

In a recent post on social media platform X (beforehand Twitter), market skilled Jackis highlights the bearish D1 pattern indicator on the 12-hour chart, indicating the necessity for Bitcoin to reclaim the $64,000 zone to reverse the current bearish day-to-day pattern.

Without reference to this cautionary outlook, there are encouraging signs, at the side of valuable inflows to Bitcoin trade-traded funds (ETFs) and prolonged-timeframe holders gathering extra BTC.

BTC Struggles To Destroy Bearish Vogue

Without reference to the sizzling restoration, Bitcoin’s technical prognosis means that the bearish pattern remains. Jackis emphasizes that despite the proven truth that the Bitcoin label makes a brand recent leg higher to $60,300, the D1 pattern indicator remains bearish except BTC manages to recapture the $64,000 zone, which has already confirmed to be a valuable resistance for the bulls, as the worth of BTC failed to breach it on its earlier attempt on July 1st.

Per Jackis’ prognosis, the goal vary for the next day-to-day leg is projected to be between $51,000 and $49,000, with a pivotal stage at $63,800 that bulls must goal to reverse the day-to-day pattern.

Then all over again, there could be capacity to reverse this location as “dip investors” personal returned, ensuing in valuable inflows into the US Bitcoin ETF market, supporting the Bitcoin label this week to forestall a deeper retracement with consecutive days of inflows to control selling stress from the German authorities’s holdings.

ETF Inflow Knowledge And Bitcoin Impress Performance

JPMorgan recordsdata displays that location Bitcoin ETFs witnessed inflows of $882 million all the plan thru the week ending July 11, with a mean of $175 million per day, marking the very ultimate inflows since May presumably presumably also unbiased 23.

BlackRock’s IBIT ETF and Fidelity’s FBTC led the surge, attracting $403 million and $361 million, respectively. Then all over again, Grayscale’s ETF persevered its pattern of outflows, shedding nearly $87 million after three weeks of outflows within the ETF market totaling over $1.1 billion.

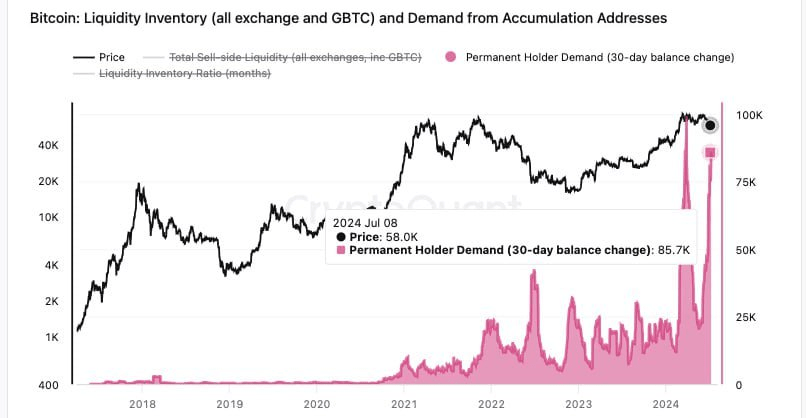

Supporting the bullish outlook, crypto analyst CryptoSoulz carried out an in-depth prognosis of Bitcoin’s label efficiency in July, finding that prolonged-timeframe holders personal amassed BTC, having purchased over 85,000 BTC within the past 30 days.

Per the analyst, this accumulation by prolonged-timeframe holders is a bullish catalyst for the worth, indicating self belief in Bitcoin’s capacity.

CryptoSoulz, akin to Jackis, means that Bitcoin is currently finding toughen within the higher time physique (HTF), looking ahead to a jump from this stage, in particular fascinated with the sizzling bearish recordsdata.

Then all over again, the analyst additional defined that if the Bitcoin label fails to preserve above the $54,000 zone within the arrival days, the next stage of toughen is expected at $49,500.

When writing, the Bitcoin label stands at $58,300, surging merely 0.7% within the 24-hour time physique as BTC looks to be like to consolidate above the aforementioned an crucial ranges.