Bitcoin designate prediction: Many market people collectively with analysts and consultants anticipated Bitcoin designate to retrace in February. Nevertheless, the top possible cryptocurrency boasting $1.22 trillion in market cap and $55 billion in 24-hour trading quantity, closed 45% better from the monthly launch to alternate at $62,000 on the tail cease of the European session on Friday.

How ETF Inflows Are Changing The Bitcoin Panorama

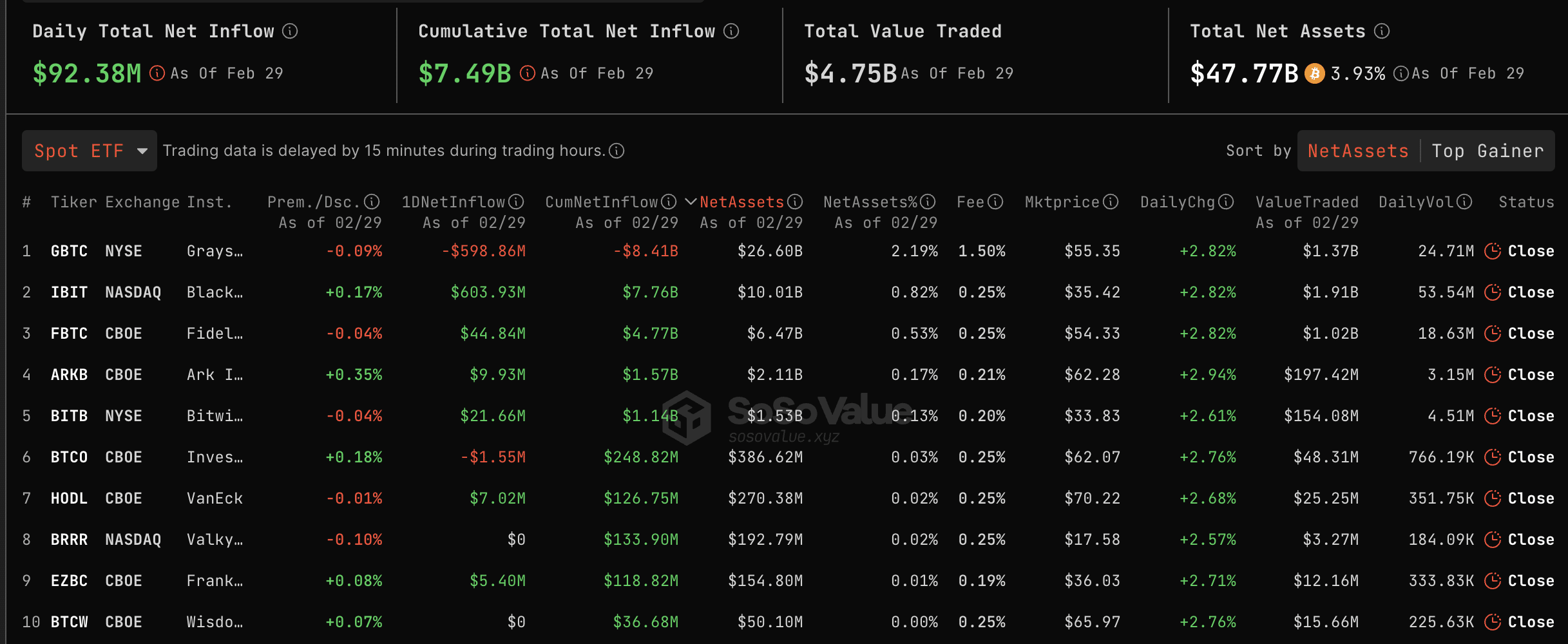

The commutative total procure inflow for the reason that Securities and Alternate Commission (SEC) green-lighted Bitcoin ETFs in January reached $7.49 billion on February 29, underscoring the mighty hobby from investors, especially institutional.

Basically based mostly on SoSoValue, a firm that tracks the efficiency of ETF products, BlackRock’s IBIT ETF stays the excellent-performing ETF, reaching $603 million in total procure inflow on Thursday.

At the various vulgar cease is Grayscale, which has persistently grappled with procure day by day outflows following the conversion of the Bitcoin Belief to GBTC ETF. This ETF saw a day by day procure inflow of -$598 on Thursday, thus a good deal reducing the day by day total procure inflow quantity to $92.38 million.

The provision and build a query to landscape for Bitcoin continues to alternate, pushed by rising ETF inflows. On prime of this, investors are preferring to retain onto their BTC in anticipation of the next breakout publish-halving in February.

Bitcoin’s halving, which cuts miner rewards by half each four years. The final halving took space in 2020, placing the next match in 2024 spherical April.

As well to giving Bitcoin its deflationary feature, halving a good deal reduces the quantity of unusual coins becoming a member of the ecosystem. Undergo in tips miner rewards will come down to three.125 BTC from the fresh 6.25 BTC.

It’s this unhurried lower in provide coupled with build a query to rising or staying the identical that tends to drive Bitcoin designate parabolically better. The ETF is also anticipated to have a serious impact on BTC as build a query to soars.

Suggested: Crypto Tag Prediction As GameFi Tokens Inch Ballistic: Tech Savvy Merchants Leer SAND, MANA, GALA

Bitcoin Tag Prediction: Uptrend To $70,000 Unstoppable In March?

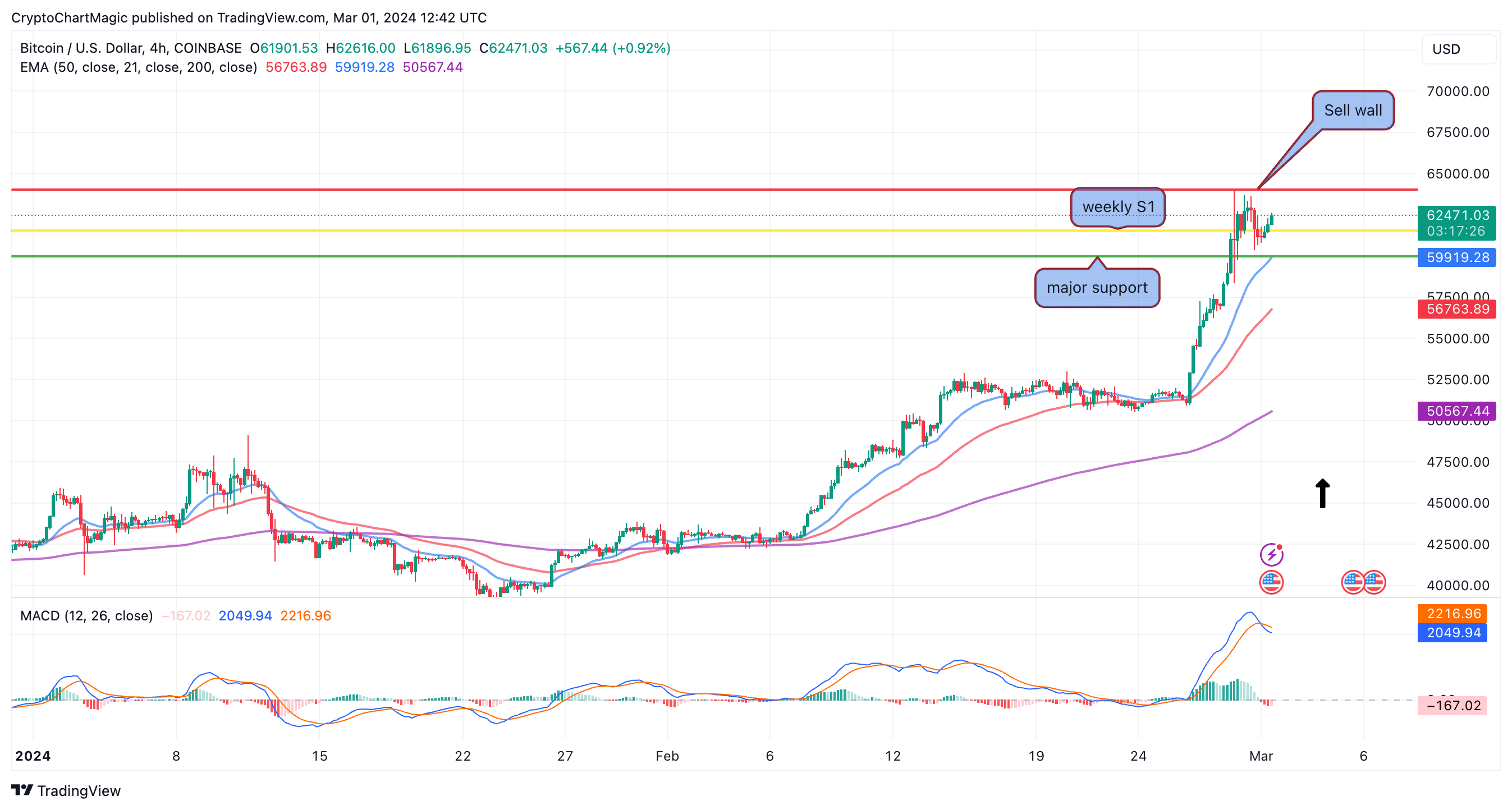

The uptick above $60,000 severely changed the technical ingredient, turning into stronger. Bitcoin examined highs at $64,000 nevertheless corrected to test toughen at $60,000 on Wednesday.

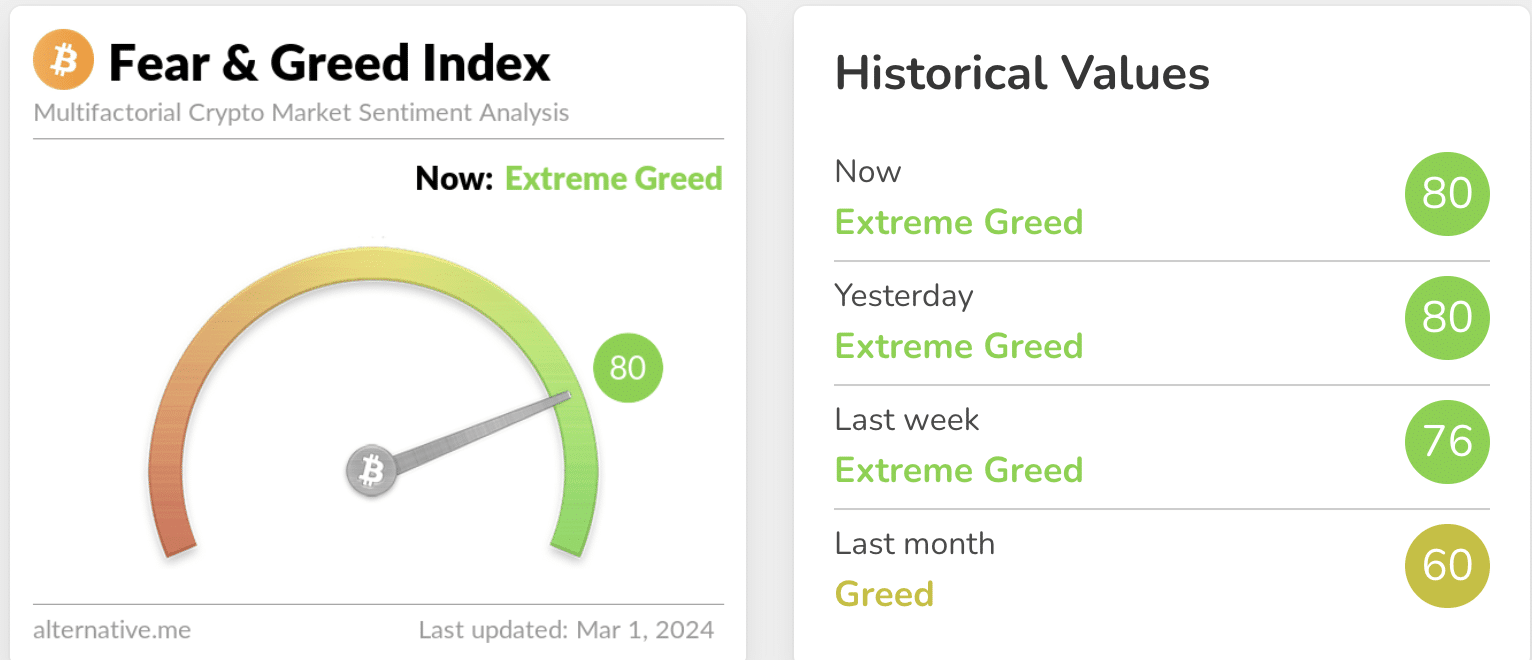

Bolstered by a spirited rise in FOMO, BTC had stabilized above $62,000 on Friday. Basically based mostly on the Crypto Fright & Greed Index investors are now in vulgar greed at 80 in comparison to the greed at 60 final month.

On the four-hour chart, traders are purchasing for consecutive four-hour candle closes above the yellow horizontal ray to validate prolonged fling north.

The gap at $63,000 represents a sell wall that will additionally fair easy be weakened to permit for beneficial properties above $64,000 (the purple line on the chart). A shatter above this may well space off extra FOMO with market people concentrated on a sweep of the all-time excessive adopted by a leg up previous $70,000.

A minor dip in the Transferring Average Convergence Divergence (MACD) threatens to unhurried down the uptrend. By encouraging traders to shut their positions.

Nevertheless, this situation may well additionally fair no longer retain or final brooding about the Money Waft Index (RSI) is fair and rolling upwards, indicating that liquidity is rising for one more leg up. Several four-hour closes below the yellow toughen line may well additionally watch BTC tumble to retest the $60,000 stage sooner than resuming the uptrend backed by extra looking out to obtain tension.

Linked Articles

- Dogecoin Tag Prediction As $DOGE Exits From 22-Month Accumulation

- 3 Below $1 Good aquire Altcoins To Flip $10 Into $100 In March

- XRP Tag: Top Analyst Predicts XRP Bull Bustle to $1