With bitcoin’s impress declining 5% in each place in the last week, miners possess been experiencing lowered revenue because the hashprice has dropped to a level not seen since Might perhaps well well. Currently, the hashprice, which is the estimated daily impress of 1 petahash per second (PH/s), is below $50 and hovering correct above $47 per PH/s.

Declining Bitcoin Cost Squeezes Mining Revenues and Hashrate

Over the previous week, bitcoin (BTC) has lowered by 5%, and over the last 30 days, it has shown a 10% decline. This tumble in impress has impacted bitcoin miners and their earnings from block rewards and connected costs. Currently, miners create between 0.076 BTC and nil.16 BTC in costs per block, severely lower than a few months ago.

Then again, costs in June possess exceeded those peaceable in Might perhaps well well. With one day left within the month, evidently bitcoin mining revenue for Might perhaps well well and June will doubtless be connected. In Might perhaps well well, $964.24 million used to be peaceable, with $64.85 million coming from costs. From June 1 to 29, $914.43 million has been peaceable, with $ninety 9.62 million from costs.

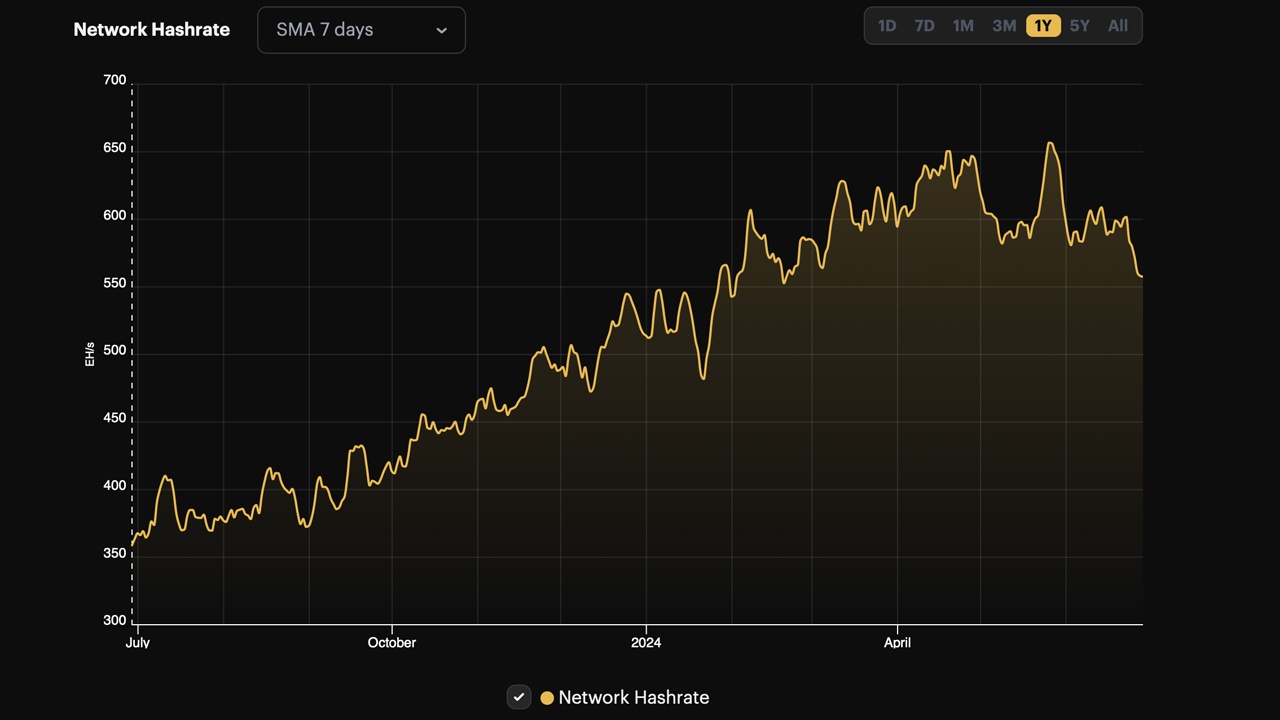

The hashprice, representing the estimated impress of 1 PH/s per day, used to be $47.33 on Saturday, June 29, the lowest since Might perhaps well well 1, when it used to be below $forty five per PH/s. This decline in revenue has forced miners, inflicting the overall network hashrate to diminish. As of now, the hashrate is correct below 560 exahash per second (EH/s).

Which capacity that virtually 100 EH/s, or roughly 96 EH/s, has exited the network since late Might perhaps well well. Miners benefited from two subject adjustments, even supposing the reductions had been modest, starting from 0.seventy 9% to 0.05% over the last two retargets. With the hashrate continuing to decline and block intervals surpassing the ten-minute mark, projections repeat a doable reduction between 4.6% and 7.3%.

With bitcoin’s contemporary impress decline and the hashprice sinking, miners face heightened challenges amidst fluctuating revenues. Despite price earnings showing a runt enchancment in June, the sustained tumble in hashprice has precipitated a principal reduction within the network’s overall hashrate. As adjustments continue, the mining panorama navigates unsure waters.

What end you deem regarding the hashprice and hashrate dropping in June? Fragment your solutions and opinions about this subject within the comments allotment below.