Bitcoin’s most recent descent to levels underneath $62,000 has precipitated discussions and speculations amongst investors and analysts alike. The instant decline has pushed the Relative Strength Index (RSI) into what’s historically even handed ‘oversold’ territory. Historically, such indicators possess continuously been precursors to indispensable set apart rebounds, presenting what some analysts peek as capacity purchasing for alternatives.

Celebrated crypto analyst Ali Martinez has highlighted this phenomenon, declaring the historic rebounds Bitcoin has experienced following an analogous cases. In maintaining with Martinez, the past cases where each day RSI reached these levels resulted in impressive surges of 60%, 63%, and an improbable 198%.

Previously two years, the #Bitcoin each day RSI has hit oversold territory three cases, ensuing in $BTC set apart surges of 60%, 63%, and 198%, respectively.

With #BTC now underneath $62,000 and the RSI in oversold territory all over again, it will very properly be a high different to buy the dip! pic.twitter.com/JkJ4IgoeML

— Ali (@ali_charts) June 24, 2024

These statistics possess not long past brushed off, with the present market cases stirring discussions regarding the capacity for one more indispensable set apart restoration.

Market Influence and Dealer Sentiments

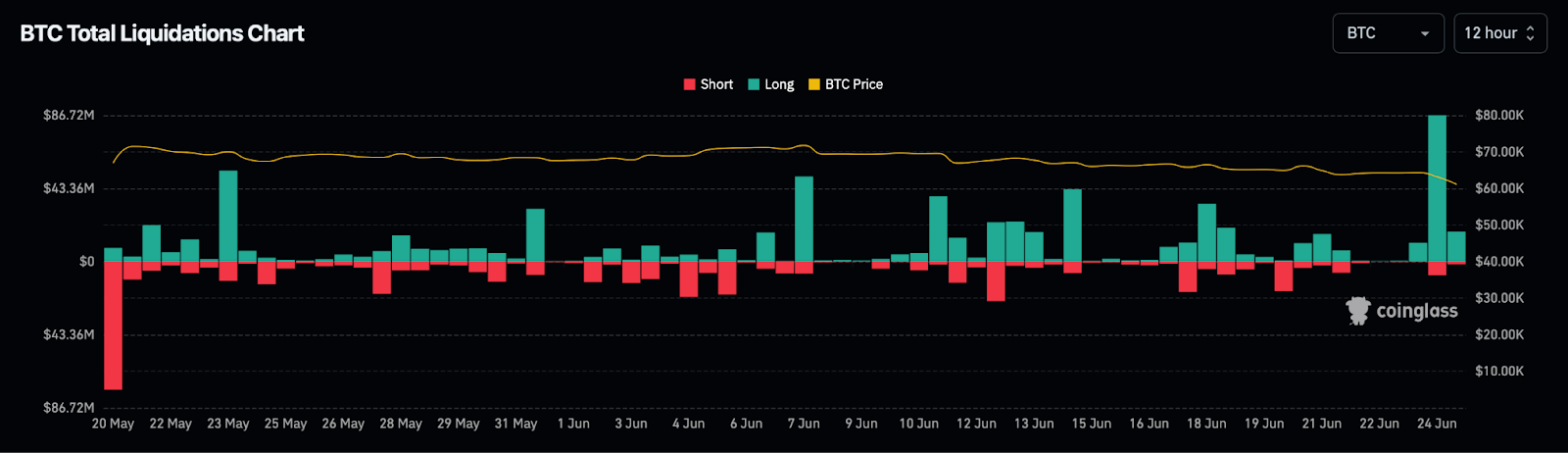

As Bitcoin grapples with these low costs, the affect resonates across the broader cryptocurrency market, affecting altcoins and influencing trader suggestions. Primarily the newest set apart dip has not most intelligent viewed a engaging decrease in set apart but additionally resulted in indispensable trader liquidations.

Info supplied by Coinglass records displays that on moderate 89,025 traders had been liquidated over a span of 24 hours leading to a entire of $314.86mn liquidations spectacles. A colossal sum of these market strikes became felt by Bitcoin traders who misplaced $128.56 million as a result.

Supply: Coinglass

In point of fact, this section of the market understandably has resulted in a blended sentiment by investors. For some, this oversold dwelling will peek care for a golden different to “buy the dip.”

But for others, this may possibly be manner too soon to reach again into the market with extra declines on conception. This cautious optimism is shared by analysts who ogle the cyclical nature of Bitcoin’s market movements, suggesting that while the capacity for good points is very primary, so too is the risk enthusiastic.