$Bitcoin has under no circumstances moved in a straight line. Each and each main rally has been adopted by a painful correction, and each deep obtain market has at final situation the stage for a brand unique expansion share. As 2026 approaches, traders are over all but again asking the identical ask: is Bitcoin making ready for one other main leg elevated, or is a prolonged cooling interval forward?

To acknowledge to that, we now bear got to step aid and seek at how Bitcoin has behaved over the years, in particular across bullish and bearish cycles.

Bitcoin’s Prolonged-Length of time Designate Habits: A Cycle-Driven Market

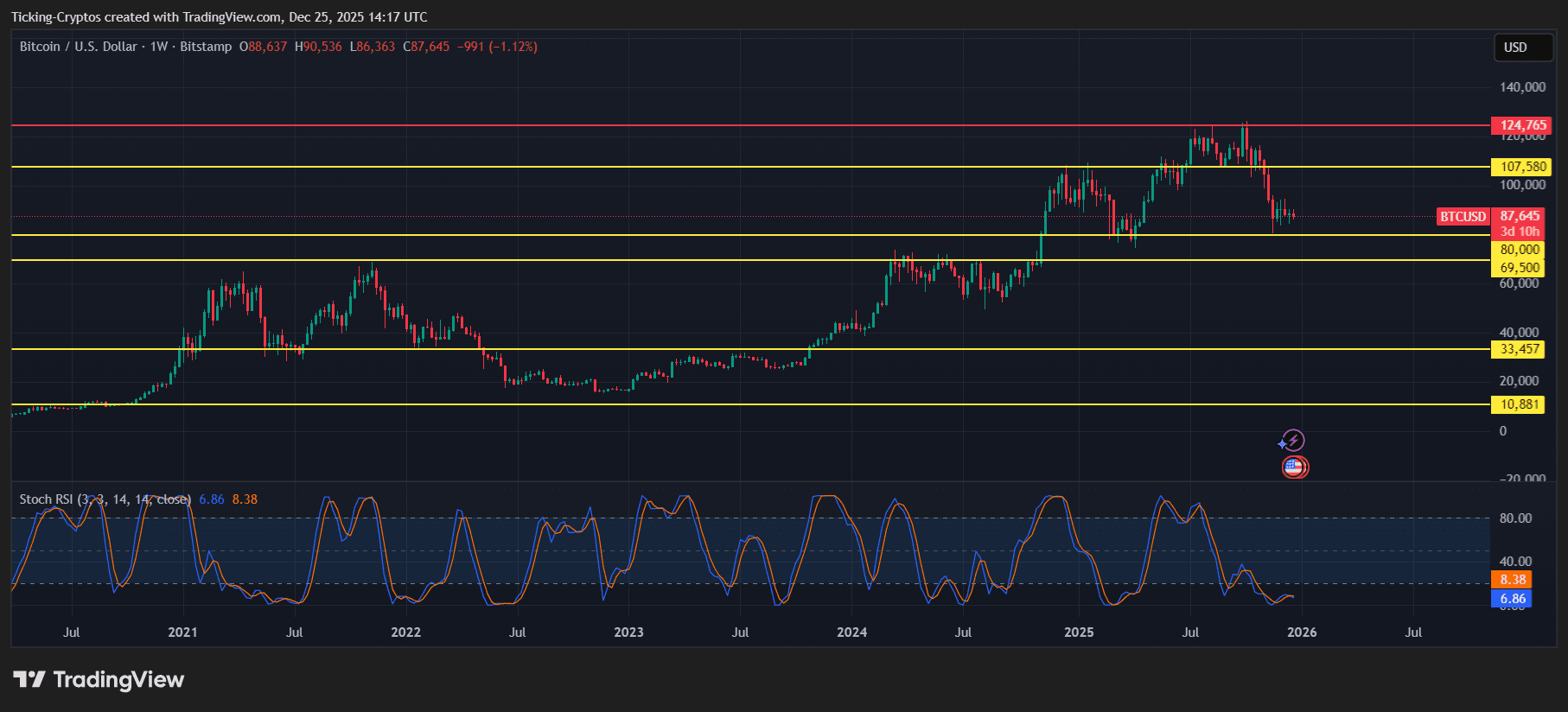

Having a seek at the weekly Bitcoin chart, one element turns into obvious: Bitcoin moves in cycles, not traits that final endlessly.

BTC/USD 1W – TradingView

Historically, BTC has adopted a rhythm tied to liquidity, macro prerequisites, and halving events:

- Solid multi-year uptrends are adopted by titillating corrections

- Extended consolidation phases customarily arrive earlier than explosive rallies

- Major enhance zones tend to withhold across extra than one cycles

On the long-timeframe chart, Bitcoin has revered key psychological phases for years. Once broken, these phases customarily flip from resistance into long-timeframe enhance — a pattern that continues to shape expectations for 2026.

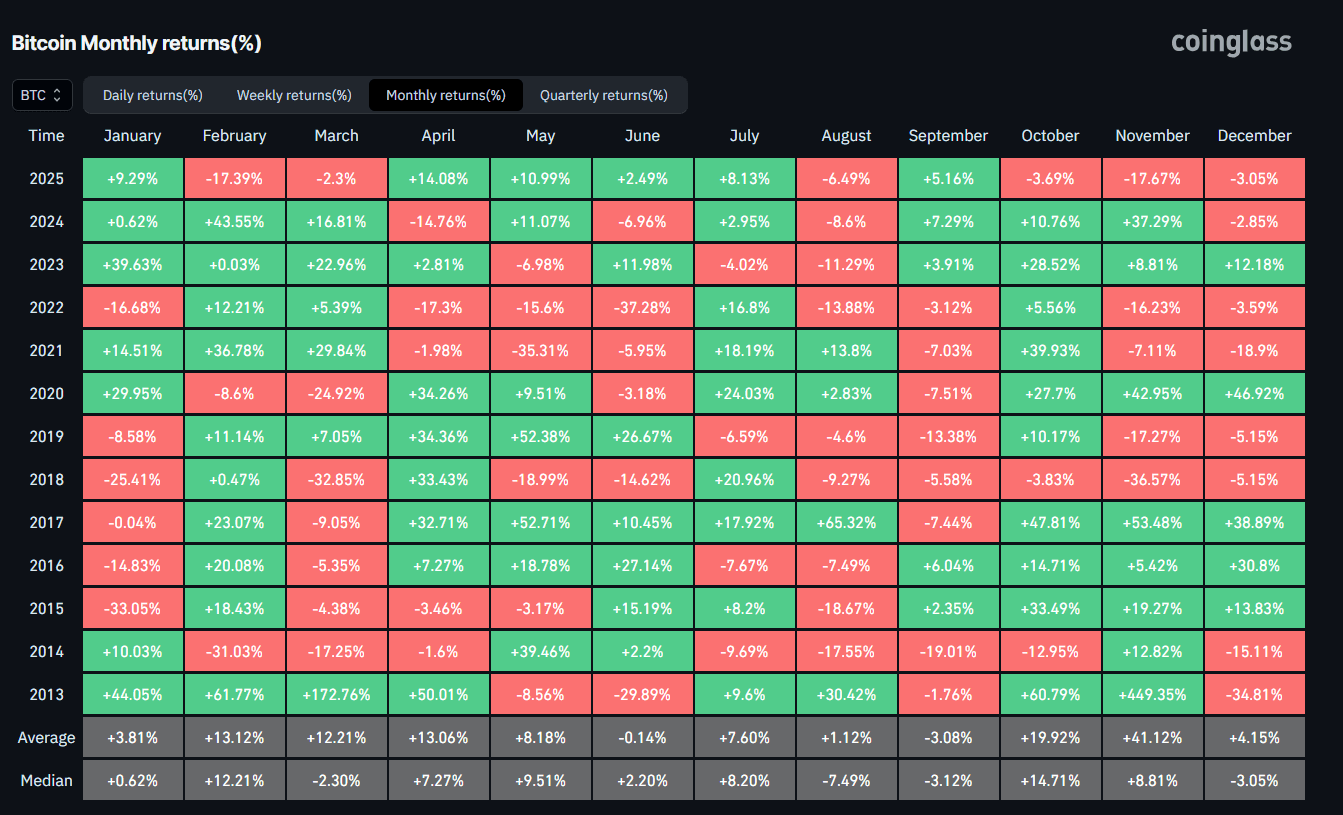

Month-to-month Returns Indicate a Clear Pattern

The Bitcoin monthly returns heatmap reinforces this cyclical nature.

Bitcoin Month-to-month Returns all the device thru the final years – coinglass

Over the past decade:

- Bull years imprint clusters of stable green months, customarily stacking double-digit gains

- Earn years are marked by prolonged crimson intervals and titillating drawdowns

- Sure months, love October and November, bear historically delivered outsized gains, whereas others tend to be extra blended

What stands out is that even in bullish years, Bitcoin experiences deep pullbacks, in most cases exceeding 20–30%. That is serious when fascinated by 2026: volatility just will not be a trojan horse in Bitcoin — it’s a characteristic.

Where Bitcoin Stands Heading Into 2026

From a technical point of view, Bitcoin is entering 2026 after a interval of heavy consolidation following a indispensable expansion share. Designate motion suggests:

- Prolonged-timeframe buyers are silent defending key enhance zones

- Momentum has cooled in contrast with peak rally prerequisites

- Volatility has compressed, which historically precedes tall moves

This style of market construction has customarily seemed mid-cycle, in want to at absolute tops or bottoms.

Bitcoin Designate Prediction for 2026: Bullish vs Bearish Scenarios

Bullish Assert of affairs

If liquidity prerequisites enhance and possibility appetite returns:

- Bitcoin might well perhaps also reclaim elevated resistance zones and push toward unique cycle highs

- Prolonged-timeframe accumulation conclude to main enhance phases might well perhaps also simply gasoline one other expansion share

- A renewed macro tailwind might well perhaps also trigger a stable 2d leg of the bull cycle

In this case, 2026 might well perhaps also resemble old continuation years in want to a plump market top.

Bearish Assert of affairs

If macro stress persists and liquidity tightens:

- Bitcoin might well perhaps also simply dwell vary-certain or trip a deeper correction

- Earlier cycle enhance zones would arrive aid into heart of attention

- Sideways effect motion might well perhaps also dominate tall functions of the year

Historically, Bitcoin has furthermore spent entire years consolidating earlier than resuming its long-timeframe uptrend.

What Historical past Suggests About 2026

Having a seek purely at historical behavior:

- Bitcoin infrequently peaks and collapses without prolong

- Post-rally years customarily alternate between continuation and consolidation

- Prolonged-timeframe holders tend to obtain for the length of intervals of uncertainty

This makes 2026 much less about chasing parabolic moves and extra about positioning, patience, and possibility management.