Bitcoin mark currently trades reach $91,300 after convalescing from the early December low reach $85,000, but the rebound remains capped under a declining trendline that has rejected each upside strive since slack October. The recovery comes as merchants predict the Federal Reserve’s closing price resolution of the 12 months and a spike in jobless claims that could presumably influence the policy outlook.

Investors Push Tag Toward Fibonacci Ranges But Construction Remains Fragile

On the on every day foundation chart, Bitcoin is trading inner a contracting structure that has fashioned across decrease highs and higher lows. Tag is checking out the underside of the descending trendline reach $92,000 while sitting spherical the 0.382 retracement at $90,811, a zone that has acted as non permanent enhance across several classes. A ruin above $93,995, the 0.5 retracement, would be conscious the first signal of growth strength, but that stage has many cases rejected rallies.

Above mark, the 0.618 retracement at $97,179 aligns with a broader provide zone created for the interval of old distribution, turning it into a major barrier. As lengthy as Bitcoin remains under that stage, the recovery appears to be like to be tactical reasonably than structural.

Related: XRP Tag Prediction: Power Downtrend Threatens $2 Toughen as…

The Supertrend indicator at $98,103 reinforces that ceiling. Sellers defended this stage for the interval of November’s failed breakout attempts and forced the market help into the contemporary consolidation. A decisive discontinuance above the Supertrend would flip sentiment toward a growth reversal.

Plight Outflows Label Distribution As Liquidity Remains Thin

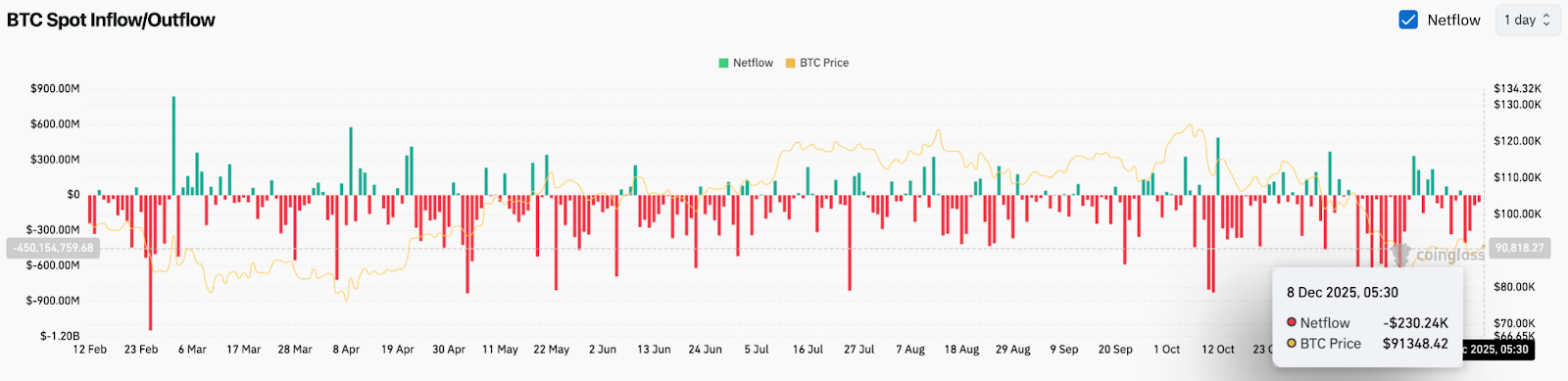

Plight flows remain adversarial, but the scale of contemporary strikes has compressed. In accordance to Coinglass files, Bitcoin recorded roughly $230,240 in obtain outflows on December 8, a diminutive figure compared to the heavy purple prints seen across October and November, when single classes on a unheard of foundation exceeded $200 million.

The slit price in outflow magnitude indicates that liquidation tension has eased, but it has no longer flipped into sustained accumulation. Positioning remains cautious, with capital drifting out reasonably than transferring in with conviction.

Short Term Momentum Improves But Resistance Cluster Limits Upside

On the 4-hour chart, Bitcoin is making an strive to originate a depraved above a rising channel that has guided mark since slack November. Intraday momentum has improved, with mark convalescing above the 20-day EMA at $90,403 and checking out the 50-day EMA at $90,978. The 100-day EMA at $92,203 marks the instant barrier, while the 200-day EMA at $94,277 remains the stage that would define a sound shift in growth direction.

The Bollinger Bands present compression after a volatility spike, indicating vitality originate-up prior to a directional switch. If mark clears the 100-day EMA, bands are at risk of widen upward. A failure would reintroduce promoting tension toward the decrease channel boundary reach $88,300.

RSI on the on every day foundation sits reach 47, displaying neutrality reasonably than exhaustion, which leaves room for every facets to dictate the following switch.

Macro Catalyst Drives Enviornment Shifting Into Fed Week

Bitcoin is convalescing into per week dominated by the Federal Reserve’s closing price resolution of the 12 months and a jobless-claims listing anticipated to expose a absorbing amplify. Economists are forecasting a upward thrust of 30,000 claims from the old 191,000 print, a shift that strengthens expectations for a first price in the slit price of because the Fed wraps up quantitative tightening.

After the $19 billion leverage wipeout in October, liquidity by no procedure completely returned. Market makers remain cautious, and scream books peaceable present reduced depth. As one investor told Decrypt, “scream books were wiped out, and market makers are skittish to jump help in in measurement.” This backdrop explains why rallies bear been shallow and reactive, no longer growth-driven.

Institutional desks are moreover adjusting treasury suggestions spherical the policy turn. Michael Wu of Amber Crew said funding spreads and borrow costs are transferring in lockstep with price guidance, causing desks to diversify liquidity across CeFi and DeFi venues to isolate volatility. This shift displays a defensive adjustment, no longer speculative positioning.

The performance gap between Bitcoin and metals has bolstered that warning. Gold and silver bear returned 60 p.c and 86 p.c this 12 months, while Bitcoin sits at adversarial 1.2 p.c, basically basically based on contemporary files. Merchants are treating metals as hedges in opposition to a policy error, while Bitcoin remains tied to liquidity swings reasonably than macro security.

Some merchants put a query to the tone to substitute rapidly if the Fed acts. Ryan McMillin of Merkle Tree Capital said the resolution to end QT and a attainable in the slit price of could presumably predicament the market as a lot as rally, adding “the price in the slit price of could presumably be the catalyst for that to originate.”

Bitcoin’s contemporary recovery is therefore driven less by solid ask of and more by verbalize adjustment into high-affect policy anguish. Till flows plot bigger and liquidity deepens, macro optimism remains a memoir, no longer a repeat.

Outlook. Will Bitcoin Dawdle Up?

The bullish case requires a discontinuance above $97,000 with enhancing flows and quantity. That could presumably ruin the trendline, shift structure from compression to enlargement, and start the direction toward $104,000.

The bearish case prompts if mark loses $88,000, confirming that merchants didn’t defend enhance. That breakdown exposes deeper correction toward $86,800 and $80,500.

Disclaimer: The files presented listed here is for informational and academic functions easiest. The article doesn’t constitute financial recommendation or recommendation of any kind. Coin Edition is no longer in price for any losses incurred because the utilization of utter, products, or products and services talked about. Readers are told to exercise warning prior to taking any action connected to the company.