Bitcoin ticket has been oscillating throughout the $105,000 ticket differ for just a few days now. While its performance also can simply gift strength against the design back, it additionally highlights a retest of BTC’s previous top zone.

Bitcoin Mark Duality

The retest also can simply manifest some resistance, which might maybe possibly well doubtlessly trigger some promote strain. On the different hand, a query resurgence also can pave the manner for more ticket discovery.

This duality of capability outcomes highlights the rising uncertainty. Nonetheless, there are some entertaining market observations that might maybe possibly well also offer more readability on Bitcoin’s next which that you can mediate of circulate.

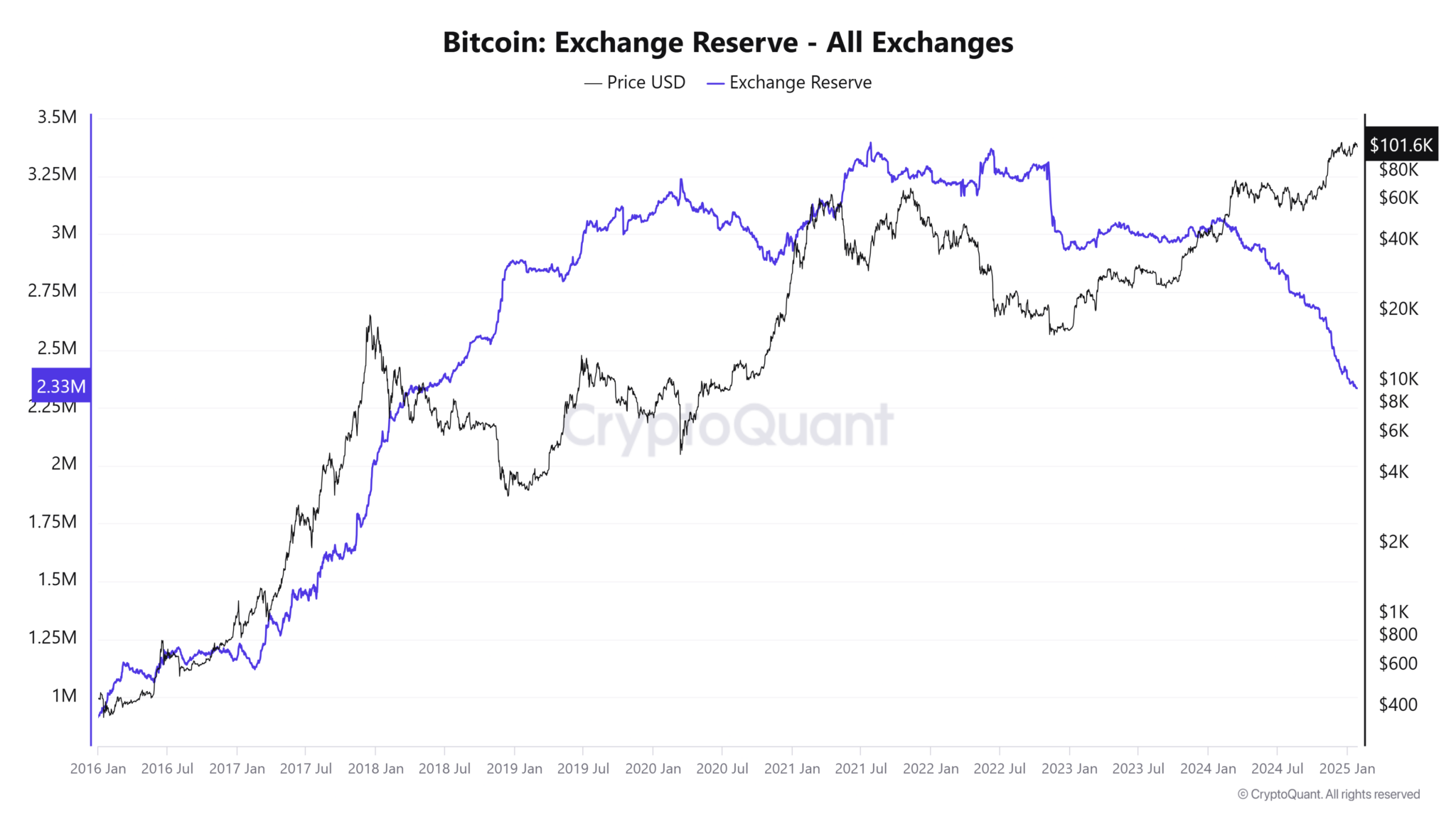

Bitcoin alternate reserves own maintained a downward trajectory and are for the time being at a multi-twelve months low. There own been roughly 2.334 million Bitcoins on exchanges on the time of observation. The closing time that alternate reserves had been this low used to be in 2018.

The declining Bitcoin alternate reserves underscore the prospective of a offer crunch if query is sustained. Such an also can trigger the following bullish wave, likely sending Bitcoin ticket above $110,000.

Most most critical Bitcoin Holders Take care of Bullish Secure to the backside of

HODL for longer appears to be the contemporary name of the game among the big gamers in Bitcoin. Right here is what a newest CryptoQuant prognosis published only in the near past, in step with the SOPR ratio evaluation.

The prognosis famed that the Bitcoin SOPR ratio demonstrated increased enhance in the previous main bull runs. In other words, the SOPR ratio has been hitting lower highs when put next with previous bull runs.

It additionally theorized that the lower SOPR ratio, especially in the contemporary bull bustle, underscores the rising shift from a short lived revenue scheme. Many own been including Bitcoin to their portfolios as long-term sources.

The CryptoQuant prognosis acknowledged that the transferring investor dynamics also can simply own contributed enormously to lower alternate reserves. It indicators that traders, especially big holders, own only in the near past now not been wanting to grab a form of profits off the desk.

Bitcoin Traders are Declining

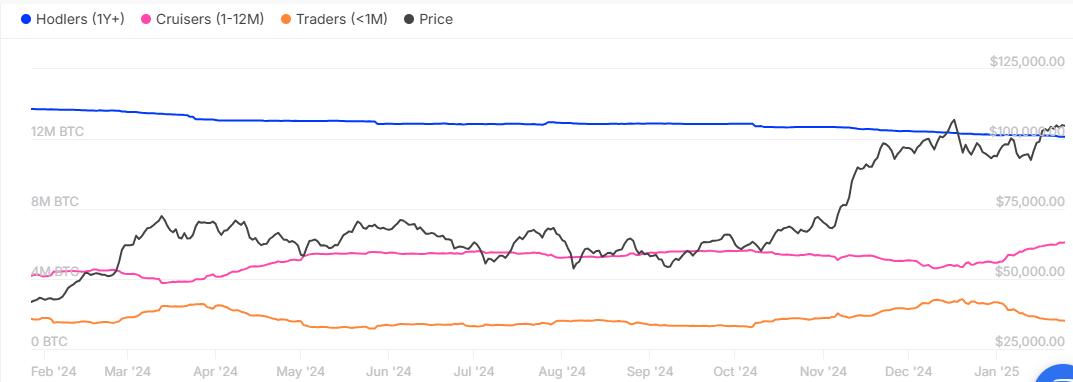

The aforementioned shift is evident in Bitcoin stability by time held. Bitcoin holders are categorised into three categories: Hodlers, Cruisers, and Traders. The Hodlers are those that defend Bitcoin for longer periods, in total higher than a twelve months.

Cruisers defend Bitcoin for shorter sessions, corresponding to weeks or months. In the intervening time, Traders commerce Bitcoin in the shortest time frames, corresponding to day and intra-day. It appears traders own been declining from 2.84 million BTC on 20 December to 1.62 million on 25 January.

On the an identical time, Bitcoin cruisers grew considerably from 4.61 million BTC on 11 December to 6.08 million BTC on 25 January. It confirmed that more traders had been switching in favor of long-term good points.

In the intervening time, long-term holders, AKA hodlers, own been securing some profits. Their balances had been down from 12.45 million BTC on 1 December to 12.13 million BTC on 25 January.

All these observations support the prospective of a offer shock in the future in the advance future. Such an also can fuel one other rally in direction of the $115,000 ticket differ. While the numbers underscore market optimism, it might maybe possibly well also yield temporary dips if promote strain intensifies and outshines query.