Bitcoin impress prediction: The crypto market is bullish as February involves an discontinuance driven by a Bitcoin impress surge from $51,730 on Monday to an intraday high of $64,000 all the design in which by US industry hours on Tuesday.

This big amplify in BTC’s value comes on the backdrop of mountainous hobby in Bitcoin ETFs, which earn over the last rather a lot of weeks posted spectacular performance.

The standard market outlook has furthermore been extremely bullish, particularly for Bitcoin as it strikes attain the halving in April. Analysts insist that this uptick in impress accounts for a pre-halving rally, as customers put collectively to promote the news shut to the match.

Bitcoin Build Prediction: Rally Objectives For $70,000 Pre-Halving

Bitcoin is shopping and selling above $61,500 as bulls price ahead bolstered by sure sentiment. Blockchain analytics platform Lookonchain revealed in a post on X the performance of Bitcoin ETFs, with 8 merchandise raking in 12,187 BTC price around $750 million at the novel alternate price.

Feb 28 Update:

8 ETFs added 12,187 $BTC($745M) this day whereas #Grayscale solely lowered 429 $BTC($26M).#Blackrock added 9,114 $BTC($557M)!https://t.co/vfmtWeLFsv pic.twitter.com/FjDswGNppn

— Lookonchain (@lookonchain) February 28, 2024

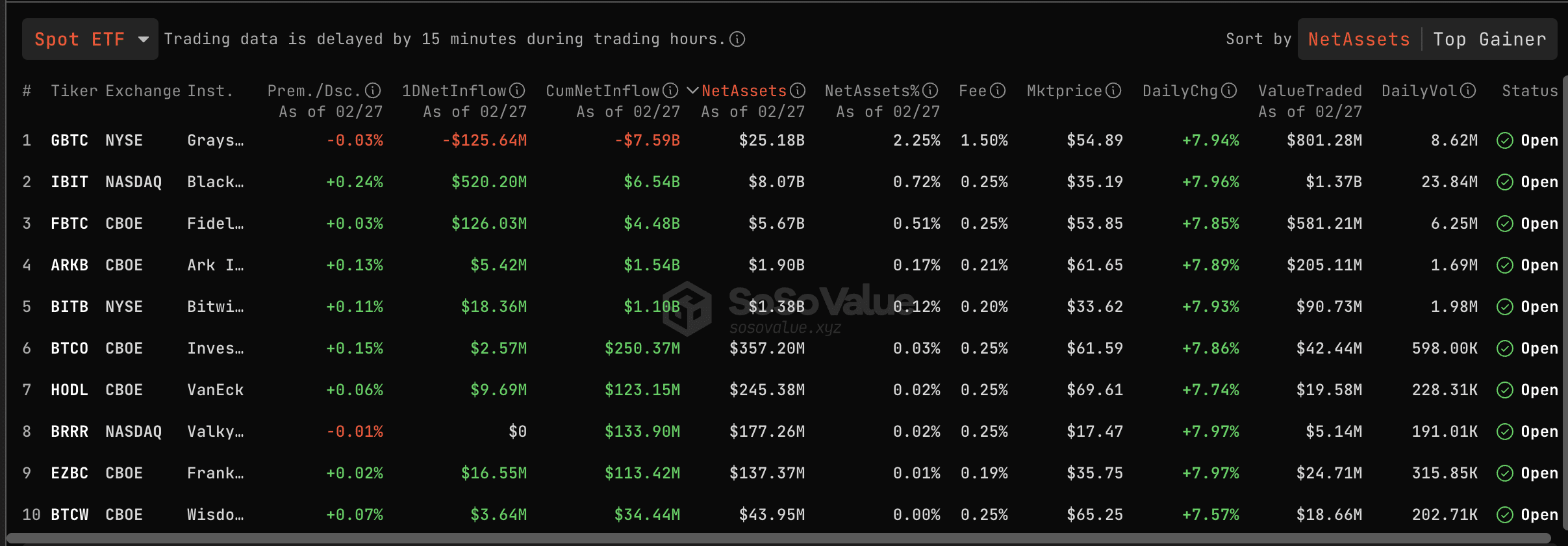

In step with SoSoValue, BTC ETFs earn cumulatively carried out a win influx of $6.72 billion since they started shopping and selling in January. BlackRock’s IBIT ETF continues to manual the pack, accounting for $500 of $576 million — the total day-to-day win influx.

Grayscale outflows earn furthermore been persistent nonetheless the spectacular performance of the a couple of ETFs cancel out their affect on the total win inflows.

The Bitcoin halving anticipated in April this year is yet some other market mover that might well well power prices within the crypto market bigger by reducing BTC’s circulating provide.

Halving, which happens in four-year cycles, has beforehand brought on substantial impress increases rather a lot of months after the match. While parabolic rallies are no longer assured, altering provide and save a matter to of dynamics typically abet customers motivated thus igniting the bull traipse.

Technical Indicators Signals Further Improve In BTC Build

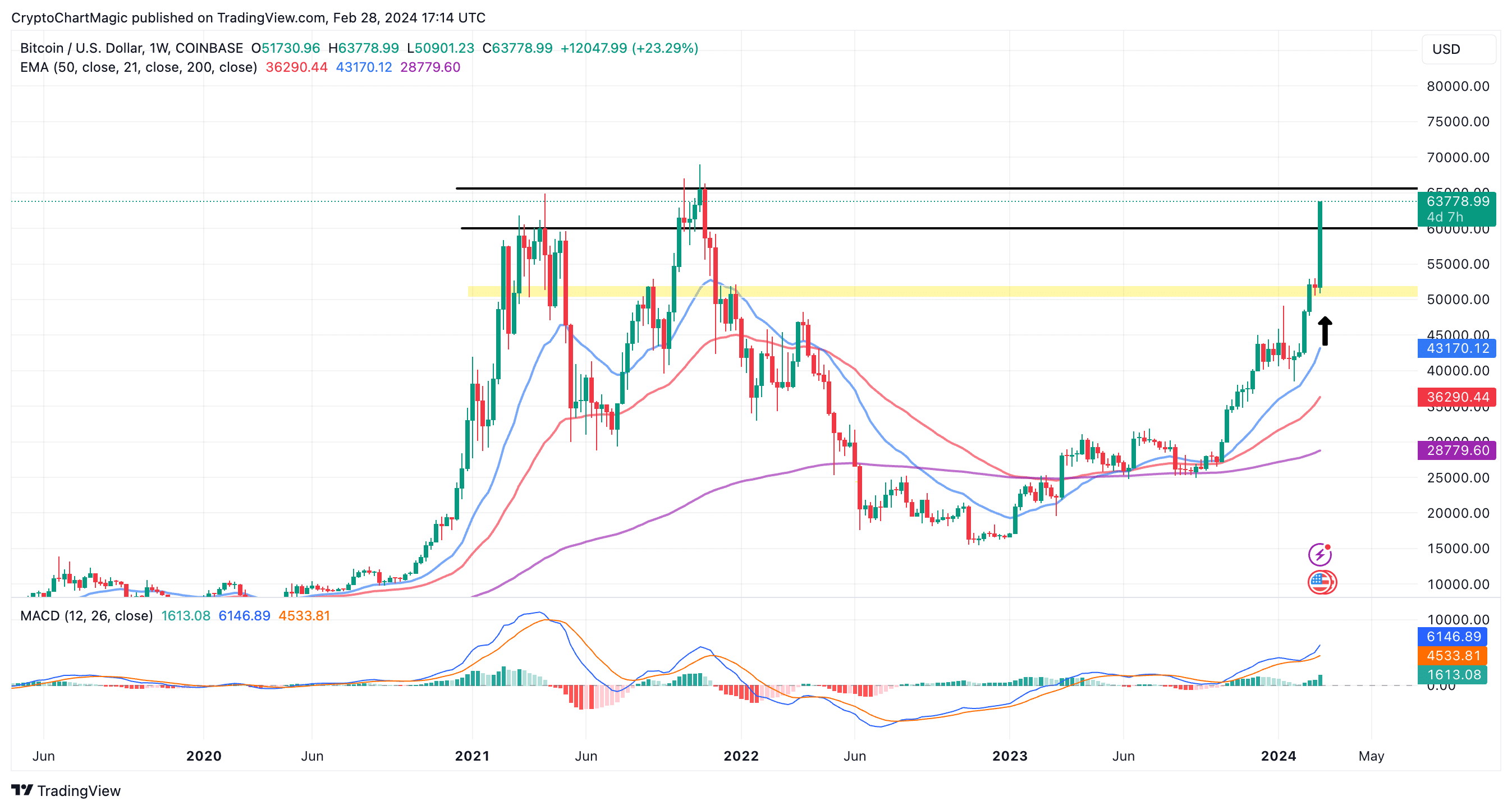

Bitcoin is within the center of of cracking resistance at $64,000 for a shut switch to the all-time high attain $69,000. FOMO appears to be to be utilizing the rally which confirmed excellent energy on Wednesday.

The Interesting Moderate Convergence Divergence (MACD) indicator is bullish backed by a purchase signal and key histograms above the honest issue. This reveals that the pattern leans bullishly strengthened by customers willing to throw all their weight within the help of Bitcoin.

Merchants would be looking out to search out key fortify ranges to purchase dips amid the tough momentum. For now, $56,020 – $57,975 is the ideal save a matter to of zone to test intently. If there is a pre-halving pullback, Bitcoin impress might well well well faucet this issue to bag liquidity for a a lot stronger breakout into impress discovery mode above $70,000.