Bitcoin’s value remains in a suppose of indecision, confined internal a trusty consolidation vary bounded by the 100-day and 200-day transferring averages.

An impending breakout from this vary will likely resolve the asset’s short-time period direction.

Technical Prognosis

By Shayan

The Day-to-day Chart

Bitcoin has been caught in a multi-month consolidation between the $55K-$71K value vary since March 2024, without a positive vogue or direction rising.

This prolonged period of sideways motion indicates an general equilibrium between traders and sellers, with accumulation occurring at the lower slay of the vary and distribution at the slay. Despite this, a bearish imprint has no longer too long previously appeared as Bitcoin broke under the 200-day transferring average at $63.4K.

Nevertheless, the downward momentum became halted upon reaching the 100-day transferring average at $61K, the put the value has since entered a phase of low-volatility consolidation.

Bitcoin is squeezed internal a narrow vary, constrained by the 100-day and 200-day transferring averages. This means that an impending breakout would possibly perhaps well well also resolve its short-time period direction. A decisive hump initiating air this vary would likely imprint the next fundamental vogue.

The 4-Hour Chart

On the 4-hour chart, an ascending wedge pattern has fashioned at some stage in the original prolonged consolidation phase. The associated charge has been oscillating between this wedge’s better and lower boundaries, which most steadily formula to a continuation of the initial bearish vogue if it breaks downward.

Following increased selling stress advance the 0.786 Fibonacci OTE level, Bitcoin experienced a huge rejection, causing the value to cascade toward the wedge’s lower boundary.

BTC is consolidating after receiving reinforce at this level, but sellers plot to interrupt under the wedge’s lower trendline, which coincides with the $60K reinforce space. Must aloof this breakdown happen, the next extreme plot for Bitcoin steadily is the $58K reinforce space.

On-chain Prognosis

By Shayan

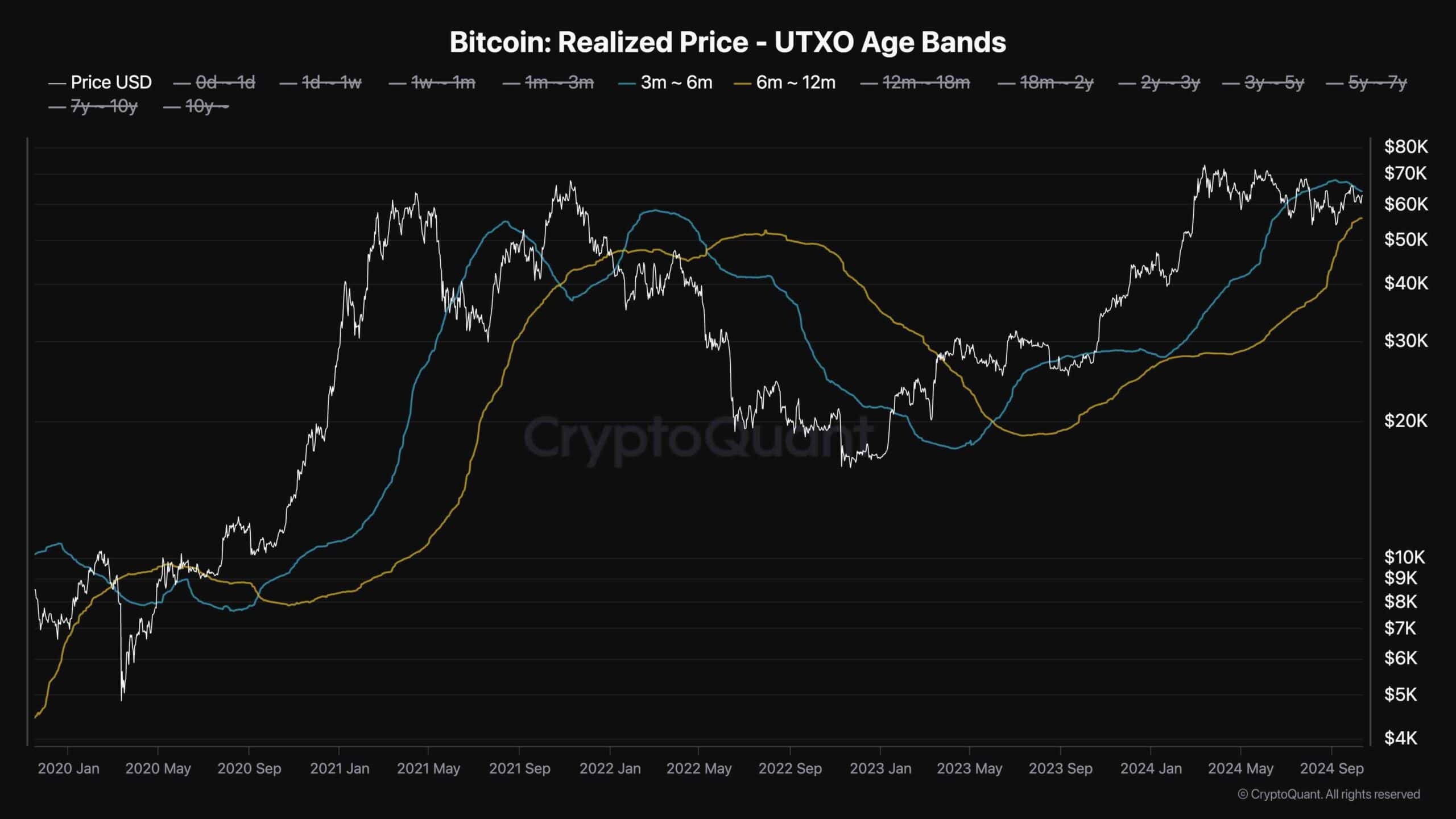

One key on-chain metric for idea Bitcoin market behavior is the realized value UTXO age bands. This metric highlights the average value at which holders received their coins, broken down by how long they’ve held them.

Historically, the realized value in the 3-6 months (short-time period) and 6-365 days (long-time period) cohorts possess served as extreme reinforce or resistance levels. When Bitcoin struggles to interrupt above the average aquire value of these teams, it most steadily signifies a bearish vogue. Conversely, if the cryptocurrency can damage above this realized value, it suggests rising bullish momentum, as new traders are willing to preserve even at better levels.

At original, Bitcoin’s value is hovering between the realized costs of these two teams:

- $64K for the short-time period holders (3-6 months)

- $55K for the long-time period holders (6-365 days)

Bitcoin no longer too long previously surged toward the 3-6 month holders’ realized value of $64K, indicating a test of this key resistance level. A a hit leap forward above this level would possibly perhaps well well also imprint upward momentum and doubtlessly continue the bullish vogue. Nevertheless, if Bitcoin fails to interrupt above this zone, it would possibly perhaps well well also just suggest renewed selling stress from short-time period holders, ensuing in bearish retracements toward the $55K level.