Bitcoin’s label has been exhibiting a willingness to tumble decrease. Alternatively, market fundamentals existing one thing diverse.

BTC is down by almost about 10% within the past week, for the time being struggling to remain above $58,000.

Technical Prognosis

By TradingRage

The Each day Chart

On the daily chart, the asset has been consolidating around the $60K stage, following a rejection from the $64K resistance line and the fundamental 200-day transferring real looking, which is found around the same label heed. The market is for the time being doable to ascertain the $56K beef up stage.

The RSI indicator has additionally dropped below the 50% stage, indicating a dinky bearishness in momentum. Therefore, if the $56K stage is no longer any longer in a position to retain the fee, a extra decline toward the $52K beef up zone could well per chance well be expected.

The 4-Hour Chart

Having a gaze on the 4-hour chart, it is evident that the market has failed to upward push abet to the $68K resistance stage, which it dropped from at the delivery, because the $64K resistance zone has rejected the fee to the design back. As things for the time being stand, a retest of the $56K stage appears to be like highly doable.

But, the cryptocurrency will doubtless be in a position to rebound from the stage, because the market structure is exhibiting indicators of weak point within the bearish pattern.

On-Chain Prognosis

By TradingRage

Bitcoin Alternate Reserve

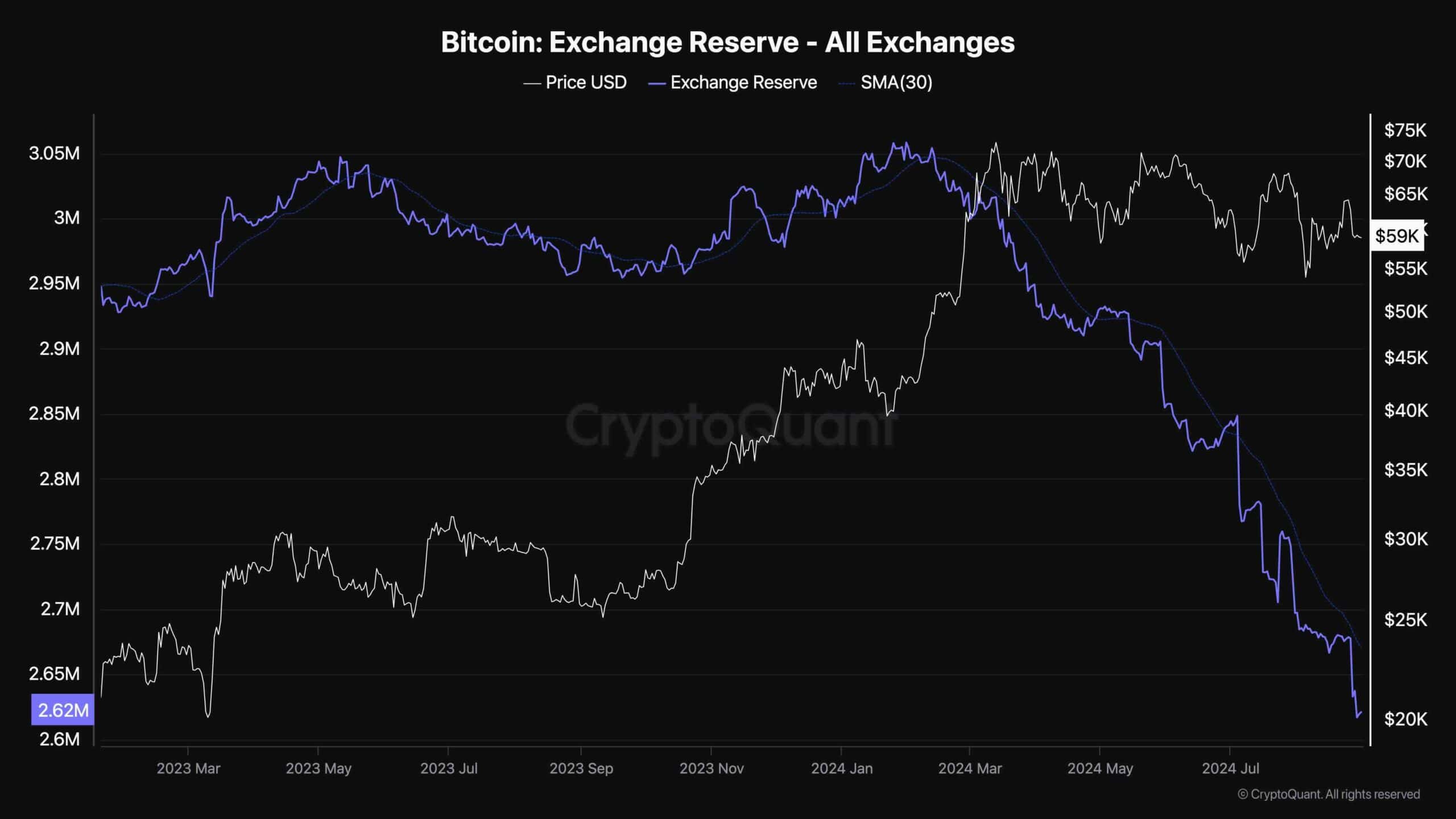

While bitcoin’s label has been going through a prolonged consolidation length over the past few months, merchants are questioning whether the market is experiencing an accumulation or a distribution length.

This chart demonstrates the Bitcoin Alternate Reserve metric, which measures the volume of BTC held on exchange wallets. As these cash could well per chance additionally be sold rapidly, they’re assumed to be a proxy for provide.

Because the chart suggests, the Alternate Reserve metric has been trending down without warning since the starting of the consolidation, indicating that an accumulation section is going down.

As Bitcoin reserves continue to claim no considerably, the odds for a provide shrink, which could result in a brand new label rally, are increasing considerably. But, the futures market situations additionally performs a enormous role in label action, and desires to be belief about fastidiously sooner than drawing any conclusions.