Bitcoin BTC$87,066.63 has spent nearly all of December locked between $85,000 and $90,000, whereas U.S. equities rallied and gold hit all-time highs. That’s left bitcoin investors frustrated, and the clarification lies in derivatives mechanics.

Now, these self same mechanics uncover that a really grand cryptocurrency will possible be making a ruin toward the high end of the differ. The more possible result after expiry is an upside determination toward the mid $90,000s in space of a sustained ruin below $85,000.

The predominant driver has been a heavy concentration of choices round newest costs. Alternatives are contracts that give traders the upright, nonetheless no longer the responsibility, to aquire or sell bitcoin at a drawl tag. Name risk holders succor if tag rises, whereas set choices succor if tag falls.

On the opposite aspect of these trades are the decisions writers, who get to honor the contracts if the holders prefer to convey them. They hedge their difficulty dynamically within the quandary and futures markets, and that habits is managed by what’s is called gamma and delta.

Delta measures how well-known an risk’s tag adjustments for a $1 pass within the bitcoin tag. Gamma measures how rapidly that delta adjustments as tag strikes. When gamma is high and shut to quandary, sellers are forced to aquire and sell again and again, suppressing volatility.

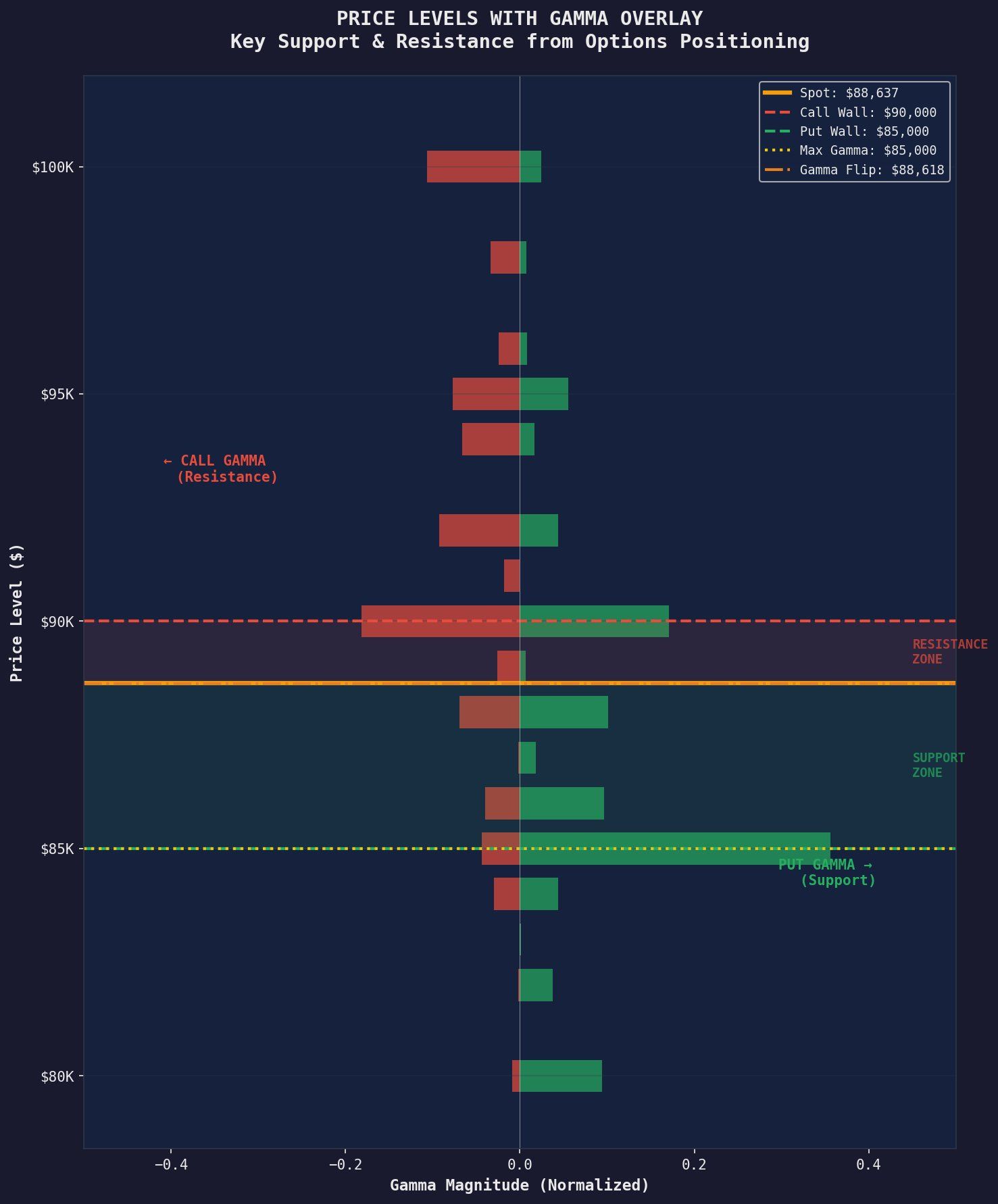

Per X legend, David, in December, expansive set gamma near $85,000 acted as a flooring, forcing sellers to aquire bitcoin because the worth dips. At the linked time, heavy name gamma near $90,000 capped rallies, with sellers selling into energy. This created a self-reinforcing differ driven by hedging necessity in space of conviction.

With $27 billion of choices impending expiry on Dec. 26, this stabilizing compose weakens as gamma and delta decay.

This expiry is intensely expansive and has a bullish tint in opposition to it. Extra than half of of Deribit begin ardour rolls off, with a group-name ratio of upright 0.38 (that is, there are nearly three cases as many name choices as locations) and most begin ardour concentrated in upside strike costs between $100,000 and $116,000.

The max effort level, which refers back to the worth stage at which choices patrons would lose the most cash at expiry and the sellers, in most cases sellers, would compose the most, is at $96,000, which boosts the upside skew.

In addition, implied volatility measures the market’s expectation of how well-known bitcoin’s tag would possibly also just fluctuate eventually, and the Bitcoin Volmex implied volatility index hovering near one month lows round forty five suggests traders are no longer pricing in elevated near-term difficulty.