Bitcoin has decisively damaged above its outdated all-time high of $111K, triggering a highly efficient bullish rally toward the main $120K psychological resistance.

Nonetheless, as BTC approaches the $120K zone, income-taking and distribution stress could perchance presumably presumably rise, rising the likelihood of a brief corrective pullback.

Technical Prognosis

By ShayanMarkets

The Day-to-day Chart

After a continual consolidation phase, Bitcoin has decisively damaged above its outdated all-time high of $111K. This breakout modified into as soon as backed by a considerable surge in shopping activity, triggering a transient-squeeze that accelerated the bullish momentum. This capability that, Bitcoin without note climbed toward the psychologically considerable $120K resistance stage.

While this transfer alerts solid market self belief, the $120K assign is a doable zone for income-taking and distribution, which could perchance presumably presumably rapid slack down the rally. A brief corrective phase is due to this truth expected, seemingly pulling the price help toward the $111K assign to retest the breakout stage. In step with the Fibonacci retracement instrument, key resistance phases forward would be found at $120K and $131K.

The 4-Hour Chart

On the lower timeframe, Bitcoin printed a highly efficient bullish candle, decisively breaking above each and every the descending wedge pattern and the outdated ATH at $111K. Following a minor pullback to retest the breakout zone, the price resumed its upward surge, reaching the $120K label.

Such impulsive rallies are in most cases followed by brief corrections, as merchants birth to have earnings. A wholesome retracement would seemingly procedure the 0.5 ($113K) to 0.618 ($111K) Fibonacci phases, a key zone where the market could perchance presumably presumably stabilize and assemble momentum for the next leg up.

On-chain Prognosis

By ShayanMarkets

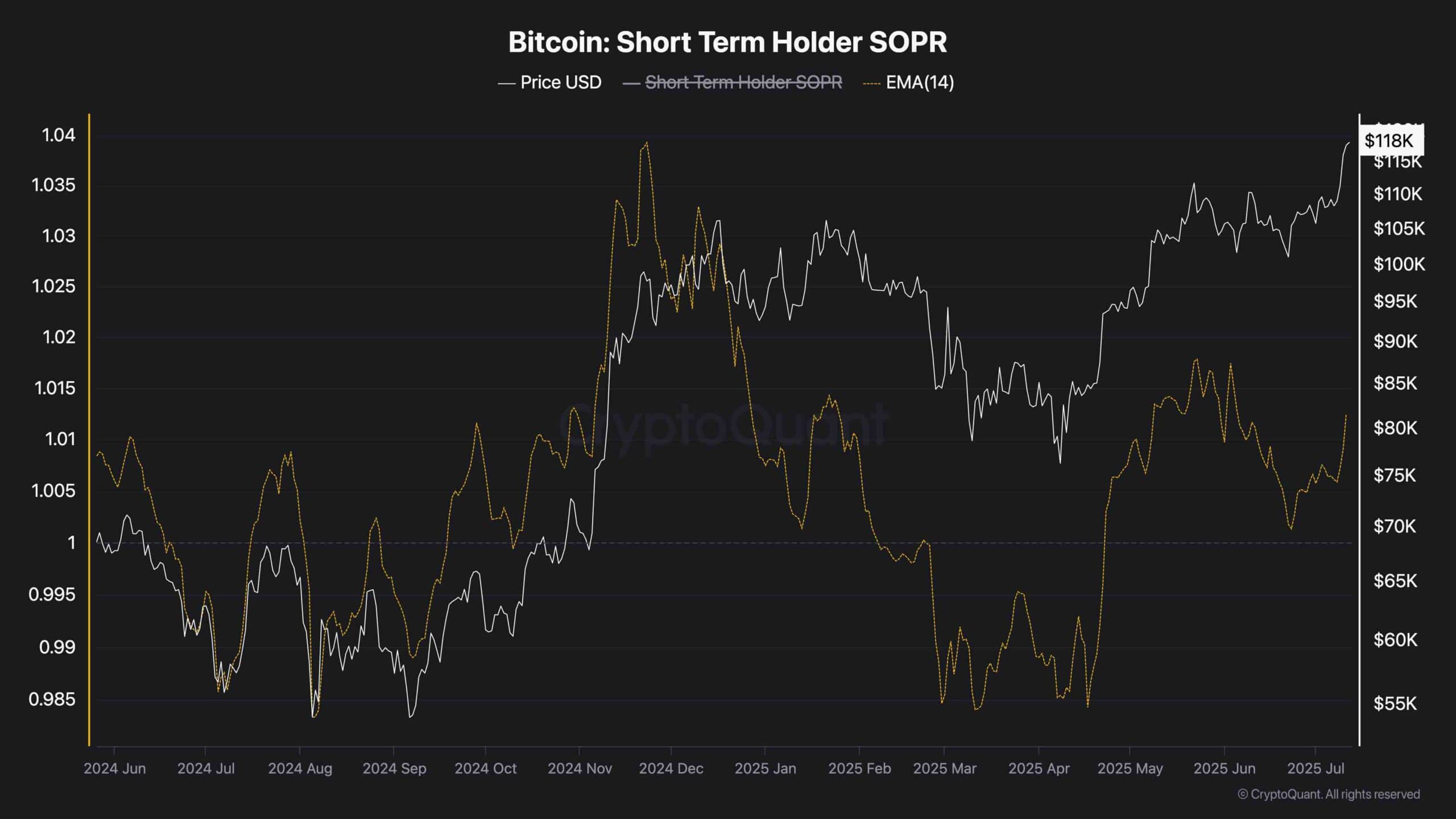

As Bitcoin trades at all-time highs come $120K, an spellbinding insight emerges from the Brief-Time duration Holder SOPR metric. This indicator, which measures realized earnings from patrons who’ve held BTC for no longer up to 155 days, stays critically muted, in particular compared to November 2024, when Bitcoin first reached $111K.

Despite the present surge, brief holders aren’t cashing out aggressively, indicating that income-taking is peaceable quite tiny. Historically, the pause of a bullish cycle is ceaselessly accompanied by elevated SOPR values due to very extensive income realization. But for now, the data suggests the market isn’t overheated, and the present rally could perchance presumably presumably peaceable comprise room to develop if new ask enters.