Bitcoin (BTC) continues to cement its tell as a dominant asset within the international monetary panorama, attaining a ancient milestone this week.

In accordance with the most modern Bitfinex Alpha Market Represent, BTC’s market capitalization has surpassed that of silver, reaching an all-time high (ATH) of $1.856 trillion.

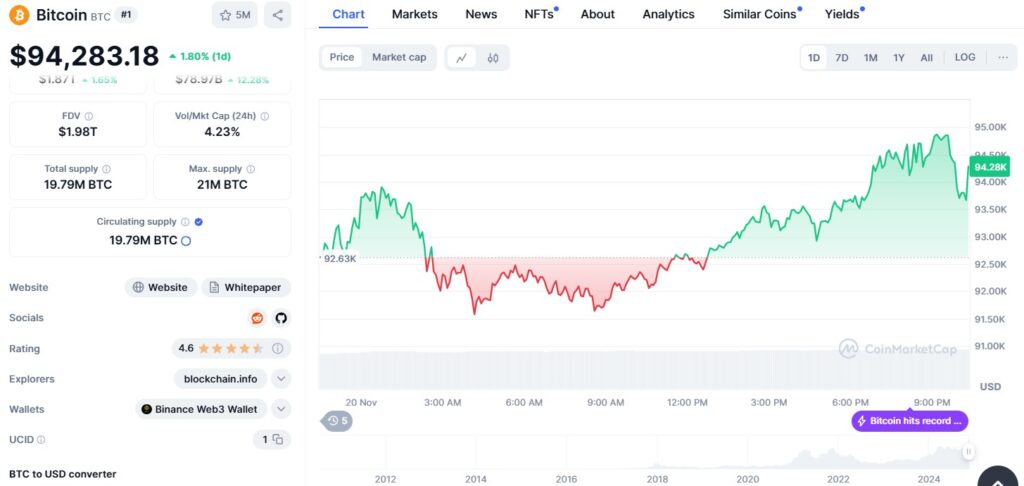

This fulfillment follows a formidable price rally that noticed BTC climb to $94,309.46, marking its 2nd ATH within a single week.

The surge underscores the increasing influx of institutional funding in digital assets, elevating Bitcoin’s tell amongst the sphere’s ultimate traded assets.

Source: CoinMarketCap

BTC surges past silver in market price

Bitcoin’s market capitalization leapfrogged silver’s $1.762 trillion, positioning it as the seventh Most worthy asset globally, as reported by Endless MarketCap.

The recent motion also highlights the big volume of capital flowing into Bitcoin.

In January 2021, Bitcoin’s market capitalization stood at $450 billion.

The exponential development since then alerts a dramatic rise in market participation, driven by institutional players looking for publicity to digital assets.

With Bitcoin’s market capitalization now exceeding silver, the foremost heart of attention shifts to whether or not BTC might perchance almost right this moment rival gold replace-traded funds (ETFs).

Gold remains the dominant international asset with a staggering market capitalization of $17.686 trillion.

Bitcoin’s recent tempo suggests that it’ll surpass the assets below administration (AUM) of gold ETFs within the next two months.

This accelerated trajectory underscores the maturation of Bitcoin as an asset class.

The cryptocurrency’s ability to entice critical capital inflows in a compressed timeframe showcases its increasing acceptance amongst frail monetary institutions.

As a hedge against inflation and an different retailer of price, Bitcoin continues to make traction amongst a various range of merchants.

Institutional money drives chronicle-breaking rally

Potentially the most modern Bitcoin rally stands out as a result of the size of institutional involvement.

Analysts enjoy smartly-known that involving Bitcoin’s price now requires tremendously more capital when put next to its earlier rallies.

The recent ATHs, achieved within hours of each other, replicate unheard of ranges of funding bid.

Market contributors are more and more drawn to Bitcoin’s lengthy-period of time price proposition, particularly as frail assets face economic uncertainty.

Institutional adoption is extra bolstered by increased regulatory clarity and the originate of Bitcoin ETFs in foremost markets, which give more accessible funding avenues.

Bitcoin’s increasing dominance amongst international assets

Bitcoin’s rise to the seventh tell in international asset rankings marks a pivotal 2nd within the cryptocurrency’s evolution.

It now outpaces legacy assets akin to silver and is narrowing the gap with technology and monetary giants.

BTC’s market capitalization of $1.856 trillion underscores its transition from a speculative digital forex to a known monetary instrument.

No topic its achievements, Bitcoin faces challenges, alongside with price volatility and regulatory scrutiny. Its resilience and fixed development over the years continue to entice each retail and institutional merchants.

The quiz now’s whether or not or not Bitcoin can withhold its most modern momentum.

With macroeconomic components akin to inflation and monetary policy playing a necessary function, BTC’s efficiency might perchance hinge on broader market instances.

Nevertheless, its established tell as a digital asset leader makes it smartly-poised for added development.

As Bitcoin climbs the international asset rankings, its function in shaping the vogue forward for finance becomes more and more evident.

The cryptocurrency’s ability to consistently outperform frail assets alerts a shift in investor preferences, cementing its tell in popular portfolios.

The post Bitcoin overtakes silver as seventh ultimate asset after hitting $94k ATH appeared first on Invezz