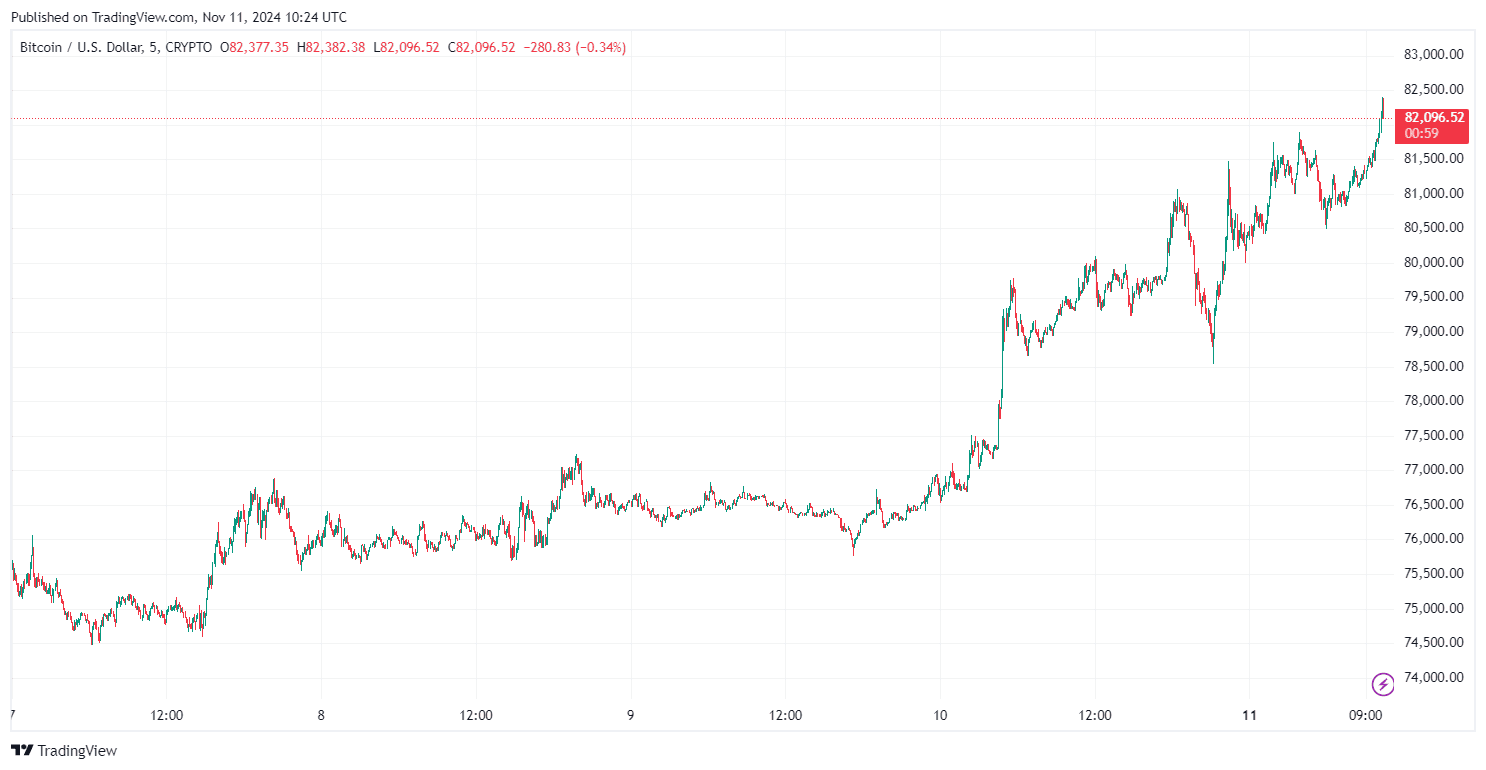

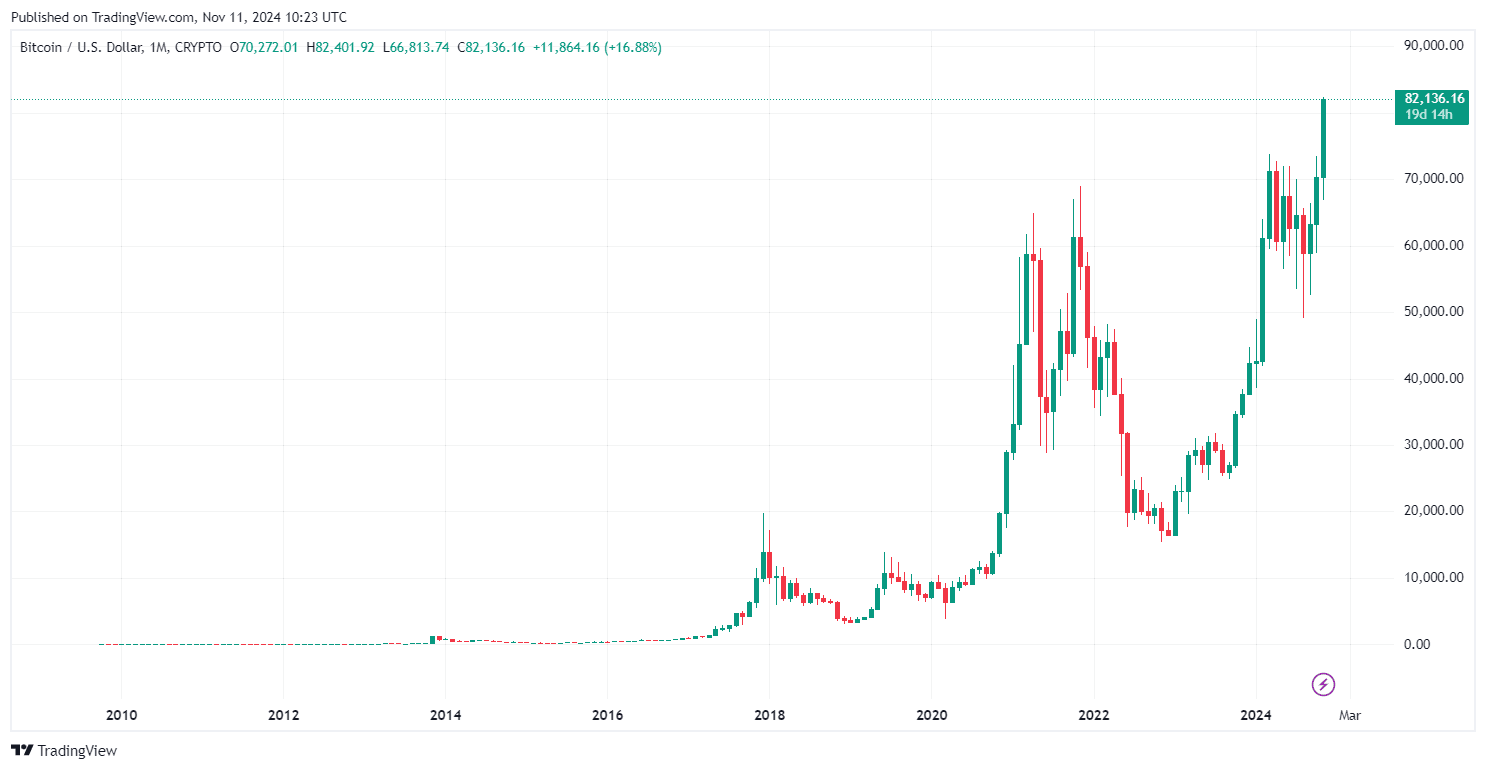

Bitcoin impress surged past $82k, marking a brand new all-time excessive that has sparked excitement in the cryptocurrency world. This newest impress rally comes as President-elect Donald Trump’s skilled-crypto stance gains traction. With hopes of a more favorable regulatory atmosphere, pushed by Trump’s policies and a talented-crypto Congress, Bitcoin and the broader crypto market are seeing document-breaking development. This impress surge isn’t any longer handiest a victory for Bitcoin but has additionally pushed main gains for altcoins esteem Solana, Cardano, and Dogecoin. This article will explore the main factors in the abet of Bitcoin’s meteoric upward push, along side Trump’s have an effect on on the crypto market, MicroStrategy’s intrepid Bitcoin technique, and what lies forward for Bitcoin’s future impress trajectory, highlighting its main key stages to sight out for next.

Bitcoin Mark Surge Ahead of Trump’s Pro-Crypto Insurance policies

Bitcoin impress climbs to new heights above $82k is basically attributed to the rising optimism surrounding Donald Trump’s re-election and his skilled-crypto policies. Trump’s commitment to making the U.S. a international chief in digital property has sent waves of optimism at some level of the market. All the intention in which by his advertising and marketing and marketing campaign, Trump promised to utter Bitcoin as a key strategic reserve asset, akin to gold, and to affect a U.S. Bitcoin stockpile. Furthermore, his efforts to appoint skilled-crypto regulators and push for regulations esteem the Bitcoin Act own extra fueled investor self assurance.

Following Trump’s re-election, the crypto market has witnessed a surge in investments. Bitcoin’s market capitalization soared to over $1.6 trillion, and the overall market valuation reached $2.8 trillion. This set up higher in Bitcoin’s impress is reflective of a broader pattern of institutional and retail hobby in cryptocurrencies, especially Bitcoin, which is viewed because the flagbearer for digital property.

MicroStrategy’s $20 Billion Bitcoin Portfolio Impact on the Market

Any other main pattern contributing to the upward thrust in Bitcoin prices is the persisted funding by MicroStrategy, a exchange intelligence company led by Michael Saylor. MicroStrategy has been a main Bitcoin purchaser, collecting over 252,000 BTC in its portfolio, price over $20 billion at presently’s prices. This strategic mosey by MicroStrategy to retain Bitcoin as an organization asset is section of its broader initiative to boost $42 billion by fairness and securities for future Bitcoin acquisitions. As Bitcoin impress rises, MicroStrategy’s stock has additionally surged, proving the interlinked development of Bitcoin and venerable monetary markets.

MicroStrategy’s bullish stance on Bitcoin has ended in immense unrealized gains, with the company’s portfolio seeing a 107% set up higher in impress. This rising corporate embrace of Bitcoin positions the cryptocurrency as a legit asset in both corporate and deepest funding portfolios, signaling the functionality for wider adoption among institutional traders.

File Bitcoin Positive aspects and the Position of Bitcoin ETFs

To boot to Trump’s skilled-crypto policies and institutional investments esteem those of MicroStrategy, Bitcoin’s impress gains were pushed by the rising hobby in Bitcoin alternate-traded funds (ETFs). Following Trump’s re-election, Bitcoin ETFs own viewed main inflows, with $2.28 billion pouring into Bitcoin ETFs since November 6. The rising reputation of Bitcoin ETFs reflects rising institutional hobby in Bitcoin as a store of impress and a hedge in opposition to inflation.

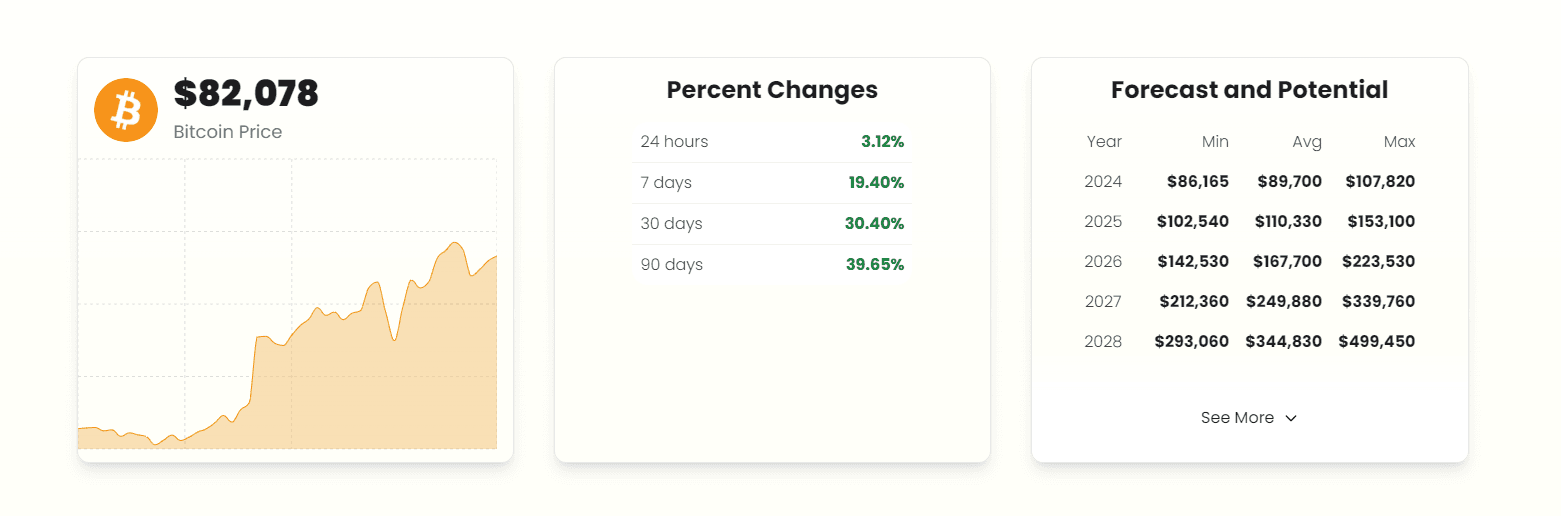

With Bitcoin’s impress pushing past $82,000, analysts are predicting that Bitcoin may perhaps also attain $100,000 by Trump’s inauguration day on January 20, 2025, according to traits in ETF accumulation and historical market files. Bitcoin ETFs are now keeping over 1 million BTC, an indication of accelerating institutional self assurance in the cryptocurrency market.

What’s Next for BTC Mark: See Out For These Key Ranges

The outlook for Bitcoin stays bullish, with many analysts predicting extra development. A technical breakout from Bitcoin’s newest impress stages may perhaps also signal a mosey in opposition to $300,000 by 2026. Bitcoin is currently experiencing a wide inverse head-and-shoulders (IH&S) pattern, akin to the breakout viewed in gold at some level of the 2009-2010 length. If Bitcoin’s impress breaks above the main resistance stages, it may perhaps presumably additionally spark a brand new bull speed, making $300,000 a believable purpose in the approaching years.

For now, the mix of Trump’s skilled-crypto policies, institutional investments, and the rising acceptance of Bitcoin by mainstream monetary markets means that Bitcoin may perhaps also continue to interrupt records in the come future. With Bitcoin’s market capitalization now exceeding $2.7 trillion and an rising different of skilled-crypto policies in the U.S., the means forward for Bitcoin seems to be to be to be like extremely promising.

So, in the transient Bitcoin Mark Prediction, key resistance stages to sight would be: $83k $85k, and $89k. A success surpassing these stages may perhaps also delivery BTC impress to over $90k. And if this Bitcoin surge continues stronger, it is miles amazingly likely to glance Bitcoin impress over $100k, but the main resistance level would must be around $99k and $101k. These would be for November and December 2024.

But when Trump is abet reasonably than job, elevated stages would be expected for BTC impress in early 2025. So according to Bitcoin impress performance and stages reached these November and December can utter the route of Bitcoin impress in the lengthy speed after Trump’s return to the White House formally. Analysts’ opinions are divided in the lengthy speed, some build a query to Bitcoin impress rally to slack down in early 2025, while others build a query to it to skyrocket fueled by the adoption of cryptos and Bitcoin in particular worldwide reaching the digital era highly awaited sooner than expected.

Key Takeaways: Why Bitcoin Mark Surge Issues

- Trump’s Pro-Crypto Insurance policies: Trump’s election has sparked optimism for Bitcoin’s future with guarantees of a Bitcoin stockpile and skilled-crypto regulatory reforms.

- MicroStrategy’s Technique: MicroStrategy’s aggressive Bitcoin acquisitions own no longer handiest added billions to its portfolio but additionally helped set Bitcoin as an organization treasury asset.

- Institutional Adoption: Bitcoin ETFs and rising institutional hobby are main catalysts for Bitcoin’s impress surge, reflecting broader acceptance of digital property.

- Bitcoin’s Future: With analysts predicting that Bitcoin impress may perhaps also hit $100,000 by the level Trump is inaugurated and presumably $300,000 by 2026, the bullish pattern is expected to continue.

As Bitcoin impress pushes new highs, the crypto community is intently looking on the market’s next moves, that can additionally likely be influenced by ongoing regulatory changes and broader economic prerequisites.