The Bitcoin ticket has been slightly indecisive in its motion over the last week, jumping between the $117,000 and $120,000 consolidation zone in that duration. The flagship cryptocurrency, alternatively, got here tumbling toward the $115,000 stamp following large coin movements toward centralized exchanges in the previous day.

Interestingly, a well-liked market skilled has recommend an even extra bearish outlook for the Bitcoin ticket over the following couple of weeks. With this most up-to-date projection, the worth of BTC appears to be like to handiest be first and indispensable of a downward spiral, which could aggravate over the impending days.

How BTC Price Would possibly possibly possibly perchance perchance Be At Anxiety Of Extended Decline

In a July 25 put up on social media platform X, Chartered Market Technician (CMT) Aksel Kibar painted a bearish reveal for the Bitcoin ticket after falling to $115,000 on Friday. In accordance to the analyst, the flagship cryptocurrency will be on its capability to round $109,000 in the impending days.

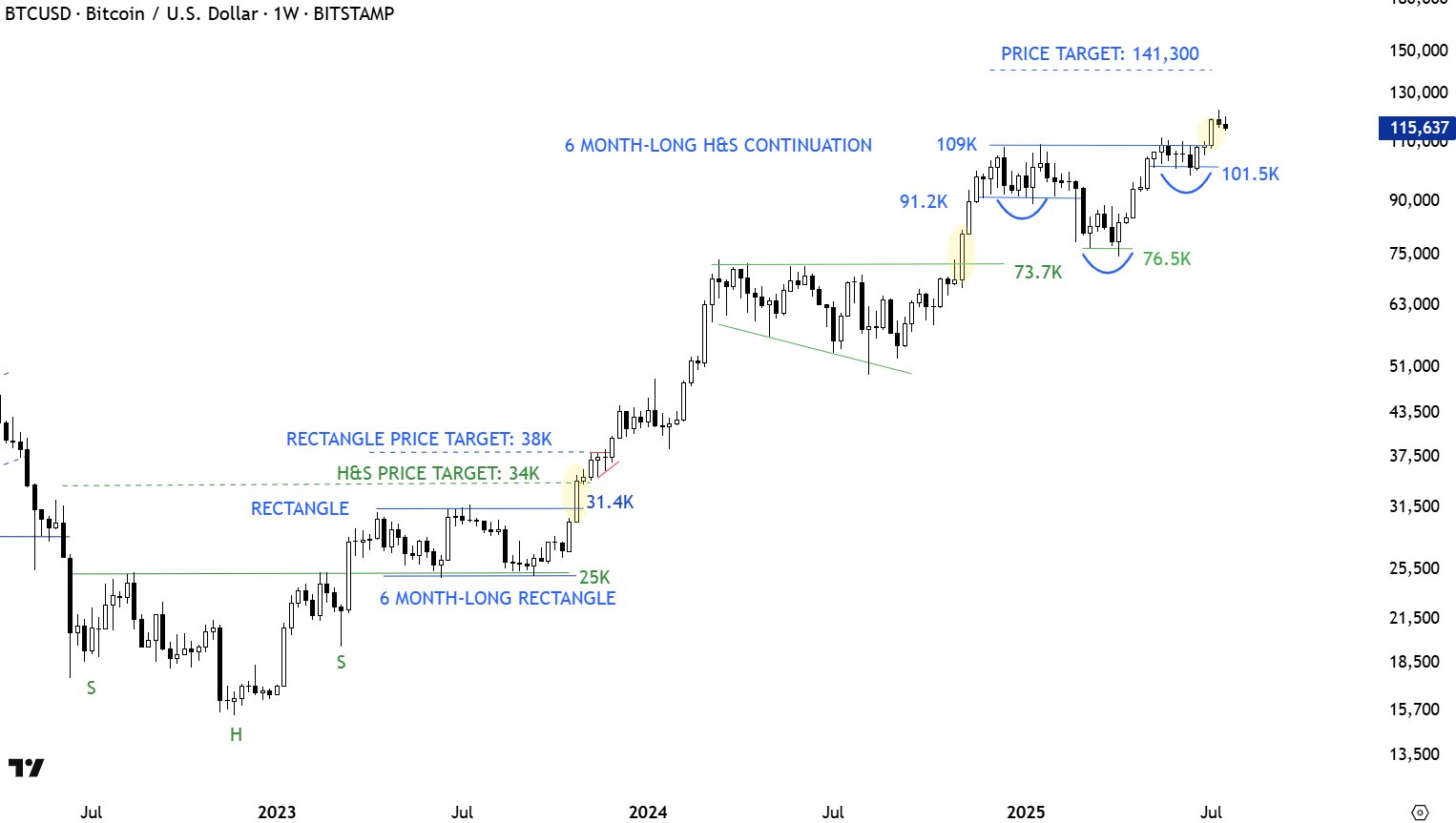

Kibar’s bearish stance revolves all over the inverse head-and-shoulder sample on the Bitcoin ticket chart on the weekly timeframe. The inverse head-and-shoulders sample is a technical diagnosis formation characterized by three definite ticket troughs, alongside side a lower “head” suppose between two bigger “shoulders.”

Typically, the inverse sample signals a that it’s doubtless you’ll possibly have faith bullish breakout and is validated when the worth breaches the neckline — a trendline connecting the crests (swing highs) between the top. As shown in the chart below, the Bitcoin ticket has already damaged throughout the neckline to realize a new all-time excessive.

On the opposite hand, Kibar explained that the worth breakout witnessed by Bitcoin couldn’t be the textbook breakout in total anticipated in most inverse head-and-shoulders sample scenarios. In accordance to the market skilled, most head-and-shoulder breakouts are followed by pullbacks and retests as a replace of heterosexual rallies.

Chart info offered by the analyst presentations that, since Would possibly possibly possibly perchance perchance furthermore merely 2017, the Bitcoin ticket has witnessed a retest or pullback (form 2 continuation) extra times than a straight rally (form 1 continuation) after a head-and-shoulder sample breakout. This fashion explains the reason in the back of Kibar’s bearish projection for BTC in the following couple of days.

If the worth of Bitcoin does endure a deeper correction as in the sort 2 continuation, it’s a ways liable to realize to the neckline — and all over the $109,000 stamp. A toddle take care of this could occasionally signify an over 5% decline from the most up-to-date ticket level.

Bitcoin Price At A Gaze

After a horrendous launch to the day, the market leader appears to be like to be convalescing nicely from its most up-to-date fall to $115,000. As of this writing, the worth of BTC stands at round $117,323, reflecting a mere 0.6% decline in the previous 24 hours.