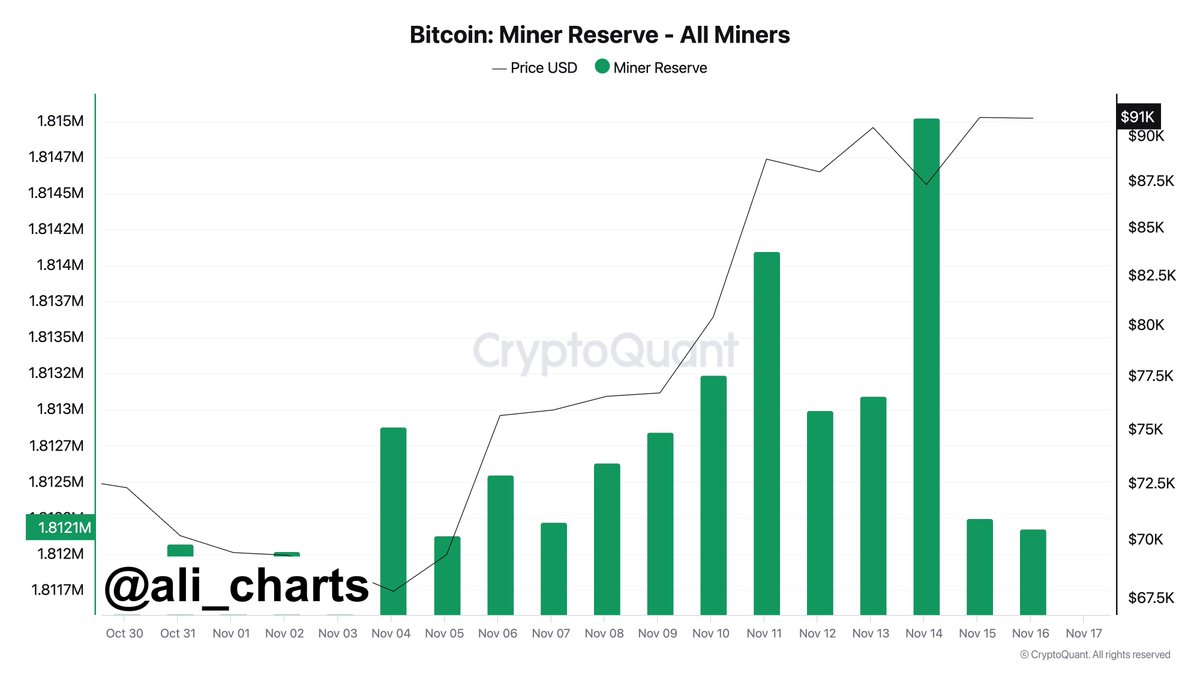

Key recordsdata from CryptoQuant finds that Bitcoin miners have bought over 3,000 BTC in the previous Forty eight hours. This wave of miner profit-taking recurrently signals a cooling fragment, because it introduces extra provide into the market. Whereas the selling explain isn’t routine during sessions of solid label motion, it goes to also lead to a brief-term consolidation fragment below the all-time excessive of $93,400 residing earlier this week.

Despite this, Bitcoin’s capability to retain above $90,000 highlights solid underlying quiz and tough market sentiment. Merchants and analysts are closely staring on the coming days to gaze if Bitcoin can steal in this selling stress and preserve its bullish trajectory.

Bitcoin Appears to be Very Sturdy

Bitcoin’s label motion has remained tough, breaking all-time highs extra than one times over the previous 11 days and reaffirming its bullish momentum. On the replace hand, after such an aggressive upward motion, the market looks to be to be entering a length of consolidation as some investors and entities lock in earnings.

Crypto analyst Ali Martinez shared key recordsdata on X that highlights that Bitcoin miners have bought over 3,000 BTC in the previous Forty eight hours, valued at approximately $273 million. This selling explain suggests that miners, in most cases prolonged-term holders, are taking earnings amid the original surge. Such moves are celebrated during solid bull runs and can suppose that market members sit down up for a brief-term label plateau or retrace.

Whereas miner selling is a natural fragment of market dynamics, sustained explain of this kind could perchance sign a shift in sentiment. If selling stress persists, it can perchance perchance push Bitcoin towards lower quiz zones, providing seemingly re-entry alternatives for sidelined investors.

Currently, Bitcoin’s capability to steal in this selling stress will determine whether or not the original bullish building remains intact. A short consolidation fragment could perchance be priceless, permitting the market to set a stronger foundation for the next leg up. For now, investors are closely staring at key levels to gauge the seemingly for persisted sigh or a deeper correction.

BTC Holds Widespread Above $90,000

Bitcoin is in the intervening time buying and selling at $90,600 after a volatile few days that saw its label vary between its all-time excessive of $93,483 and a local low of $86,600. This consolidation comes after aggressive bullish momentum that residing unusual recordsdata, leaving investors and analysts staring on the next moves closely.

Despite the original cooling off, Bitcoin’s label motion remains solid, supported by increasing quiz and overall bullish sentiment. If Bitcoin can retain above the $86,000 level over the next couple of days, a renewed surge to situation and doubtlessly surpass its all-time excessive looks to be plausible. The market has shown resilience, with unusual quiz persevering with to emerge even as minor profit-taking happens.

On the replace hand, there’s a threat of a deeper retracement. Have to aloof Bitcoin lose toughen at $86,000, it would seemingly check lower quiz levels, trying to glean a solid unfriendly to fuel its next upward pass. Key toughen zones could perchance provide the foundation for renewed trying to glean hobby and residing the stage for the next bullish fragment.

Featured image from Dall-E, chart from TradingView