Bitcoin has persevered its corrective switch this week, shedding from all-time highs and testing key trendline and toughen stages. While the broader macro structure stays bullish, the quick-term outlook suggests consolidation and even deeper device back if purchaser momentum fails to step in rapidly.

Technical Diagnosis

By Shayan

The Day-to-day Chart

On the each day timeframe, BTC has damaged below the 100-day consuming sensible, positioned around $115K, however is currently sitting appropriate on the decrease trendline of the successfully-organized ascending channel and the severe 200-day consuming sensible. This self-discipline also aligns with a outdated repeat block and is performing as major toughen.

On the opposite hand, RSI stays below 40, reflecting a clear lack of bullish momentum, and unless the price rebounds fleet, this trendline might per chance per chance per chance well atomize, opening the door in direction of stages below the key $100K zone, which might per chance per chance per chance well result in an overall bearish shift in market vogue.

The 4-Hour Chart

Zooming in, it’s evident that BTC has fashioned a minor sinister around $105K after the breakdown of $115K and $109K stages. The asset is struggling to reclaim the $108K-$109K zone that has now grew to turn out to be into resistance. Moreover, the RSI is a diminutive bouncing however soundless lacks solid momentum, hovering around 38.

The final structure soundless favors the bears within the quick term unless a solid reclaim of $110K followed by larger lows materializes. In every other case, sellers might per chance per chance per chance well push BTC into the $100K self-discipline and even decrease.

Sentiment Diagnosis

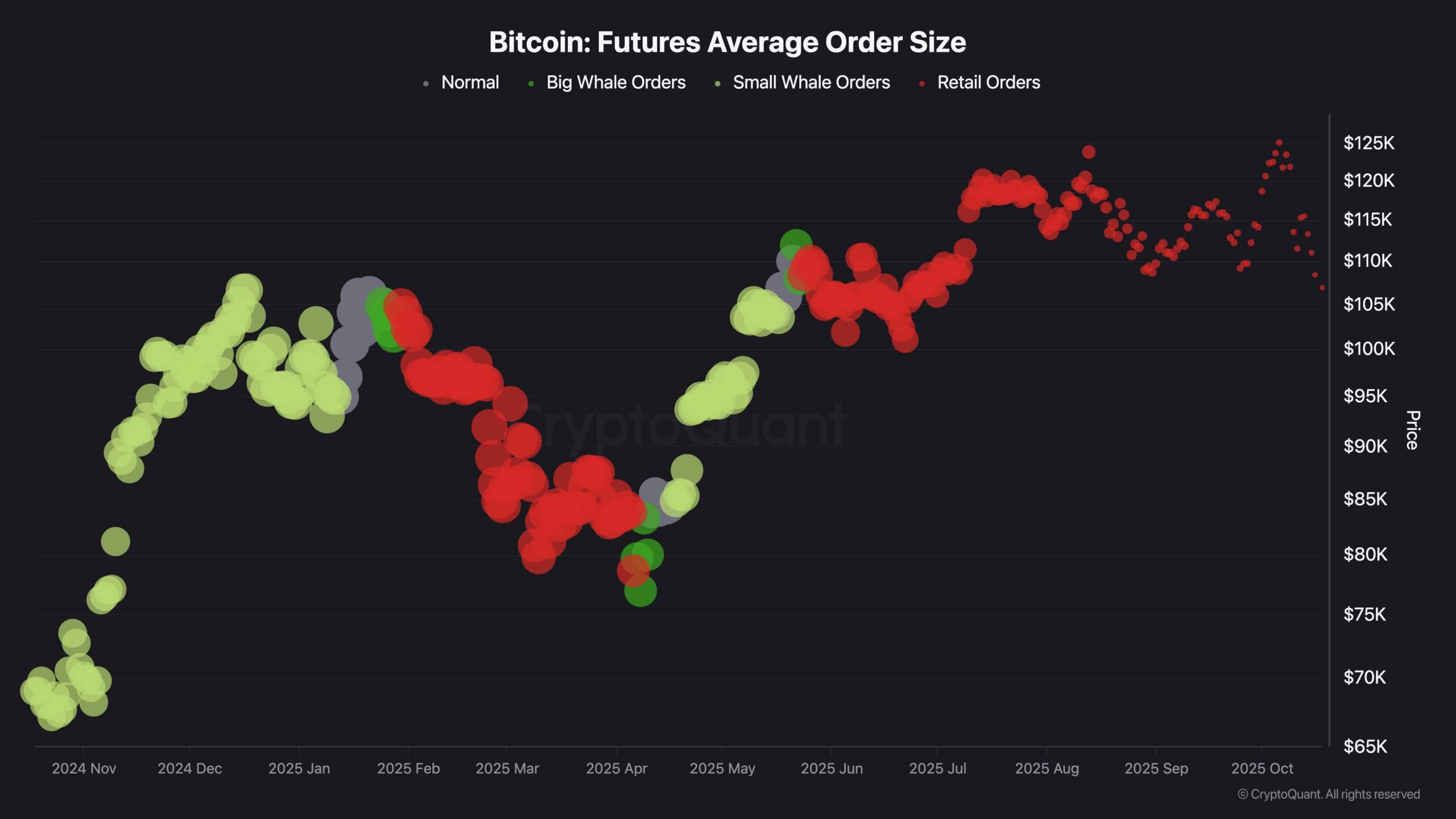

Futures Average Uncover Dimension

Futures repeat size recordsdata reveals a dramatic shift from whale declare in direction of smaller, retail-pushed positions over the previous few weeks. As the price started correcting in September, the series of successfully-organized whale orders started to fade, replaced nearly thoroughly by smaller retail trades.

This implies that the trim cash has stepped aside from leveraged positions, while retail merchants proceed to interact. This on the total happens throughout vogue exhaustion phases and the latter phases of bull markets, which is a truly referring to vogue.

It reinforces the postulate that the fresh dip will not be pushed by solid accumulation, which increases the risk of extra device back unless fresh institutional seek recordsdata from steps in.