-

Bitcoin surged 18.66% in Could well per chance well simply, hitting $111,970, nonetheless Lark Davis says key profit indicators demonstrate the rally quiet has room to develop.

-

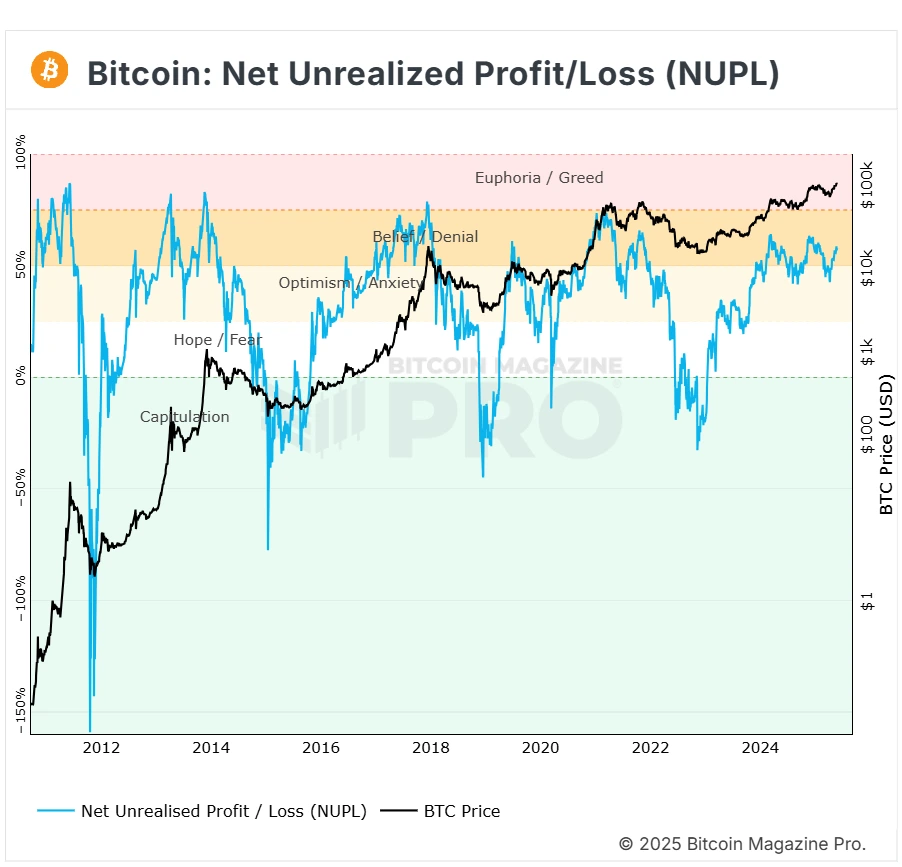

Lark Davis highlights the Accumulate Realised Income/Loss (NPL) and Accumulate Unrealised Income/Loss (NUPL) metrics, signaling Bitcoin holders aren’t rushing to promote yet.

Bitcoin continues to take hold of investor consideration as it navigates a well-known section in its worth cycle. Entrepreneur and well-identified Crypto Analyst Lark Davis no longer too long within the past shared his perspective on whether or no longer the market is nearing its height or quiet has room to plod.

Bitcoin’s Could well per chance well simply Efficiency and Most fresh Designate Overview

Starting Could well per chance well simply at roughly $94,146, Bitcoin’s worth surged impressively at some stage within the month. By Could well per chance well simply 22, the cryptocurrency reached a brand fresh high plan $111,970, marking an 18.66% amplify within staunch three weeks. Though the market skilled a small correction of about 3.9% on Could well per chance well simply 23, bullish momentum fleet resumed, pushing the fee motivate up by over 1.5% the next day.

As of now, Bitcoin’s worth stands at around $108,789—roughly 2.8% below its all-time high. This current worth circulation displays ongoing investor curiosity and a cautiously optimistic market sentiment.

Insights from Lark Davis on Market Prime Alerts

In a most modern put up on X (beforehand Twitter), Lark Davis challenged the final chronicle that Bitcoin’s rally is at its live. He referenced the Accumulate Realised Income and Loss (NPL) indicator to enhance his survey that the market quiet holds well-known upside skill.

The NPL indicator tracks the sensible paper profit right by Bitcoin holders. When the fee is strongly certain, it in overall signals that many merchants hold realized profits, in most cases preceding market corrections. Alternatively, Davis illustrious that this indicator is no longer at existing at height ranges, suggesting that current profit-taking has yet to occur.

This evaluation implies that whereas Bitcoin has rallied tremendously, many holders are quiet in profit nonetheless hold no longer rushed to promote, a condition that could per chance improve extra worth appreciation.

Realizing the Accumulate Unrealised Income/Loss Indicator

To present an explanation for, the Accumulate Unrealised Income/Loss (NUPL) metric measures how mighty profit or loss merchants follow it paper without having offered. A certain studying signifies collective profitability amongst holders, whereas a detrimental fee capabilities to unrealized losses.

On Could well per chance well simply 5, the NUPL changed into once at 52.78%. When Bitcoin reached its height worth no longer too long within the past, the indicator rose to roughly 58.7%. These values, even supposing elevated, hold no longer yet reached crude ranges historically connected to market tops. This aligns with Davis’s survey that the rally can hold to quiet quiet hold room to develop earlier than a seemingly correction.

Balanced Perspective and Market Warning

Whereas Lark Davis offers an optimistic take, it’s well-known for merchants to care for up a balanced perspective. Cryptocurrency markets remain volatile and subject to fast changes basically based mostly on external components equivalent to regulatory tendencies, macroeconomic prerequisites, and broader market sentiment.

Monitoring key technical indicators treasure the NPL and NUPL, alongside basic components, can provide treasured insights for making urged funding choices.