Bitcoin’s onchain inflows are signaling robust quiz for the enviornment’s largest cryptocurrency, with both merchants and miners ramping up their exercise irrespective of the detrimental market sentiment for the explanation that $19 billion crypto atomize.

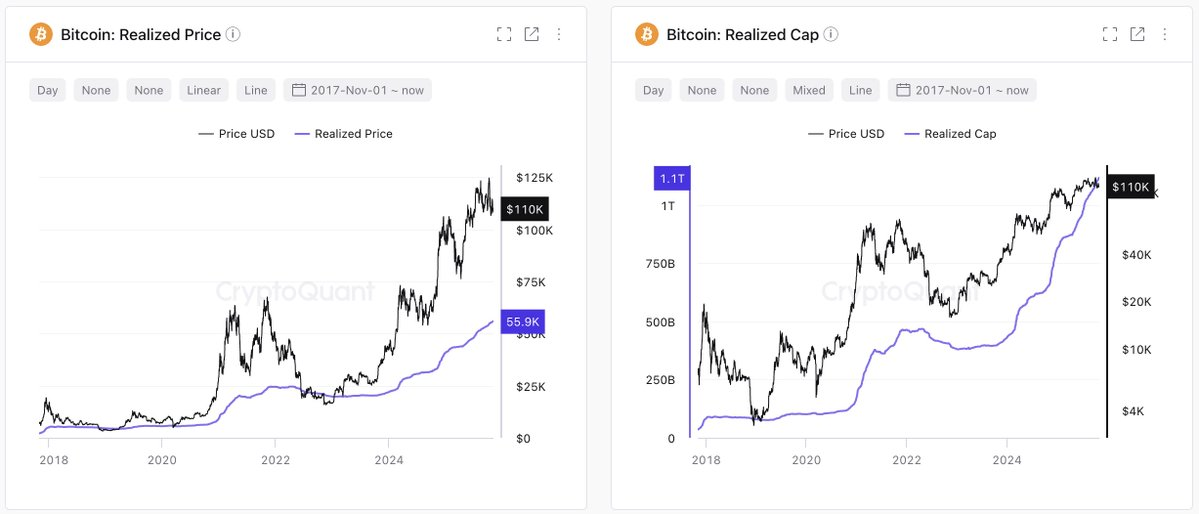

For the duration of the last week, Bitcoin’s (BTC) realized cap rose by over $8 billion to surpass $1.1 trillion, as BTC’s realized rate rose above $110,000, indicating solid onchain inflows.

Bitcoin’s realized cap measures the greenback worth of all coins at their last moved rate, revealing the whole funding held by Bitcoin holders.

The new inflows are primarily attributed to Bitcoin treasury companies and replace-traded funds (ETFs), per Ki Young Ju, the founder and CEO of crypto analytics platform CryptoQuant.

Alternatively, Bitcoin’s rate recovery will remain puny until Bitcoin ETFs and Michael Saylor’s Strategy restart their mighty-scale acquisitions, wrote Ju in a Sunday X post, along side:

“Place a question to is now driven mostly by ETFs and MicroStrategy, both slowing buys lately. If these two channels enhance, market momentum likely returns.”

Related: Saylor guidelines $150K Bitcoin in 2025 irrespective of Trump tariff shocks: Finance Redefined

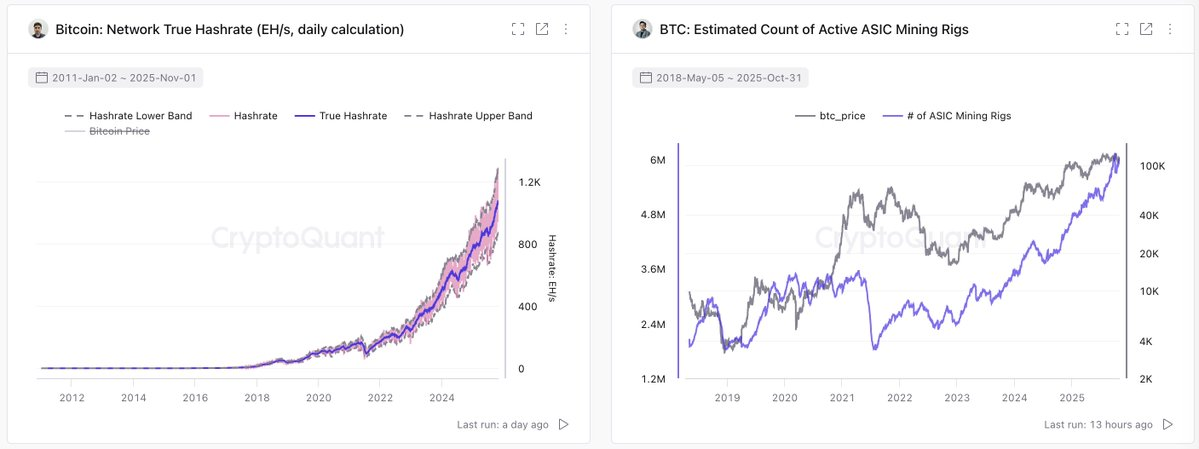

In the meantime, Bitcoin miners are rising their operations, ensuing in a rising hash rate, which is a “obvious prolonged-term bullish signal” for the continued hiss of the “Bitcoin money vessel,” defined Ju.

Just a few mighty Bitcoin miners contain lately expanded their mining fleets, along side the Trump family-linked American Bitcoin, which purchased 17,280 utility-snarl integrated circuits (ASICs) for roughly $314 million, Cointelegraph reported in August.

Related: Bitcoin ‘too costly’ for retail, threatens to whole bull market cycle

Bitcoin $140k in November, looking on ETF flows: analysts

No matter the $8 billion of most in vogue inflows, crypto investor sentiment was unable to enhance from “Anguish” territory for the explanation that file $19 billion market atomize on the starting build of October.

Investor sentiment remained depressed irrespective of the White Dwelling releasing a comprehensive assertion outlining the trade settlement reached between President Trump and Chinese President Xi Jinping on Saturday.

Alternatively, a resurgence in ETF inflows and attainable monetary easing announcement from the Federal Reserve also can propel Bitcoin’s rate to $140,000 in November, analysts from Bitfinex replace told Cointelegraph, along side:

“Our defective case sees Bitcoin rising in the direction of $140,000, with whole ETF inflows between $10 and $15 billion now not being comely.”

“Catalysts contain Fed easing with two cuts in Q4, ETF inflows doubling, and seasonal Q4 energy, whereas risks remain round tariffs and geopolitics,” added the analysts.

Journal: Bitcoin to search ‘but any other large thrust’ to $150K, ETH stress builds