Bitcoin’s tag plummeted to approximately $Fifty three,500 throughout early trading hours in Asia on Friday, hitting this low for the fundamental time in four months. This essential decline has raised alarms among traders and market analysts.

Primarily based entirely mostly on BeInCrypto data, Bitcoin (BTC) has fallen by roughly 6% in the future of the last 24 hours.

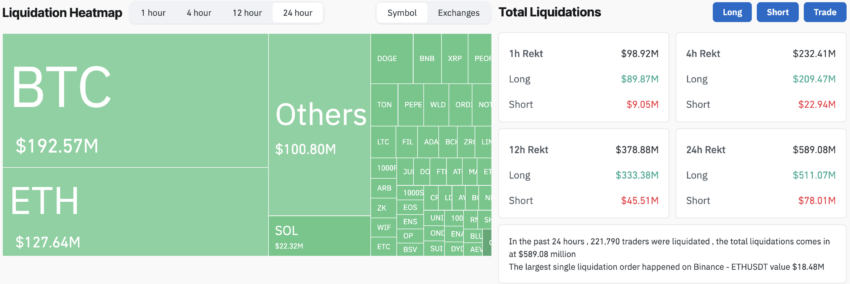

Bitcoin’s Entertaining Drop Liquidates Over $589 Million

The volatility in Bitcoin and the broader crypto market has resulted in enormous liquidations. In full, $589 million used to be liquidated, which incorporated bigger than $511 million in prolonged positions and $78 million in shorts. Particularly, nearly $100 million used to be liquidated in appropriate the previous hour.

Nonetheless, in an interview with BeInCrypto, Avinash Shekhar, the CEO of crypto derivatives exchange Pi42, explained that tag volatility is a chance for non everlasting traders.

“Such movements in most cases most recent opportunities, especially for scalpers to receive successfully their liquidated trades,” Shekhar told BeInCrypto.

Read more: Bitcoin (BTC) Label Prediction 2024/2025/2030

Extra unsettling the market, the Mt. Gox economic smash property transferred billions of greenbacks price of Bitcoin to an unknown wallet. Primarily based entirely mostly on blockchain analytics agency Arkham Intelligence, this eager transferring 47,228 BTC, valued at around $2.71 billion.

Outdated to this, the property conducted several little check transactions. With repayments expected to launch soon, about 142,000 BTC and 143,000 Bitcoin Cash (BCH) are poised for disbursement.

Additionally, contemporary actions by the German executive like contributed to market apprehension. This week, it transferred about 1,300 BTC, price roughly $75.5 million, to its wallet and several other crypto exchanges, in conjunction with Bitstamp, Coinbase, and Kraken. This vogue has exacerbated fears of additional tag declines.

Amid these traits, excellent crypto analyst Miles Deutscher expressed his frustration, suggesting a swift fall to $forty eight,000 to full the market’s most recent turmoil.

“Will we appropriate nuke to $forty eight,000 already and receive this sh*t over with? Dear Germany & Mt. Gox – please appropriate jeet your entire stack. Dear retail, please appropriate exertion sell your low conviction alts. Good receive the wretchedness over with mercurial, then up most productive,” Deutscher wrote.

At the same time as, crypto analyst Dave the Wave successfully-known that Bitcoin had breached a extreme enhance level at $56,500. He identified that the next valuable Fibonacci level, around $forty eight,000, would possibly presumably provide the dear enhance.

Read more: 7 Most effective Crypto Exchanges in the united states for Bitcoin (BTC) Trading

Despite the market’s setbacks, Dave the Wave maintains an optimistic outlook, reminding traders that the market is “serene technically in a bull market.