As the huge majority of resources in the cryptocurrency sector are making vital strides which enjoy pushed its complete market capitalization lend a hand above $2 trillion, its consultant, Bitcoin (BTC), is main the payment with the supreme imprint since December 2021 and more broad gains incoming.

Certainly, at $1.11 trillion, Bitcoin alone accounts for nearly half of the exchange’s market cap and is on the “parabolic trajectory” toward its imprint hitting $200,000 moderately soon, per the observations shared by crypto and shares analyst Gert van Lagen in an X submit printed on February 27.

Namely, van Lagen outlined that the flagship decentralized finance (DeFi) asset has been on this bullish trajectory since November 2022, following all of the five steps, i.e., “subwaves,” historically per its old parabolic moves, and toward a sell point at $210,000 after its next halving.

Furthermore, the knowledgeable renowned that the value of Bitcoin “has already surged vastly previous the 78.6% Fibonacci retracement stage of the old endure market, which handiest befell submit-halving in the previous,” alongside side that breaching this point on the complete ends in a straight away parabolic take hang of-off.

In other phrases, the maiden digital asset could no longer even anticipate its halving tournament sometime in April 2024 in uncover to make this broad skedaddle upward and reach the brand new all-time excessive (ATH) effectively previous its old story of $69,000 it hit in November 2021.

Bitcoin vs. shares

On top of that, van Lagen renowned that the value circulate of the currently biggest asset in the crypto sector by market cap “also neatly aligns with the escalating threat-on sentiment, which is drawing shut [‘fear of missing out’ (FOMO)] phases in the inventory market atm.”

As he highlighted, there has been a mighty structural correlation between Bitcoin and the S&P 500 since the stay of 2021, and the inventory index has been making its ATHs “already for a lot of weeks in a row,” illustrating his point at aspect-by-aspect chart patterns of every.

Bitcoin imprint diagnosis

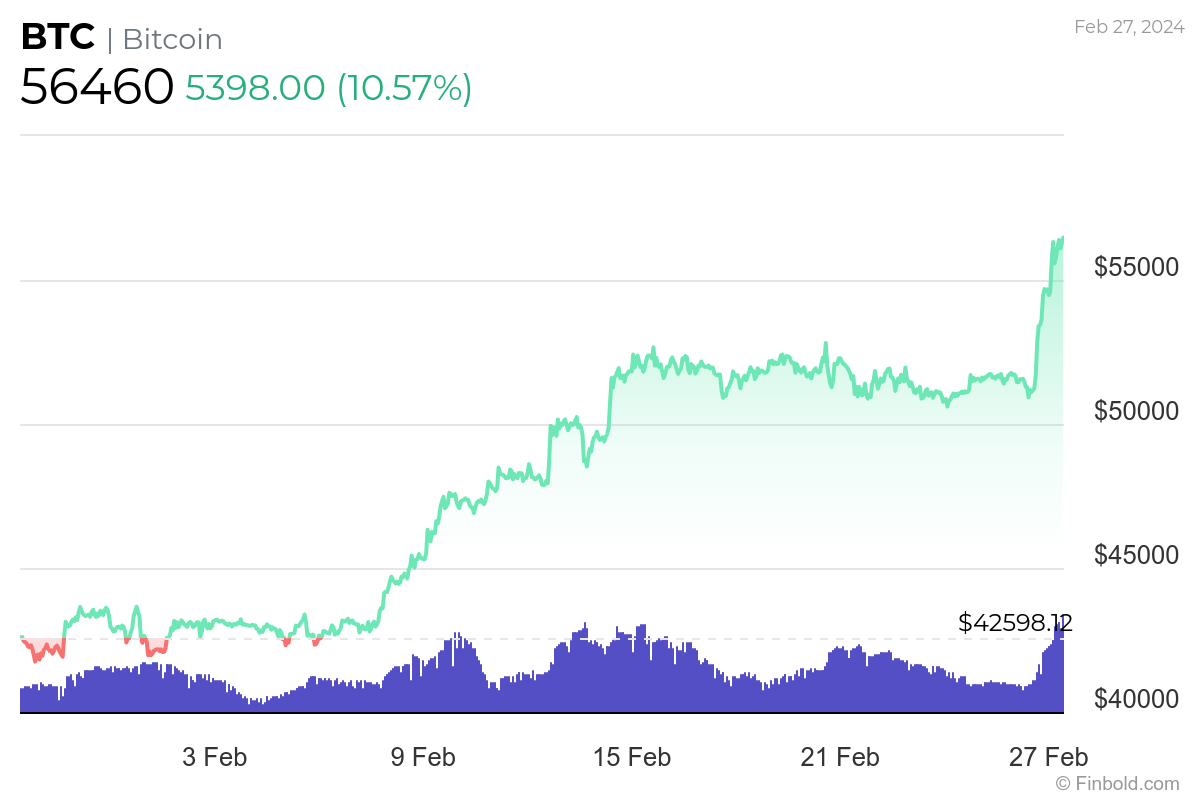

Meanwhile, Bitcoin used to be at press time trading at $56,460, up 10.57% on the day, apart from recording a create of 9.03% across the previous week, alongside side as much as the accumulated come of 32.93% in the final month, as per the latest knowledge retrieved by Finbold.

All things regarded as, heaps of indicators counsel Bitcoin is in for a broad rally in the next few months, most doubtless even surpassing the $200,000 imprint point and proving the knowledgeable accurate. Then again, it’s some distance important to take hang of into yarn that things in this sphere can exchange on a whim, so warning is warranted.

Disclaimer: The boom on this teach could mute no longer be regarded as funding advice. Investing is speculative. When investing, your capital is at threat.