The Bitcoin label this present day is trading advance $118,400 after failing to defend above the $120,000 breakout degree. Whereas momentum from early July’s rally pushed BTC in direction of contemporary 2025 highs, recent candles indicate signs of exhaustion below the upper boundary of a key ascending triangle. This structural slowdown is accompanied by mixed derivatives signals and fading dominance, suggesting bulls are going by means of increasing resistance.

What’s Occurring With Bitcoin’s Ticket?

On the 4-hour chart, Bitcoin label action stays above the 20/50/100/200 EMA cluster, which now aligns between $116,420 and $113,653, suggesting merchants restful hang medium-timeframe alter. On the opposite hand, label is struggling to shut above the Bollinger Band mid-line at $118,727, whereas the upper band advance $122,056 continues to reject further upside. Contemporary candlesticks present decrease wicks and diminished physique size, a price of purchaser hesitation advance key resistance.

On the each day chart, BTC no longer too long ago broke out from a protracted-timeframe ascending triangle but is now stalling advance the horizontal resistance at $120,000. This zone, beforehand untapped since December 2024, has ended in consolidation no topic the trim trendline destroy. The apex compression sample generally outcomes in aggressive breakouts, but Bitcoin’s failure to elongate beyond $120K weakens bullish momentum.

The Chande Momentum Oscillator shows values above 64.8 but has started to curve a small bit downward, in general an early warning of fatigue in stable trends. With label compressing between the Bull Market Toughen Band (now at $100,297) and rising wedge resistance, merchants are staring at carefully for resolution.

In the period in-between, the Parabolic SAR stays below the price, suggesting pattern continuation. Nonetheless the On-Steadiness Quantity (OBV) indicator has flattened at 1.84M, reflecting stagnating inflow.

Why Is The Bitcoin Ticket Going Down Right now?

Why Bitcoin label going down this present day stems largely from fading momentum all the way by means of multiple indicators and weakening BTC dominance. The weekly BTC dominance chart confirms a breakdown from a rising wedge, with RSI falling sharply to 50.98. MACD also confirms bearish crossover territory, suggesting a doable risk-off rotation away from BTC and into altcoins.

On the Neat Money Ideas (SMC) chart, a recent Destroy of Structure (BOS) became adopted by a sweep of the $119.2K dilapidated high. Ticket has since failed to defend above the liquidity zone and is consolidating true below, hinting that the most modern high can also very successfully be a trap for unhurried longs. Key liquidity swimming pools spherical $108K and $100K remain unmitigated, reinforcing plot back risk if BTC loses its most modern structure.

Indicators and Derivatives Suggest Volatility Incoming

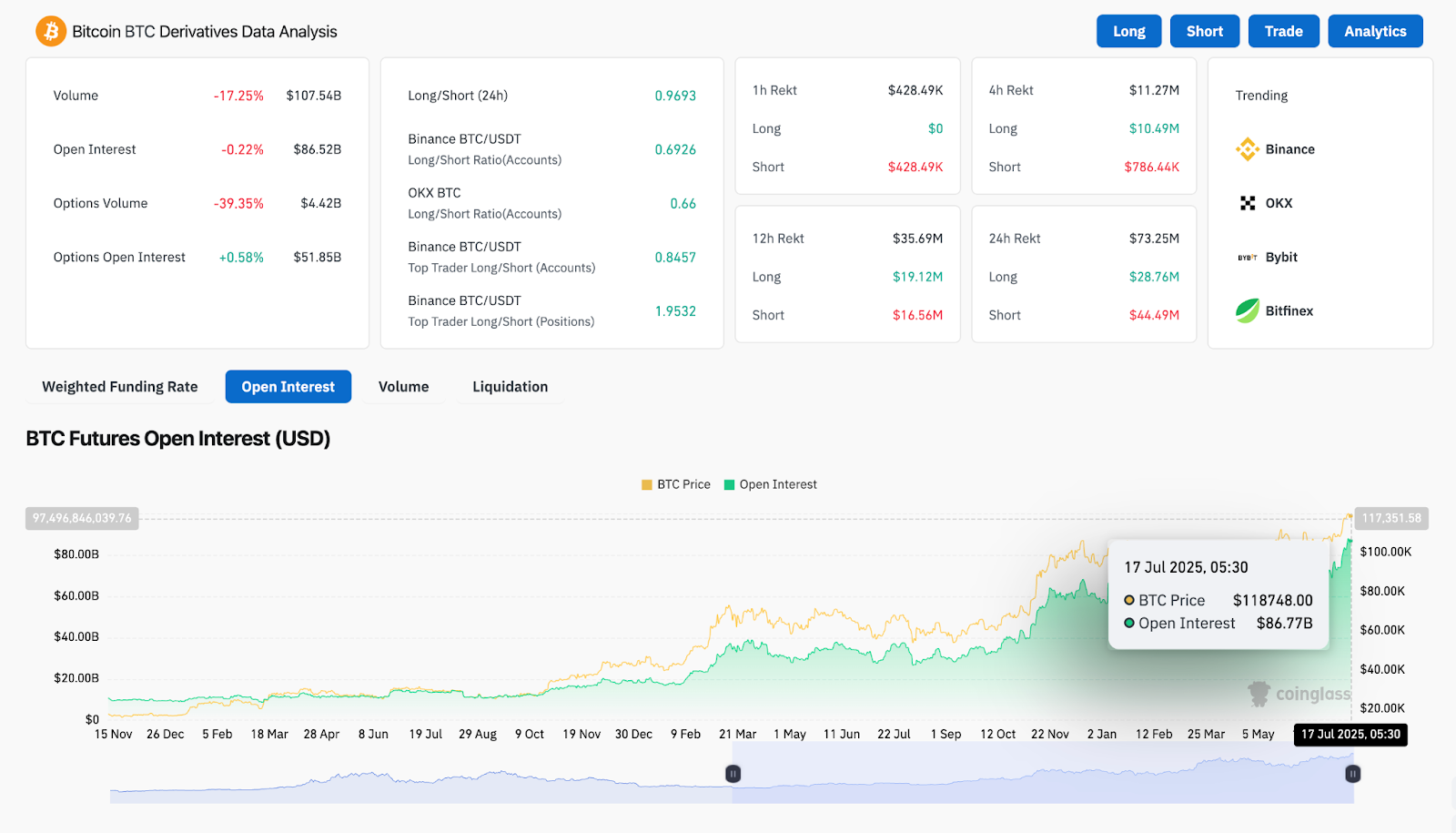

Derivatives data paints a mixed picture. Basically based fully totally on Coinglass, Bitcoin’s 24-hour quantity is down 17.25%, whereas options quantity plunged by 39.35% to $4.42B. On the opposite hand, options start pastime is up a small bit at $51.85B, and futures start pastime stays elevated at $86.77B.

The long/short ratio sits advance parity (0.969), indicating market indecision. Particularly, Binance high merchants withhold a protracted-heavy bias (1.95), suggesting institutions can also restful restful be positioned for upside no topic broader cooling.

Technical compression is also evident on the Bollinger Bands, in particular on the 4-hour chart. With band width tightening advance $118,000, the market is making ready for a volatility enlargement. Whether it resolves upward or downward is depending on the ability of bulls to reclaim $120,000 with quantity.

BTC Ticket Prediction: Short-Time length Outlook (24h)

If Bitcoin label this present day fails to decisively certain $120,000 within the subsequent session, a breakdown in direction of $116,000 and $113,600 turns into seemingly. The $115,398 Bollinger Band give a rob to on the 4-hour chart stays a advance-timeframe degree to gawk, with further plot back targets advance the liquidity clusters at $108,000 and $103,400.

On the opposite hand, if bulls reclaim $120,500 with affirmation, upside targets lie at $122,700 (greater band extension) and then $125,000, aligning with Fibonacci extensions and historical rejection zones.

No topic pattern give a rob to from EMAs and Parabolic SAR, weakening OBV and rising volatility risk can also favor short-timeframe correction forward of any sustained breakout. Merchants can also restful video display the $118,000–$120,000 zone carefully because the rapid battlefield.

Bitcoin Ticket Forecast Desk: July 18, 2025

| Indicator/Zone | Level / Signal |

| Bitcoin label this present day | $118,400 |

| Resistance 1 | $120,000 |

| Resistance 2 | $122,700 |

| Toughen 1 | $115,398 (BB Decrease) |

| Toughen 2 | $113,653 / $108,000 |

| 4H EMA Cluster | 20/50/100/200 stacked (Bullish) |

| Bollinger Bands (4H) | Tightening, breakout seemingly |

| Parabolic SAR (1D) | Below label (bullish bias) |

| OBV (1D) | Flat advance 1.84M |

| RSI (BTC Dominance) | 50.98 (falling) |

| Chande Momentum Oscillator | 64.87 (a small bit curving down) |

| SMC Destroy of Structure | $119.2K swept, consolidation below |

| Derivatives Long/Short Ratio | 0.969 (Neutral) |

| Originate Hobby (Futures) | $86.77B (elevated, risk-cushy) |

Disclaimer: The info presented listed right here is for informational and tutorial capabilities simplest. The article would not constitute financial advice or advice of any kind. Coin Version is no longer to blame for any losses incurred since the utilization of philosophize, merchandise, or services and products talked about. Readers are instructed to exercise caution forward of taking any action linked to the firm.