Following the completion of the 2024 Bitcoin (BTC) halving, the level of hobby has turned to the asset’s impress trajectory, which has exhibited volatility within the short term.

Sooner than the halving occasion, Bitcoin aimed to preserve stability above the $65,000 label. Nonetheless, the leading cryptocurrency has faltered in maintaining this space, with its impress now dealing with the looming threat of dipping below.

Amidst uncertainty, a lot of crypto analysts comprise supplied insights into what to are expecting referring to Bitcoin’s valuation post-halving.

Particularly, in an X (beforehand Twitter) post on April 20, evaluation by Rekt Capital instantaneous a sample is named the ‘post-halving re-accumulation range’ which in total follows the “Bitcoin pre-halving retrace.”

In accordance with the evaluation, this pre-halving length sets the stage for the subsequent cycle in Bitcoin’s halving trail, with the bottom of this retrace serving because the fallacious for re-accumulation. In accordance with Rekt Capital, this consolidation phase prepares for a doable breakout into a parabolic upside.

“When the Pre-Halving Retrace bottoms, that bottom acts because the fallacious of the Re-Accumulation (i.e. Differ Low). When this Differ Low is established, a bout of consolidation begins in preparation for a future breakout into Parabolic Upside,” the analyst said.

Bitcoin’s impress bottom

In conjunction with to the optimism is an analyst with the pseudonym El_crypto_prof, who indicated that Bitcoin could even comprise realized its bottom, suggesting a doable turnaround in its impress trajectory.

Critically, the expert highlighted the importance of reclaiming definite technical ranges sooner than the halving, a sample seen in old market cycles that has steadily preceded foremost upward actions.

Total, Bitcoin continues to endure bearish sentiments, with numerous market indicators indicating sustained losses for the cryptocurrency. For instance, according to a file by Finbold, Bitcoin’s reasonable transaction prices surpassed the $100 label for the main time on April 20, post-halving, suggesting a doable sell-off.

Uncertainty is further heightened, brooding about Bitcoin reached its epic excessive sooner than the halving occasion, diverging from historical trends. This capacity that, it remains annoying to discover if Bitcoin will abilities further upward momentum, even supposing the aptitude for elevated volatility persists.

Bitcoin impress evaluation

By press time, Bitcoin had retraced after rapidly touching the $64,000 level. It is a ways currently shopping and selling at $63,865, marking a descend of over 5% within the previous seven days.

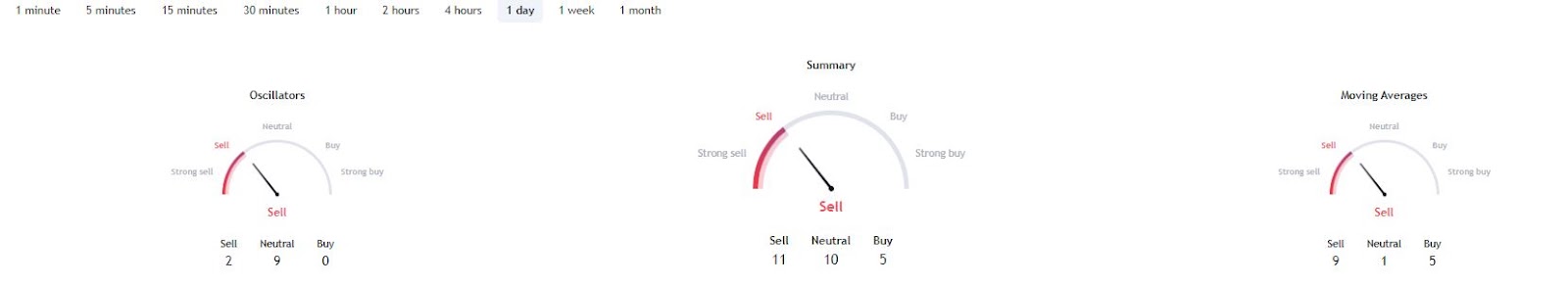

On the identical time, Bitcoin’s one-day technical evaluation, sourced from TradingView on April 20, signifies bearish sentiments. A summary of indicators, transferring averages, and oscillators align with a sell sentiment, registering at 11 and a pair of, respectively.

While these analyses provide perception into doable future actions, unforeseen events similar to escalating geopolitical tensions can rapidly alter impress trajectories.

Disclaimer: The divulge on this web divulge should no longer be thought of funding recommendation. Investing is speculative. When investing, your capital is at anguish.