Bitcoin value peaked at $58,800 on Aug 8, scoring 6% good points amid bullish tailwinds from recordsdata of Ripple securing a lenient stunning within the lengthy-working lawsuit with the US SEC. Technical indicators highlight key BTC value resistance and make stronger ranges to see.

BTC Ratings 6% Beneficial properties Amid XRP Rally

On August 8, 2024, Bitcoin surged by 6%, fueled by a broader cryptocurrency market rally following Ripple’s settlement with the U.S. Securities and Exchange Commission (SEC).

Ripple Labs, led by CEO Brad Garlinghouse, agreed to pay a $125 million stunning to resolve charges linked to its programmed sale of XRP cash to its institutional customers.

As anticipated, the perceived lenient ruling has sparked optimism among traders. The settlement is considered as a important victory for Ripple, striking off a important factual overhang that had created uncertainty within the XRP/USD markets over the closing 4 years.

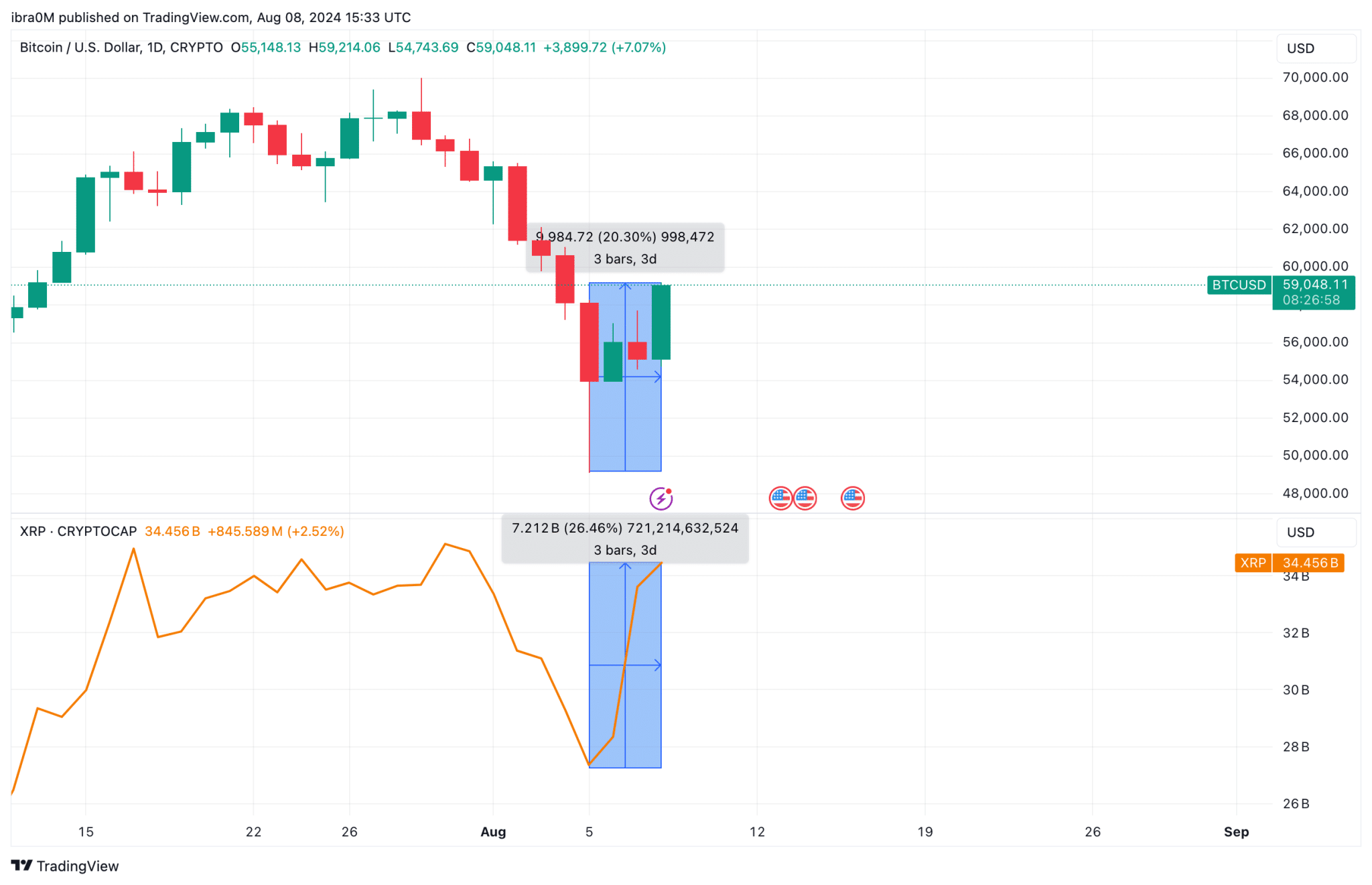

XRP led the rally with double-digit share good points in extra of 20%, as traders interpreted the beautiful as a somewhat gentle penalty.

This definite sentiment spilled over into the broader crypto market, lifting Bitcoin (BTC) and various assets within the stop 20 crypto rankings.

Having a stare upon the BTC/USD charts, we discover how Bitcoin value grazed the $59,214 label within the future of the afternoon GMT trading hours. The surge in market search recordsdata from propelled BTC above the $59,000 label for essentially the most essential time since the Aug 5 smash.

This confirms the myth that Ripple settlement also can fair non-public boosted traders self assurance at it additional deepens the regulatory readability around cryptocurrencies in total.

BTC Sign Forecast: Technical Indicators Price at $65k Leg-Up

Particularly, the 6% rally on Wednesday manner that Bitcoin value has now rebounded 20% from the weekly low of $49,111 recorded within the future of the Aug 5 market smash.

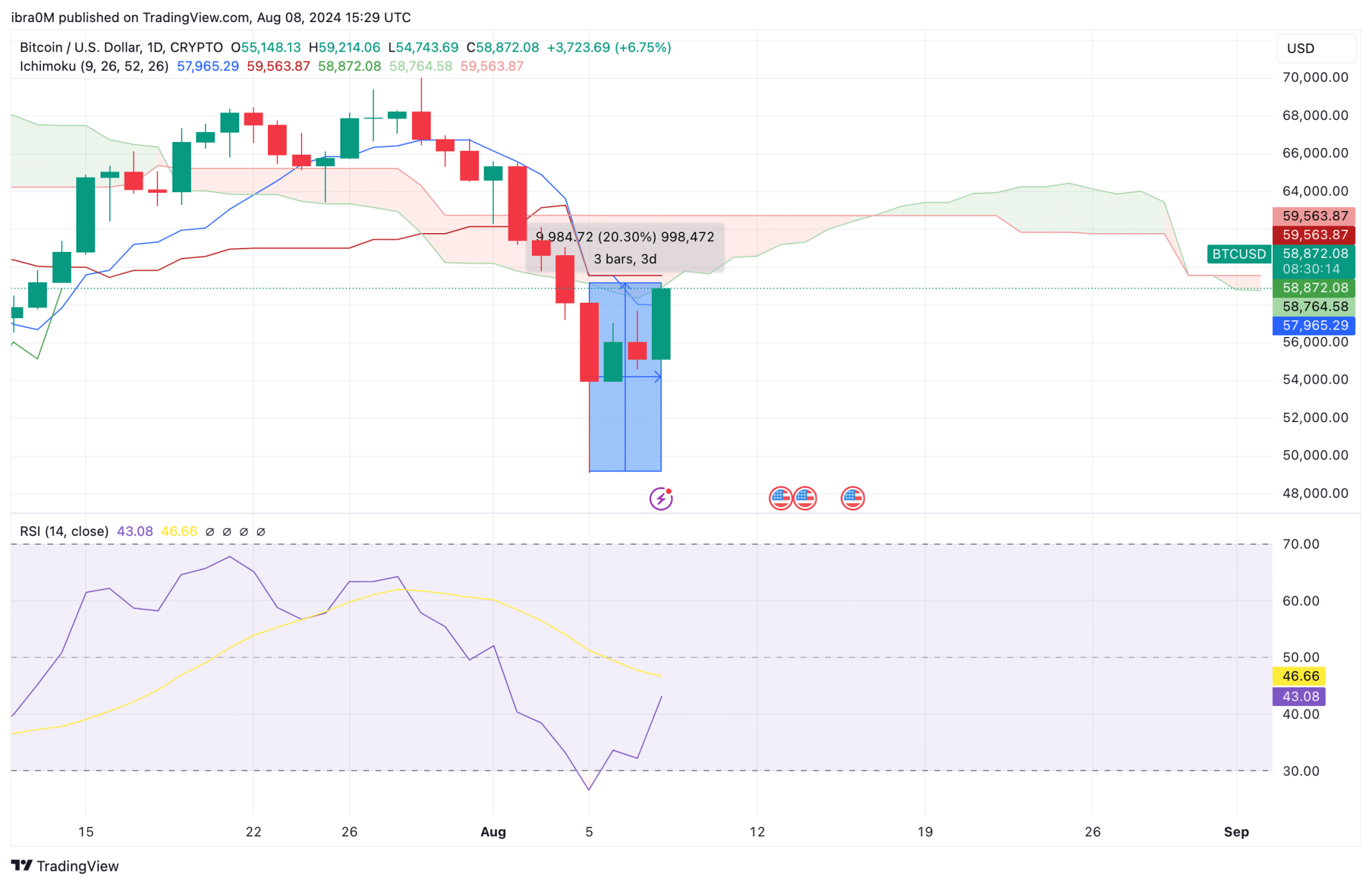

With traders silent cautiously optimistic, the Relative Strength Index (RSI) and Ichimoku cloud technical indicators on the BTC/USD every day value charts are hinting at one other leg-up.

First, the Ichimoku Cloud, a comprehensive indicator combining a lot of keen averages, helps traders assess momentum, model direction, and attainable make stronger and resistance ranges.

On the chart, Bitcoin is trading beneath the cloud, which most regularly signifies a bearish model. Nonetheless, right this moment’s candle has made a important upward dash, pushing Bitcoin in the direction of the cloud’s decrease boundary at $59,563.87.

This implies that Bitcoin is attempting to gather away of its most contemporary downtrend, with the cloud’s decrease boundary serving as essentially the most essential major resistance level. A profitable end above this level would possibly per chance signal a reversal in the direction of the upper ranges of the cloud, doubtlessly targeting the next resistance around $60,000.

The RSI, which measures the lumber and commerce of value actions, is currently at 43.08. That is beneath the neutral level of fifty, indicating that Bitcoin has been in bearish territory. Nonetheless, the RSI has shown a most contemporary uptick from oversold ranges, suggesting that the selling stress also can fair be waning.

This aligns with the Ichimoku Cloud diagnosis, where the pricetag dash signifies a seemingly bullish reversal. If the RSI continues to upward push, especially if it crosses above 50, it would possibly per chance additional verify a shift in momentum from bearish to bullish.