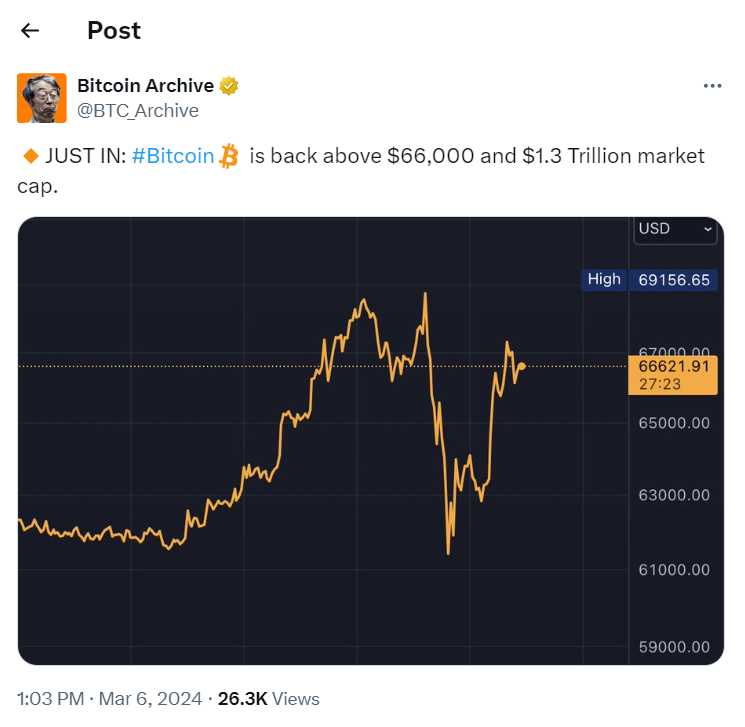

Bitcoin’s novel all-time high of $69,200 on Tuesday March 5th snappy became into a selloff, with the Bitcoin tag snappy falling practically $10,000 to reach $59.700 USD to 1 coin.

Bitcoin’s tag in USD

Then again, data true in from Bitcoin Archive on X (@BTC_Archive), says that the crypto is abet above $66,000 and now has a $1.3 trillion market cap.

On the time of this article going to press, that tag had rallied extra to $67,178.50 in USD.

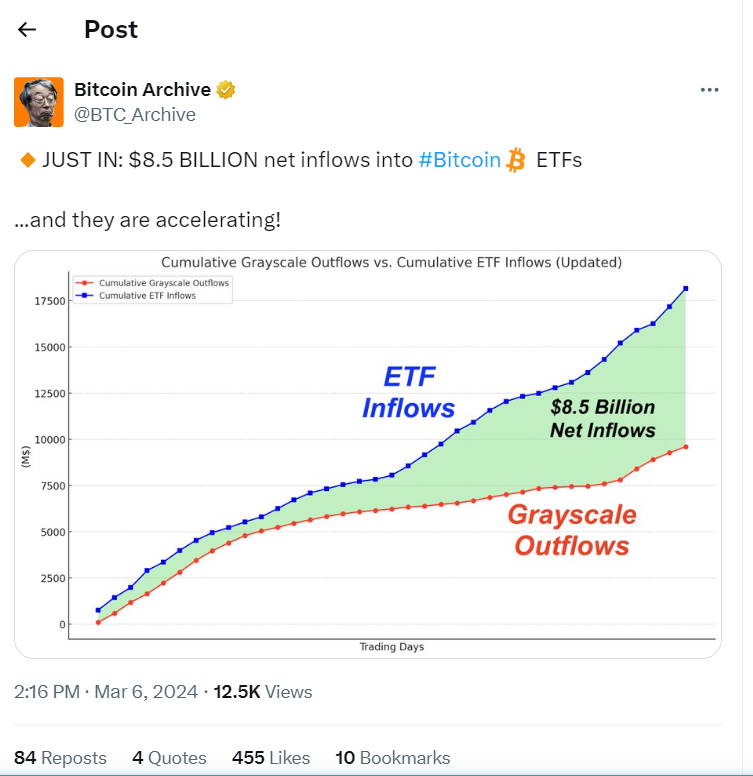

8.5 billion in inflows

That’s no longer all from Bitcoin Archive, who furthermore posted recently on X that Bitcoin ETFs glean now had $8.5 billion in bag inflows since being licensed earlier this one year.

Predicted, nonetheless still a shock

With the total pleasure all by the novel all time high Bitcoin tag that’s been brewing this week, a different of consultants predicted that Bitcoin’s tag would face a tumble as quickly as it had topped $69,000. Read our analyst’s prediction from the day gone by, as an illustration.

So why has Bitcoin rallied so hasty?

The first likely cause for Bitcoin’s rally

Tom Cohen, head trader at Algoz Skills, believes right here is attributable to continued bullishness from the approval of Bitcoin ETFs and their well-known question:

For the time being, these Bitcoin ETFs are procuring 9000 BTC coins a day and the miners are producing true 900 coins a day. Quiz is dramatically better than provide. Hence the huge tag amplify. Main as a lot as a halving of BTC, which is able to occur in April this one year, there had been 3 outdated halving bull markets and data suggests this fourth one has handiest true begun.”

The second most likely cause for Bitcoin’s rally

Rania Gule, market analyst at XS.com, mediate it will even glean more to attain with the lead-as a lot as the Bitcoin halving event occurring quickly:

Occurring approximately 60 days earlier than the Bitcoin halving event, this stage is marked by an amplify in Bitcoin’s tag attributable to investor anticipation. Prices present high volatility as traders notice a methodology of shopping for earlier than halving and promoting snappy. Caution is instantaneous, as a temporary tag tumble might per chance occur earlier than the halving – a portion I mediate the market is at show camouflage in.”

The post Bitcoin tag recovers from post all-time high mosey, nonetheless will the upward thrust withhold? regarded first on Invezz