Actual Vision’s chief crypto analyst, Jamie Coutts, is highlighting the outperformance of Bitcoin (BTC) amid a correction experienced by stocks and crypto sources.

Coutts says that even when Bitcoin has historically been extra volatile than stocks, it has goal no longer too prolonged ago witnessed a rather lower stage of correction than would be expected in response to its historical ranges of impress swings.

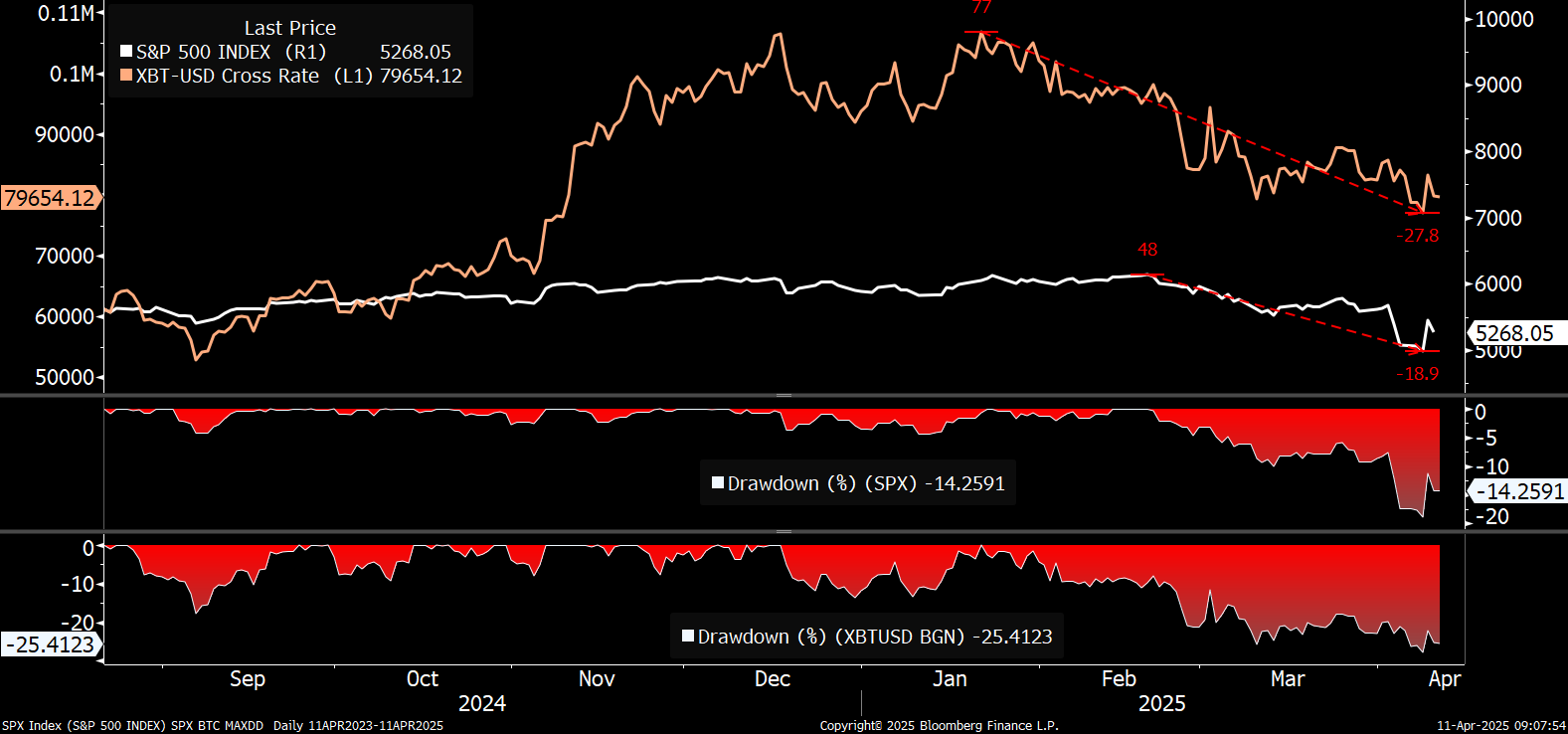

“Folks don’t understand what’s going on with Bitcoin genuine through this possibility-asset apprehension. BTC with 2.5x the volatility of the S&P 500 experienced a drawdown of 28% vs. the S&P 500’s 19%. That could well even be a huge OUTPERFORMANCE.

Presumably it’s no longer appropriate BTC’s energy, nonetheless a reflection of the rising fragility of the fiat draw and its asset markets – complicated systems inherently trend in direction of entropy/chaos. Bitcoin is mirroring this unraveling.”

Going forward, Coutts says that Bitcoin will develop in importance as two of its utilize cases manufacture prominence right through the globe.

“What’s going on compatible now could well be legend. Issues are breaking. The fiat fractional reserve credit rating-essentially essentially based completely draw’s fragility is on paunchy conceal, as soon as all every other time. Watch through the next couple of days and understand Bitcoin’s ascendancy as a international settlement layer and collateral asset is accelerating. Fleet.

Sooner than it became the plebs who understood this, this time it could well be nation states.”

Bitcoin is shopping and selling at $83,227 at time of writing.

Generated Image: Midjourney