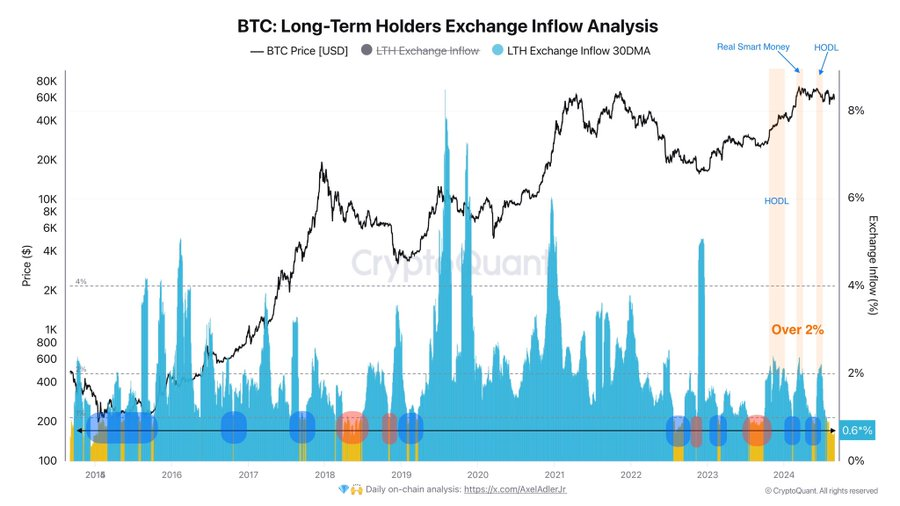

There is a resounding expectation in the crypto crew that the price of Bitcoin would look for a resounding upward momentum in the advance future. An prognosis accomplished by crypto researcher Axel Adler Jr., the usage of the BTC Long-Duration of time Holders Trade Influx Evaluation chart, offers compelling insights into this expectation. His Bitcoin brand prognosis provides a resounding causes why the anticipation of a bullish future for BTC is no longer baseless. This aligns with broader Bitcoin brand predictions suggesting most likely fundamental features.

BTC LTH Trade Influx Evaluation: What It Conveys

In a contemporary put up shared by Adler in X, he has shared the commentary referring to the future command most likely of the price of Bitcoin.

Bitcoin Sign Momentum: A General Evaluation

The price of Bitcoin is barely now real $59,414.15. Since mid-March, after the price of BTC reached the annual peak of $73,000, the strength of the BTC brand has fallen. This month, August, 2024, it dropped even below the outdated month’s lowest of $55,844, to $54,031. Though in the final month the market raised steeply between July 8th and July 21, in which the price became lifted from $55,801 to $68,109, this month between August 2 and August 5, the market skilled a steep plunge, from $65,302 to the bottom point of $54,031. Till now, the market has no longer yet recovered from the impact of the autumn, albeit its contemporary attempts on August 8 and August 23 to push the price increased.

Within the final 30-days by myself, the market has viewed a plunge of 10.1%. The market has skilled a 7-day decline of two.7% and a 24-hour tumble of 1.5%, indicating that no constructive signal of market reversal has emerged in the chart yet

Additionally Test Out : Bitcoin ETF Info: Blackrock IBIT Terrorized by $563.7M Outflow—Is This a Disaster Sign?