Bitcoin’s sign has experienced a huge decline in the previous 24 hours, losing extra than 10% and sending relatively about a consumers into fright mode.

Technical Evaluation

By TradingRage

The Day-to-day Chart

On the day after day chart, it is evident that the price’s failure to interrupt above the $68K resistance level has proven costly, because the market has been losing repeatedly since.

Both $60K and the 200-day sharp practical, situated all over the $61K tag, were broken to the map back. BTC is for the time being shopping and selling at around $50K and can soon test the $48K toughen level. Yet, with the RSI showing oversold values, the price could per chance well catch a bottom soon, even for a short time.

The 4-Hour Chart

The 4-hour chart depicts a nearly vertical decline since the breakdown of the $60K toughen level. With the $54K July low getting broken via, the market structure is extremely bearish for the time being.

Within the meantime, The Relative Strength Index is all as soon as more showing a clear oversold signal on this timeframe. Whereas this cannot be belief to be ample for a restoration, in any case a consolidation above the $48K toughen level seems to be skill in the short term.

Sentiment Evaluation

By TradingRage

Bitcoin Funding Charges

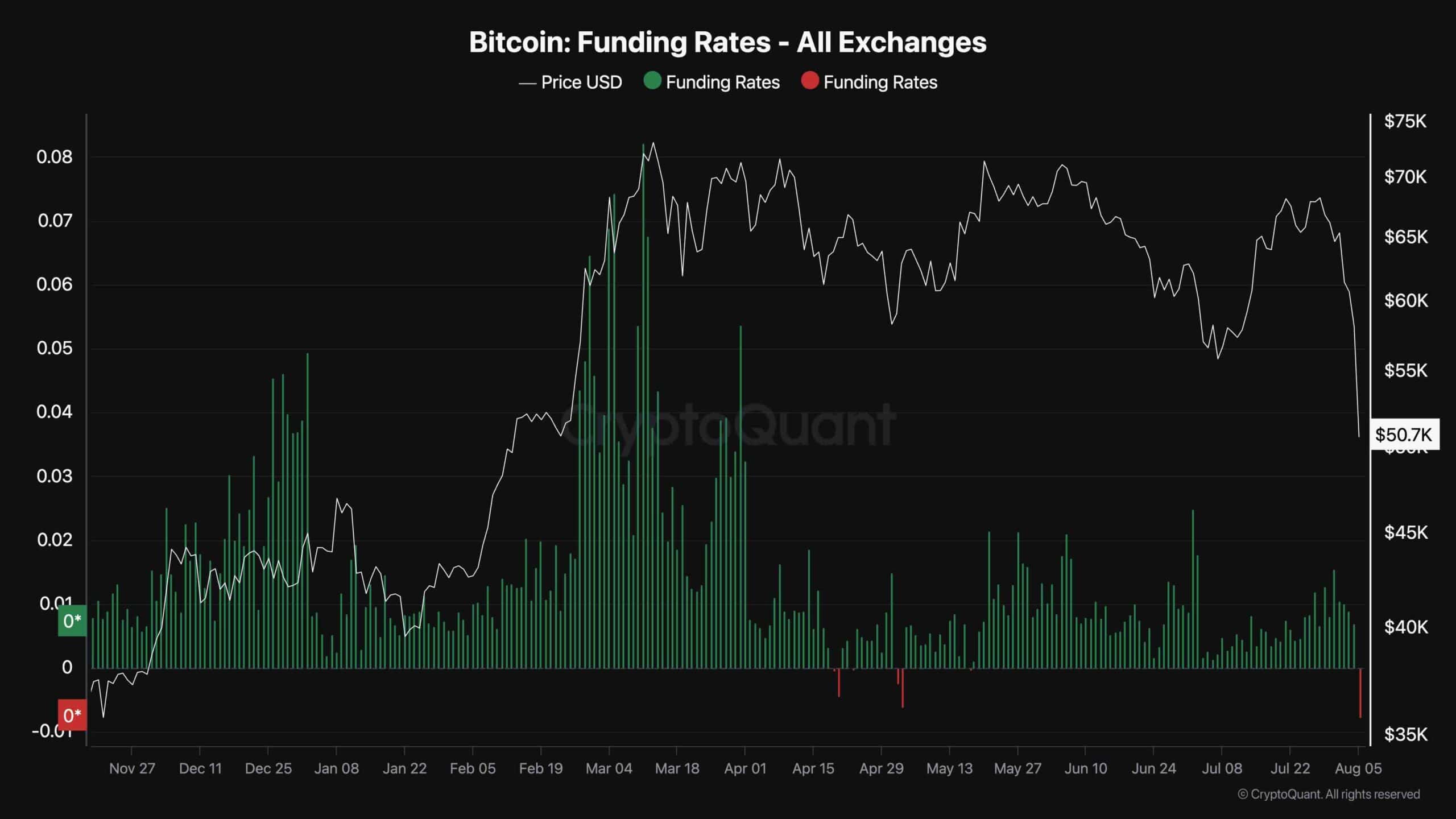

The futures market has over all as soon as more triggered concerns for Bitcoin, because the price has been in a free fall ensuing from a huge long liquidation cascade. This match could per chance well even be clearly seen on the Funding Charges metric chart.

The Funding Charges metric demonstrates whether or not the consumers or sellers are extra aggressive on combination (market orders).

The most new wreck has resulted in the most harmful funding rate sign seen in 2024. Negative funding rates can even consequence in a short liquidation cascade, which could per chance well consequence in a v-formed restoration. Yet, it’ll properly be too soon to map this kind of conclusion.