Bitcoin and US buck–pegged stablecoins are rising as a global various for engrossing value across borders without banks and card networks, as the Bitcoin community’s settlement volume begins to rival the enviornment’s ideal price giants.

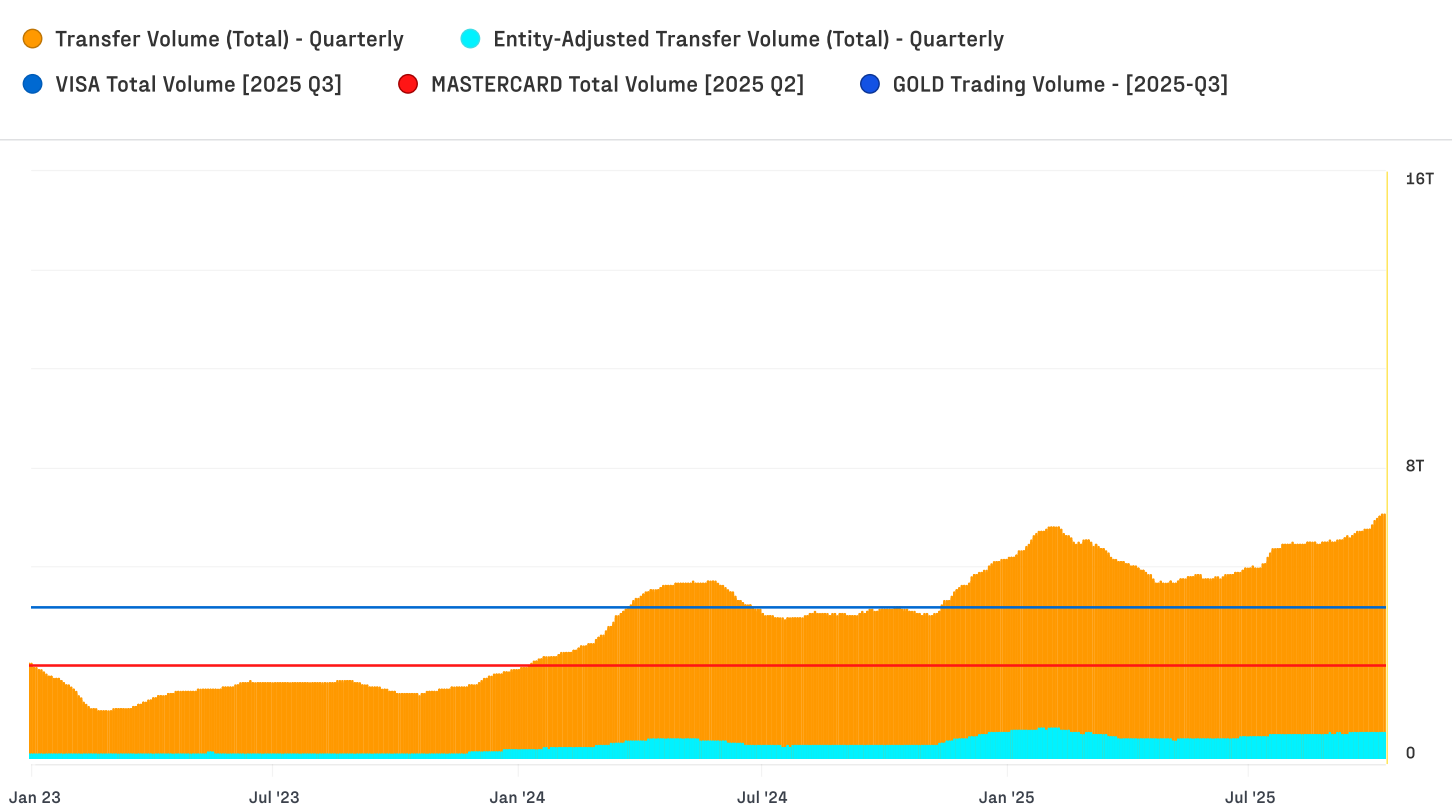

Bitcoin (BTC) settled $6.9 trillion value of payments within the future of the last 90 days, which is “on par with or above Visa and Mastercard,” in accordance with blockchain recordsdata platform Glassnode’s digital asset look at document for the fourth quarter of 2025, printed on Wednesday.

Over the connected duration, Visa processed $4.25 trillion in price volume and Mastercard $2.63 trillion, for a mixed $6.88 trillion, in accordance with the document.

“Exercise is migrating off-chain as flows switch to #ETFs and brokers, but Bitcoin and #stablecoins proceed to dominate on-chain settlement,” Glassnode said on X.

Associated: Financial institution of The US backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

Bitcoin’s economic settlement quiet shrimp subsequent to cards

Once interior transfers between addresses controlled by the connected entity are stripped out, Bitcoin’s “economic” settlement is nearer to $870 billion per quarter, or about $7.8 billion per day, Glassnode estimated. The company said the numbers quiet point to Bitcoin’s increasing role as a “globally relevant settlement community, bridging every institutional and retail transaction flows.”

This figure pales in comparability to Visa’s $39.7 billion day to day moderate transaction volume, or Mastercard’s $26.2 billion, the lion’s share of which is inclined for particular person retail spending and day to day wants.

In distinction, Bitcoin’s settlement volume is mainly attributed to buying and selling, remittances, and store-of-value investment, as global carrier provider adoption stays low.

Worldwide, ideal 20,599 merchants receive Bitcoin payments in accordance with BTCmap, when put next with Visa’s 175 million global carrier provider locations.

Associated: Bitcoin merchants hit peak unrealized misfortune as ETFs begin as a lot as flip sure

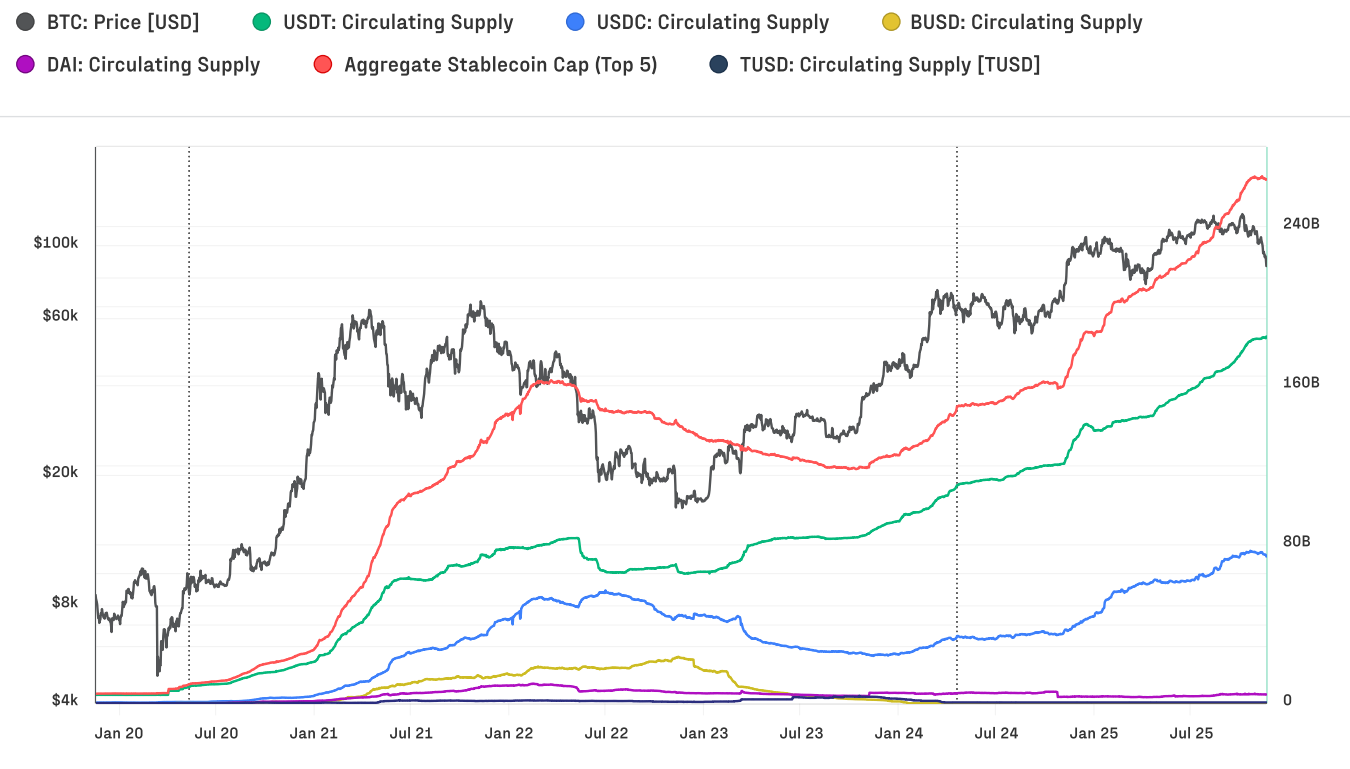

Stablecoins switch $225 billion a day, but mostly bots

Stablecoins are rising as every other global value switch various, thanks to their mounted model, low transaction expenses and 24/7 availability.

Stablecoins are basically engrossing a median of $225 billion in value per day, in accordance with the 30-day engrossing moderate of combination switch volume for the highest 5 stablecoins calculated by Glassnode.

But, about 70% of the $15.6 trillion stablecoin transfers within the future of the third quarter of 2025 have been linked to automated buying and selling bots, no longer natural exercise.

Natural non-bot exercise ideal accounted for roughly 20% of the total, while the final 9% used to be attributed to interior clear contract transfers and interior alternate transactions, in accordance with a look at document from crypto alternate CEX.io.

The alternate’s researchers said it used to be “indispensable” to expose apart between natural and bot exercise for policymakers to mediate the systemic chance and valid-world adoption of stablecoin payments.

Magazine: Small one boomers value $79T are within the waste getting on board with Bitcoin