Bitcoin’s mark is level-headed consolidating across the $60K level. But, an impulsive pass could well well maybe delivery up quickly.

Technical Prognosis

By Edris Derakhshi (TradingRage)

The Each day Chart

On the day-to-day timeframe, it’s evident that the price has but to climb back and recover definitively above the $60K level after its expeditiously rejection and fall from the 200-day transferring realistic, located round $63K.

Following the new rebound from the $52,500 level, the price has once once more tested the pivotal vary. Right here’s important on fable of for the market to delivery up a new rally, every $60K and the 200-day transferring realistic can even level-headed be broken to the upside first.

The 4-Hour Chart

Taking a question on the 4-hour chart, the price is in a vital dwelling, as it’s testing a bullish trendline which has been respected for the closing couple of weeks.

If the trendline holds, an elevate above the $60K level could well well maybe be highly probable. On the opposite hand, a breakdown of this vary can even consequence in a fall toward $57K and even the $53K dwelling within the approaching weeks.

On-Chain Prognosis

By Edris Derakhshi (TradingRage)

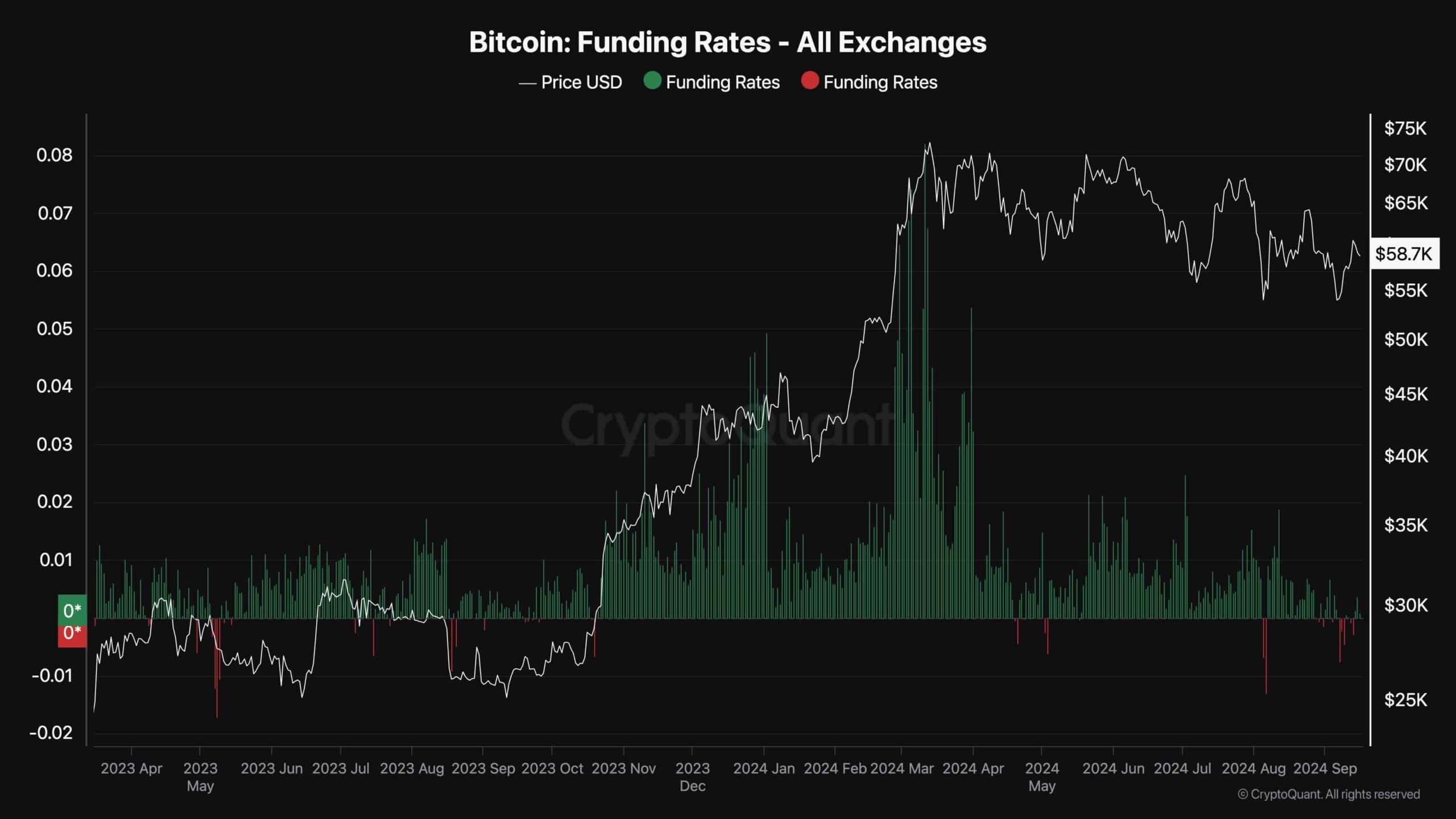

Bitcoin Funding Rates

The futures market has played a valuable role in figuring out the fast-length of time mark motion of Bitcoin over the old couple of years. Due to the this truth, analyzing its sentiment can even be highly important.

This chart demonstrates the Bitcoin funding rates metric, which measures whether the investors or the sellers are more dominant within the futures market. Ride values present bullish sentiment, while adversarial funding rates are associated with fright and bearish sentiment.

As evident on the chart, the rates derive diminished vastly within the route of the new mark consolidation and correction, as many futures traders derive either been liquidated or shifted their views on the market and are in reality on the promote aspect.

Whereas right here’s a clear bearish sentiment signal, it goes to additionally suggest that the market is no longer any longer overheated, and with ample just buying for force, a sustainable rally can delivery up quickly.