Solv Protocol has launched SolvBTC.AVAX, a token that links Bitcoin to real-world asset (RWA) yields. Built on Avalanche, the product permits users to fabricate returns from damaged-down monetary devices while retaining BTC on-chain. Users deposit BTC.b or SolvBTC and score SolvBTC.AVAX, gaining publicity to tokenized resources bask in U.S. Treasuries and personal credit score.

The scheme makes consume of an automated vault to manage deposits. As soon as BTC is converted to SolvBTC.AVAX, the protocol routes capital into yield-generating positions with out requiring manual intervention. This integration targets to remodel Bitcoin from a dormant asset real into a productive one.

The product taps real into a rising pattern in crypto: the tokenization of damaged-down resources. It makes consume of a structured device to bridge Bitcoin with real-world finance, positioning BTC as a gateway to extra staunch, regulated returns.

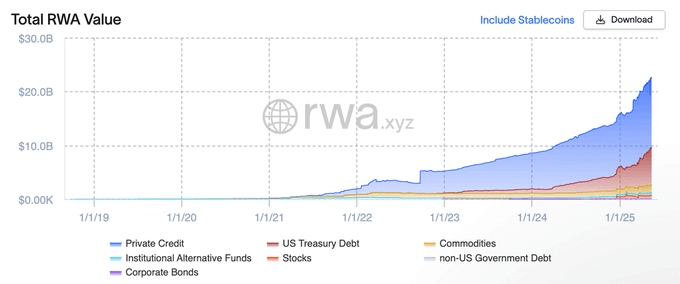

Actual-World Sources Imperfect $22 Billion, Institutional Question Grows

Data from rwa.xyz displays that tokenized RWAs now exceed $22 billion in on-chain impress. Since mid-2022, this resolve has risen sharply, with the most enhance concentrated in personal credit score and U.S. Treasury debt. BlackRock and Hamilton Lane are key contributors to this growth, supplying billions in tokenized securities.

U.S. Treasuries beget gained traction on-chain because of the their low-possibility profile and compatibility with digital finance infrastructure. Their rising presence in DeFi suggests that institutional-grade devices are gaining have faith amongst decentralized protocols.

This shift displays rising ardour in linking blockchain to legacy markets. RWAs supply predictable returns and aim below regulatory oversight, making them attention-grabbing to every institutional and crypto-native contributors seeking yield decisions.

Modular Protocol Stack Powers BTC x RWA Integration

SolvBTC.AVAX is constructed thru a coordinated device of 5 decentralized protocols. Solv handles scheme automation, compounding, and reward administration. Avalanche offers the execution layer, offering rapid transactions and low bills. Elixir mints deUSD, a stablecoin backed by tokenized damaged-down resources.

Euler enables stable looping of deUSD to enhance capital effectivity. Liquidity is deployed thru LFJ and Balancer, the attach swap bills and emissions make a contribution to returns. Each squawk performs a determined aim, guaranteeing a fully on-chain, scalable device.

The vault buildings its yield direction of spherical deUSD. Deposited BTC triggers minting of this stablecoin, which is then cycled thru lending and farming protocols. Earnings are auto-compounded reduction into the device, reflected in the rising impress of SolvBTC.AVAX.

Avalanche Chosen for Low-Imprint Infrastructure

Avalanche serves because the inspiration for SolvBTC.AVAX operations because of the its composability and bustle. The chain supports DeFi purposes at scale while affirming low community bills and finality instances, which may perhaps perhaps well well be famous for real-time capital disappear.

SolvBTC.AVAX joins a rising listing of monetary primitives being deployed on Avalanche. The platform’s enhance accommodates modular methods bask in Solv’s, which require coordination between diverse neat contracts and liquidity layers.

By leveraging Avalanche’s ecosystem, Solv beneficial properties score entry to to tooling and integration recommendations wished for vault growth. These aspects abet streamline complex yield ideas with out compromising transparency or decentralization.

Unified Plan Offers Layered Rewards

SolvBTC.AVAX contains a triple incentive mannequin. Users score AVAX-essentially based totally totally rewards proportional to their holdings. They additionally fabricate Elixir’s Potion Parts when minting deUSD, and Solv Season 2 Parts tied to vault participation.

Each incentive mechanism connects to a determined layer in the scheme stack. This encourages engagement all over extra than one protocols and offers a constructed-in reward cycle that compounds alongside the vault’s yield operations.

All processes are automated. Users simplest want to attend SolvBTC.AVAX to fabricate publicity to underlying resources, farming alternatives, and ecosystem incentives. This streamlines score entry to to yield with out requiring users to manage every protocol in my notion.

Shift Toward Productive Bitcoin Finance

The discharge of SolvBTC.AVAX signals a structural shift in how Bitcoin interacts with monetary markets. Backed by $4 billion in tokenized resources, it offers a mannequin for remodeling BTC from a static reserve real into a yield-generating tool.

Institutional involvement from companies bask in BlackRock and Hamilton Lane adds weight to this transformation. Their asset flows into DeFi toughen a rising framework the attach blockchain infrastructure mirrors damaged-down finance mechanics.

SolvBTC.AVAX objects a foundation for additonal integration between crypto and real-world capital markets. It demonstrates how Bitcoin can evolve beyond a speculative asset and into an instrument tied to macroeconomic performance.

Disclaimer: The records supplied in this article is for informational and educational capabilities simplest. The article does not sing monetary recommendation or recommendation of any form. Coin Edition isn’t liable for any losses incurred since the utilization of train material, merchandise, or products and companies mentioned. Readers are told to exercise caution ahead of taking any action connected to the company.