Bitcoin (BTC), the main crypto, is grappling with challenges after failing to shut above the needed $105,000 resistance stage. This impress point has acted as a ceiling for BTC, combating extra upward movement.

The difficulty worsened as lengthy-term holders (LTHs) opted to liquidate their positions, adding to selling rigidity and pushing the price lower.

Bitcoin Traders Lose Endurance

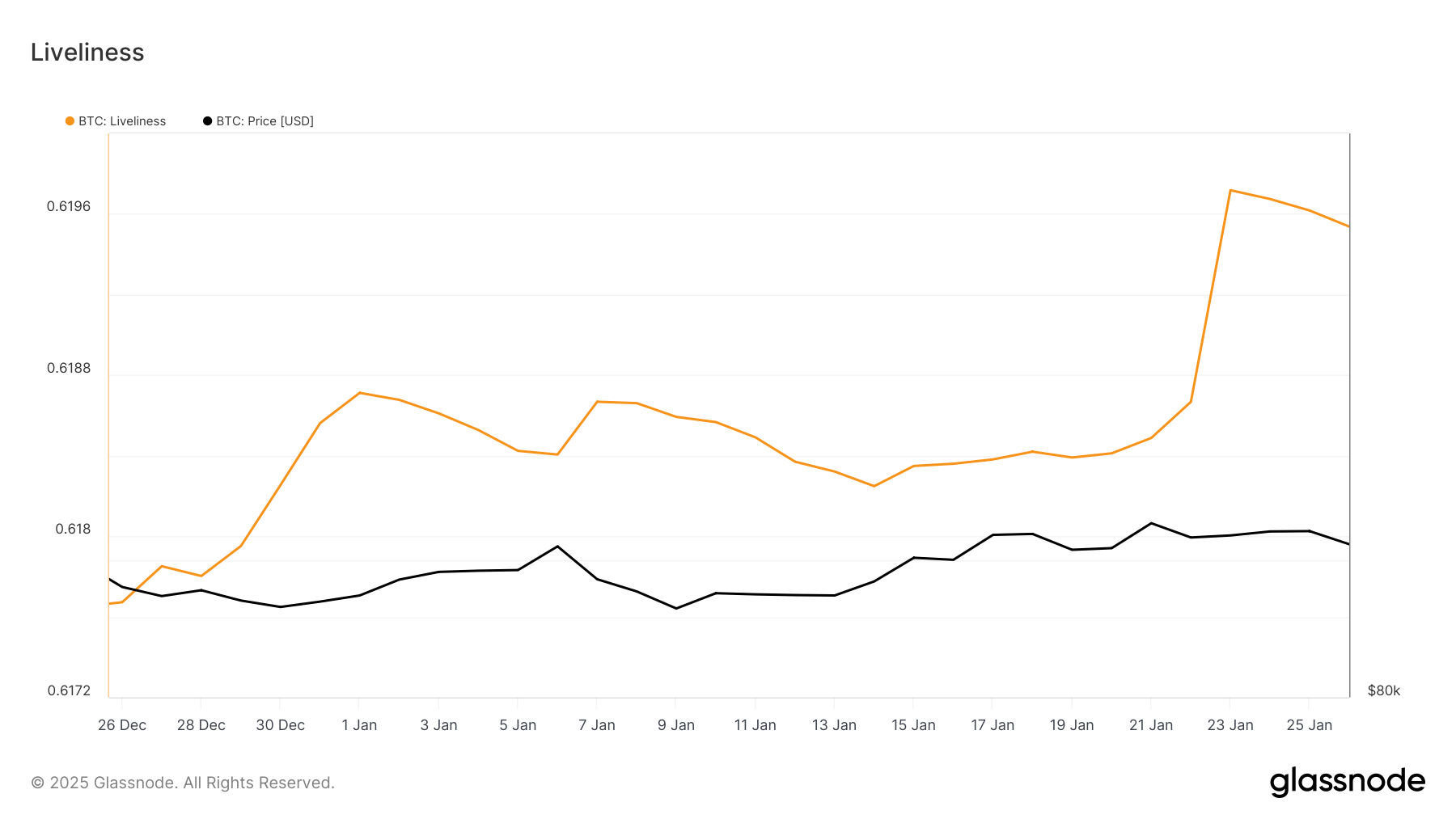

Most recent data indicates a titillating uptick in Bitcoin’s Liveliness, a metric that tracks the hiss of lengthy-term holders. This spike means that many LTHs delight in equipped their holdings over the past few days. Supporting this recount is the shift in LTH balances and a upward push in overall Coin Days Destroyed, signaling major movement of previously dormant BTC.

Since LTHs are essentially seen as the backbone of Bitcoin’s balance, their selling has historically resulted in bearish outcomes. This pattern has played out over the weekend and into today time, contributing to the continuing impress decline.

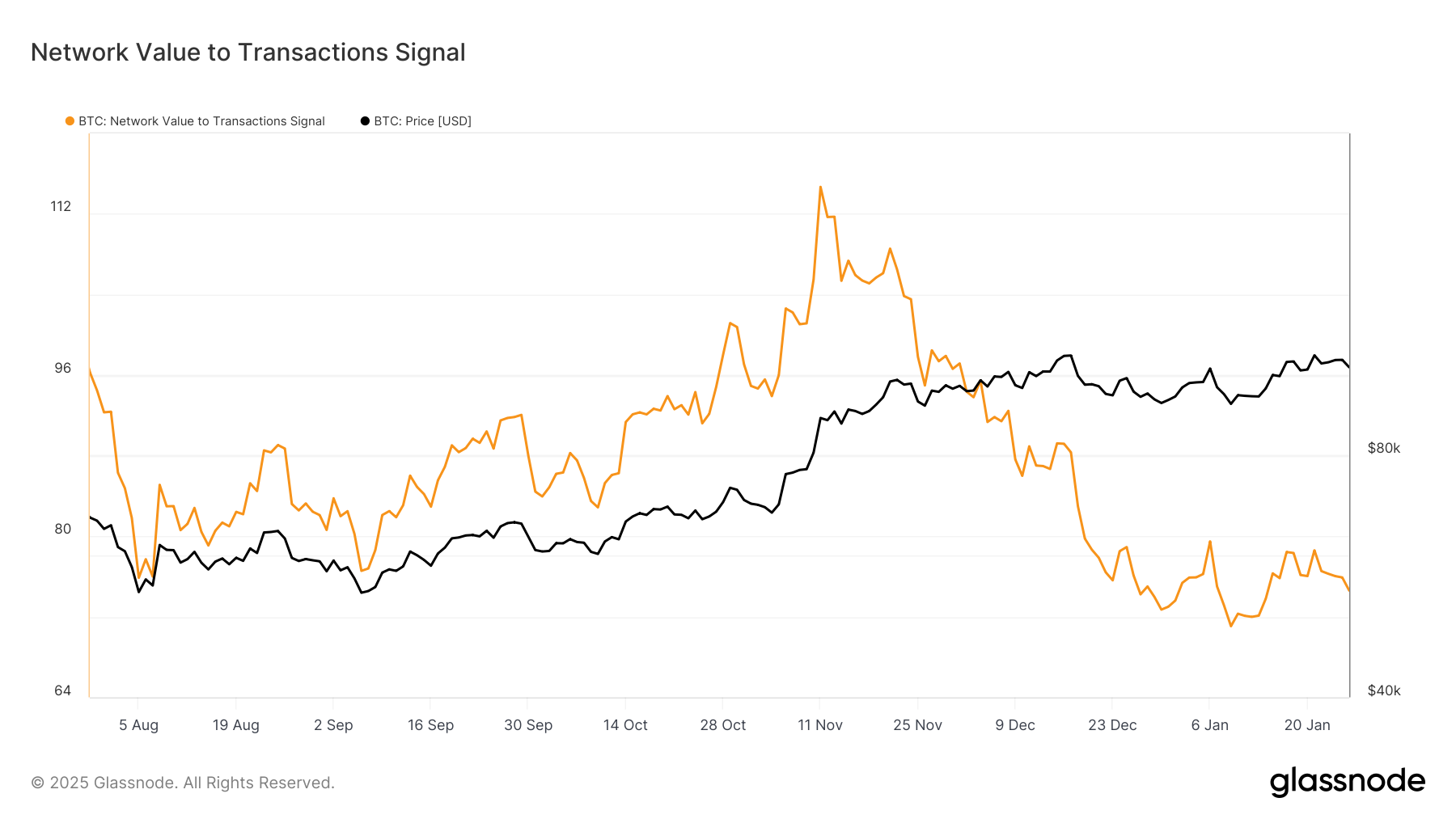

Despite the downturn, Bitcoin’s macro momentum suggests room for recovery. The Network Worth to Transaction (NVT) Signal, a key valuation indicator, is at indicate at a low. This functions to Bitcoin being undervalued when put next with its transaction hiss, hinting at the functionality for future improve.

While the NVT signal affords a determined outlook, broader market cues will must align for BTC to gain strength. Traders are possible to be not explicitly bearish for the time being, suggesting that sentiment also can toughen rapidly if supportive stipulations arise, akin to elevated buying hiss or favorable financial trends.

BTC Designate Prediction: Stopping Losses

Bitcoin’s impress has fallen by 3.88% over the final 24 hours, bringing it to $100,682. This autumn became primarily pushed by LTH liquidations and BTC’s incapacity to shut above the $105,000 resistance stage, reinforcing bearish sentiment in the brief term.

The following key toughen lies at $100,000, a severe psychological and technical stage. BTC is at likelihood of bounce off this toughen or resolve here rapidly. On the opposite hand, shedding this stage also can send the cryptocurrency all the manner down to $95,668, amplifying losses and deepening bearish rigidity.

Conversely, if broader market stipulations toughen and Bitcoin reclaims $105,000 as toughen, the bearish outlook will possible be invalidated. In this kind of scenario, BTC also can push toward its all-time excessive (ATH) of $109,699, reinvigorating investor self perception and paving the manner for a new rally.