A most up-to-date put up by crypto analyst Axel Adler Jr sheds light on Bitcoin’s novel market health the usage of the Pareto Precept. His diagnosis reveals that 80% of the community’s coins are aloof in profit, while 20% are at a loss. The mighty interrogate is: Is Bitcoin overheated? Outlandish to perceive extra? Read on!

Knowing the Pareto Precept in Crypto Markets

The Pareto Precept, which is popularly acknowledged as the 80/20 rule, suggests that roughly 80% of the outcomes reach from 20% of the causes.

In brief, the precept explains the unequal relationship between inputs and outputs.

Acclaimed crypto analyst Axel Adler claims that the Pareto Precept is acceptable to the crypto market, particularly the Bitcoin market, as an efficient manner to analyse the health of the market.

Bitcoin in Steadiness: What It Formula

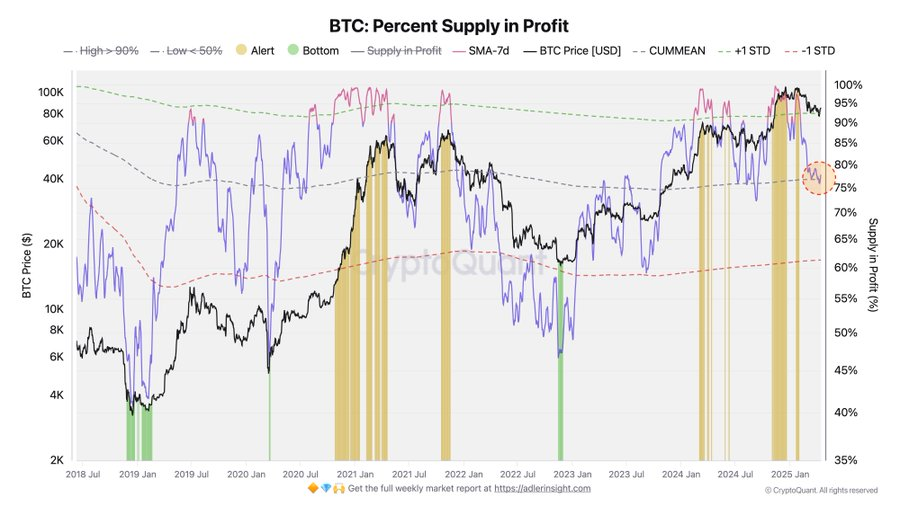

The BTC P.c Present in Earnings chart reveals that for the time being extra than 80% of Bitcoin holders are in profit while no longer no longer up to twenty% are retaining BTC at a loss.

The analyst functions out that previously, when 95 to 98% of coins were in profit, the market became overheated.

He claims that now the change of profitable coins has reach down to a extra balanced, sensible stage.

April has been a volatile month for BTC for that reason of the global economic havoc precipitated by US President Donald Trump’s aggressive tariff policy. At the open up of this month, the price of BTC was as soon as $82,541.66. Even supposing on the second day of the month, the market touched a monthly high of $88,502.71, by the level of closing that day the market slipped to $82,541.66. Between April 5 and eight, the market witnessed a decline of 8.93%.

Even supposing since April 9 the Bitcoin market has surged by over 9.56%, the novel designate of BTC is honest 1.43% above the gap designate of the month.