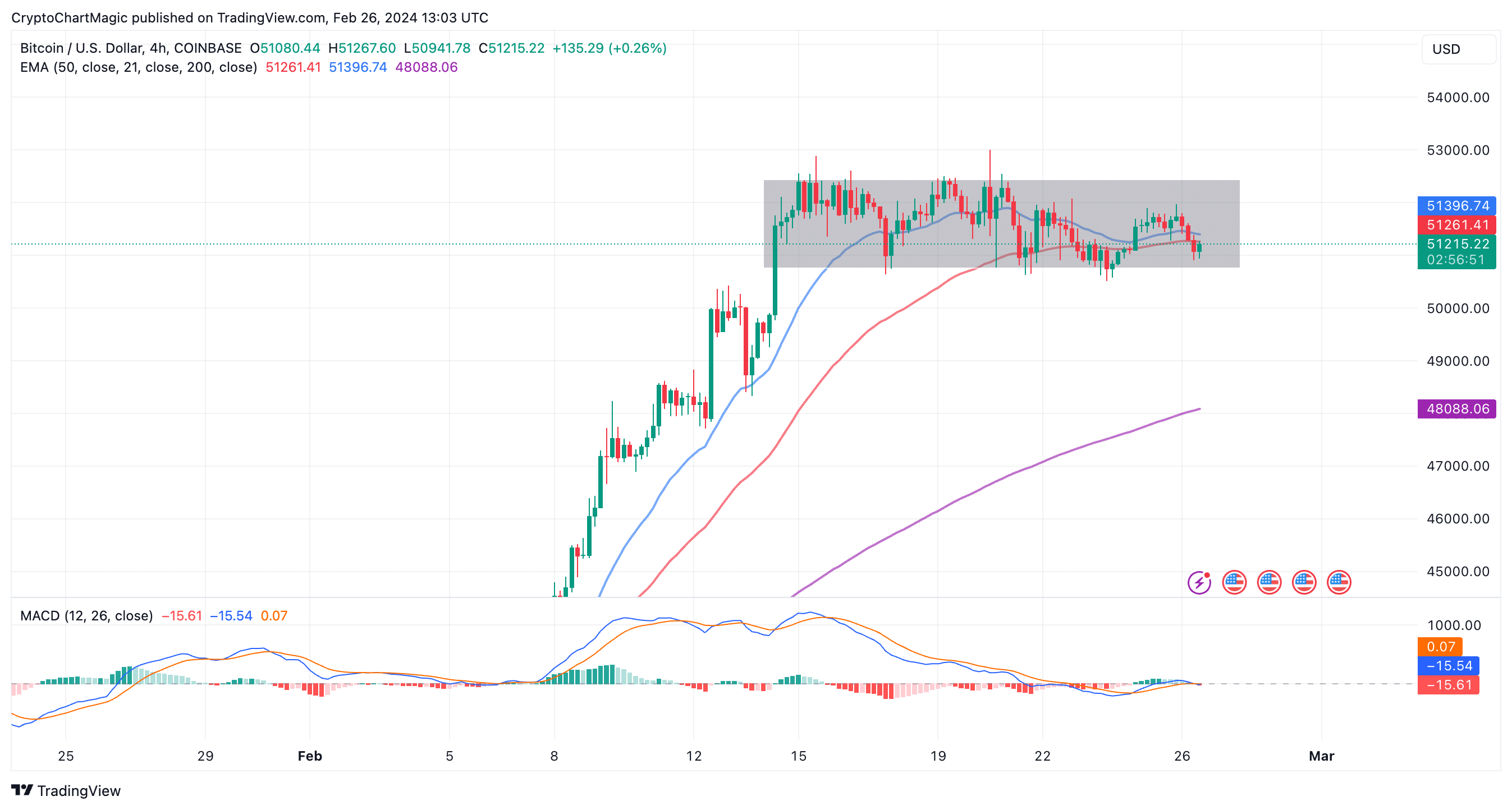

Bitcoin impress prediction: BTC is maneuvering a crucial fluctuate with ask at $50,800 and provide at $52,000. Whereas dips are proving successful, bulls bear no longer been ready to rating adequate liquidity to care for an everyday uptrend. This would presumably perhaps indicate the present market doldrums preserving Bitcoin from breaking out a bullish rectangle sample (to be discussed later).

Bitcoin Tag Prediction: Can Increasing AUM Form Sentiment In March?

Despite the stalling attributable to an lengthen at $52,000, and by extension, $53,000 the same outdated outlook of the market has remained bullish since the ETF approval in January.

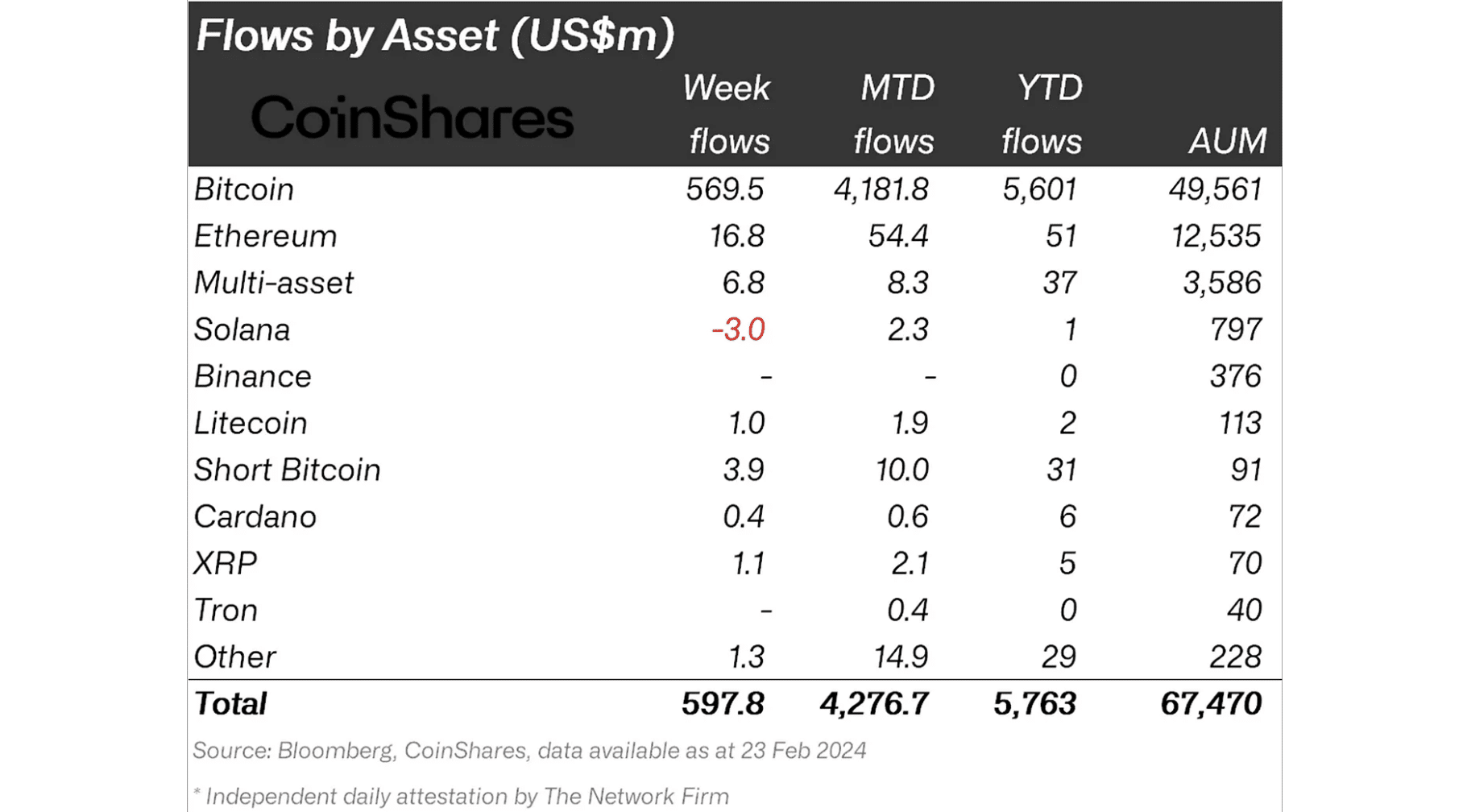

Digital asset funding products, in every other case steadily called resources below administration (AUM) proceed to execute exceptionally effectively, with $598 million in complete weekly inflows, in step with CoinShares Compare blog. Bitcoin recorded weekly inflows of $570 million in the old week, boasting $5.6 billion in one year-to-date inflows.

This big lengthen in accumulate inflows marked the “fourth consecutive week of inflows.” Thus a ways, one year-to-date accumulate cumulative inflows surged previous the $5.7 billion impress, with the US main the leisure at $610 million. Grayscale recorded more outflows of as much as $436 million in the old week.

Digital asset funding products noticed weekly inflows totalling US$598m, marking the fourth consecutive week of inflows. Year-to-date inflows bear now surpassed the US$5.7bn impress. The US noticed rather just a few the inflows at US$610m, impacted by incumbent issuer Grayscale, which noticed extra…

— Wu Blockchain (@WuBlockchain) February 26, 2024

Alternatively, the blog eminent that “Blockchain equities endured to search out outflows totaling US$81m final week, suggesting equity investors are a little cautious currently.”

Despite the persistent outflow at Grayscale, the total AUM topped at $68.3 billion — the highest level since December 2021. Funding products mute bear some ground to masks earlier than reaching the all-time of $87 billion at the peak of the old bull escape in November 2021.

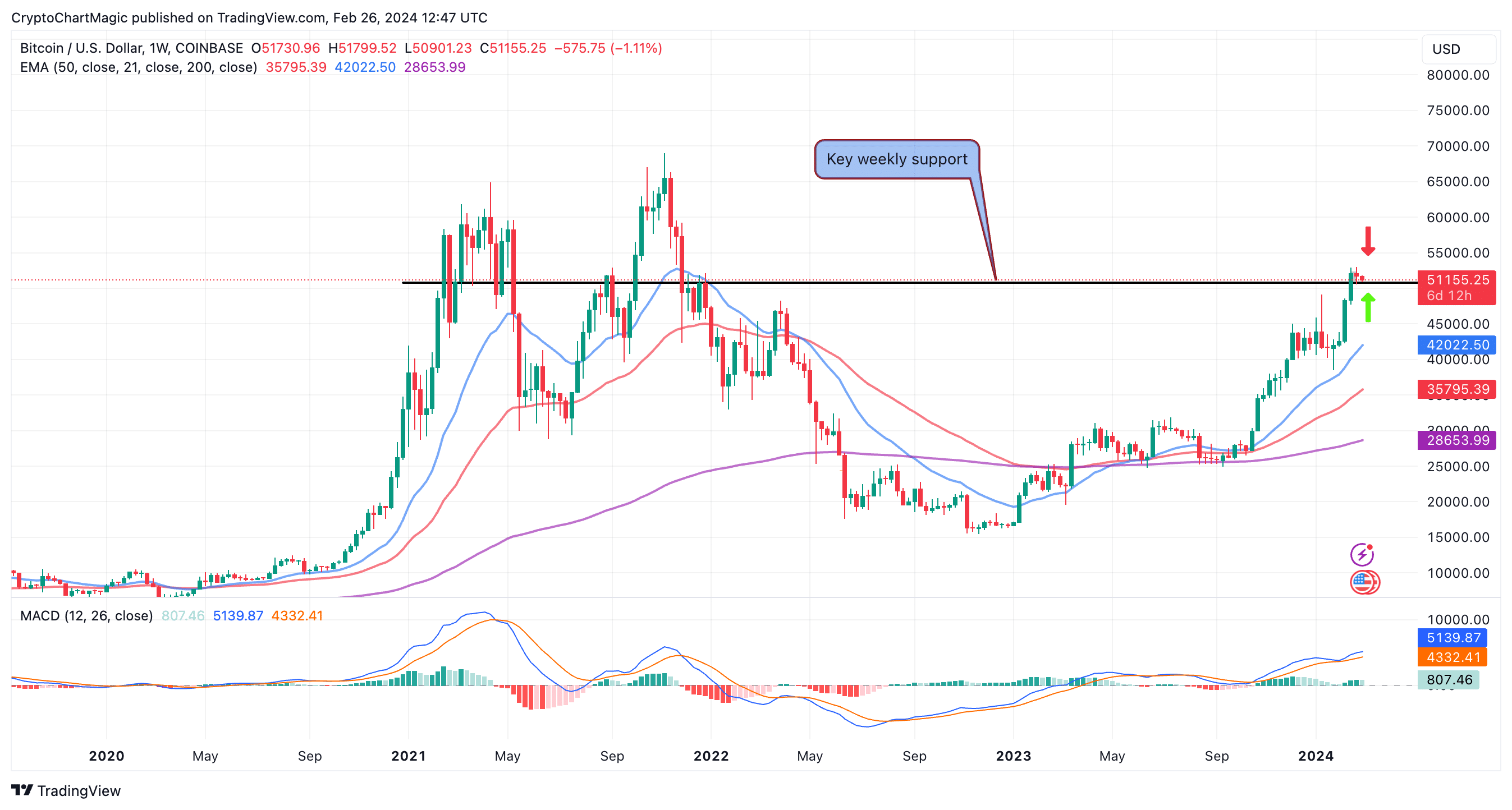

Where To Next As Bitcoin Upholds Necessary Weekly Enhance?

The sad horizontal ray on the chart represents a the truth is crucial level from as a ways relieve as September and December 2021. Even supposing it served as resistance then, Bitcoin just no longer too lengthy ago flipped it into improve, suggesting that the route of least resistance is to the upside.

As effectively as to immediate improve at $50,800, the Transferring Average Convergence Divergence (MACD) has flaunted a aquire price on the weekly chart since October, and this to a dapper degree is bullish for Bitcoin impress.

A bullish rectangle sample on the four-hour charts implies that a solid breakout is in the offing. Therefore, it would possibly per chance presumably presumably be prudent to care for onto the lengthy positions, or care for getting the minor dips waiting for beneficial properties above $53,000 for the initial fragment and towards $60,000 for the 2d restoration fragment.

Even supposing the MACD is a little bullish in the four-hour fluctuate, the fashion is rarely any longer clearly to the upside, mirroring the rectangle sample.

Intraday merchants would be in search of a destroy above each the 50-day Exponential Transferring Average (EMA) and the 20-day (the crimson and blue lines on the chart). This form of lunge would possibly per chance presumably perhaps turn consideration to BTC by encouraging self belief in the bullish bullish outlook.

The bullish rectangle sample draw that the subsequent doubtless final end result shall be a breakout to the upside with the likely of pushing BTC to the fluctuate between $53,000 and $54,000 in the short. Extra motion will rely available on the market sentiment, which is sure to enhance, especially with Bitcoin ETFs gaining momentum.

Merchants can not directly rule out the likely of a deeper sweep at decrease improve areas love $50,000 and $forty eight,000, all for Bitcoin is rarely any longer out of the woods but amid the consolidation.

Nonetheless, the halving in April space to disrupt provide while ask will increase is a ingredient at probability of care for Bitcoin buoyed by investor optimism.

Connected Articles

- 5 Rollups Tokens To Buy Earlier than Ethereum Dencun Crimson meat up

- Terra Luna Traditional Announces Predominant Core Upgrades, LUNC and USTC Tag Jumps

- Dogecoin (DOGE) Tag Entering Parabolic Breakout to $1.7, Predicts Standard Analyst