Bitcoin is on the verge of reaching a ancient milestone, with its designate inching closer to the coveted $100,000 designate. This outstanding rally has fueled optimism among traders, signaling Bitcoin’s continued dominance within the cryptocurrency market.

On the opposite hand, despite the bullish outlook, Bitcoin is no longer fully proof in opposition to attainable bearish stress. The backbone of Bitcoin’s designate steadiness — prolonged-term holders (LTHs) — appears to be wavering, raising issues over most likely downward actions within the near term.

Bitcoin’s Wait on Is Wavering

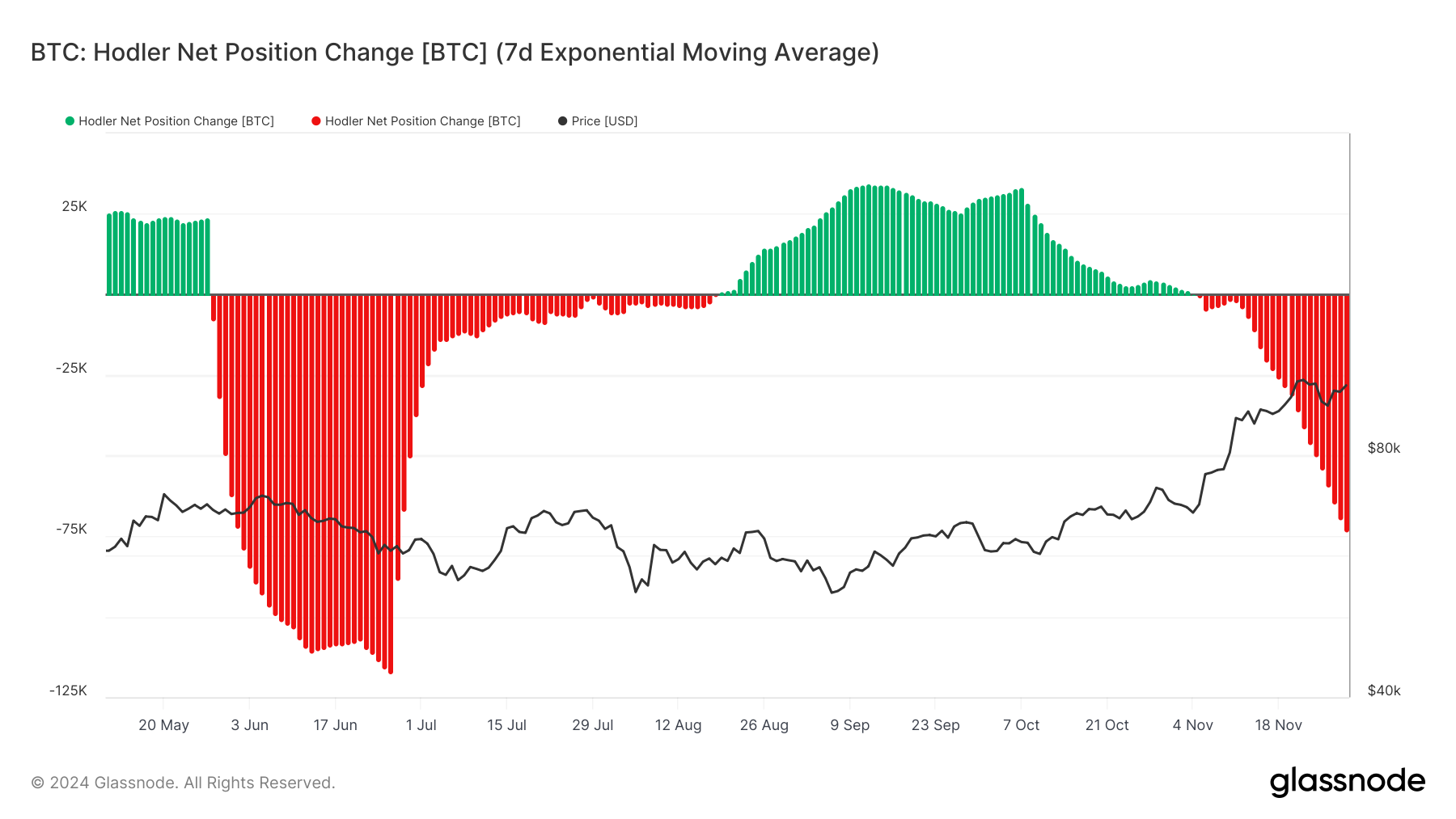

Lengthy-term holders of Bitcoin bag no longer too prolonged within the past shown indicators of bearish sentiment. The HODLer salvage enviornment trade indicator, which tracks the behavior of LTHs, has grew to change into antagonistic.

This shift signifies that a well-known different of prolonged-term traders are taking earnings by promoting their holdings. Unfavorable values on this metric in total signal a prick value in self belief, which might perhaps even attach stress on Bitcoin’s designate.

Since LTHs are in point of fact apt the backbone of Bitcoin’s designate, their promoting exercise has the attainable to disrupt market momentum. These traders typically take care of sources through market fluctuations, contributing to fee steadiness.

After they open to sell, it will steer to increased volatility, and if the pattern continues, it will also dwelling off a designate correction. This attainable promoting stress is something that Bitcoin traders are carefully monitoring, in particular with the $100,000 threshold so near.

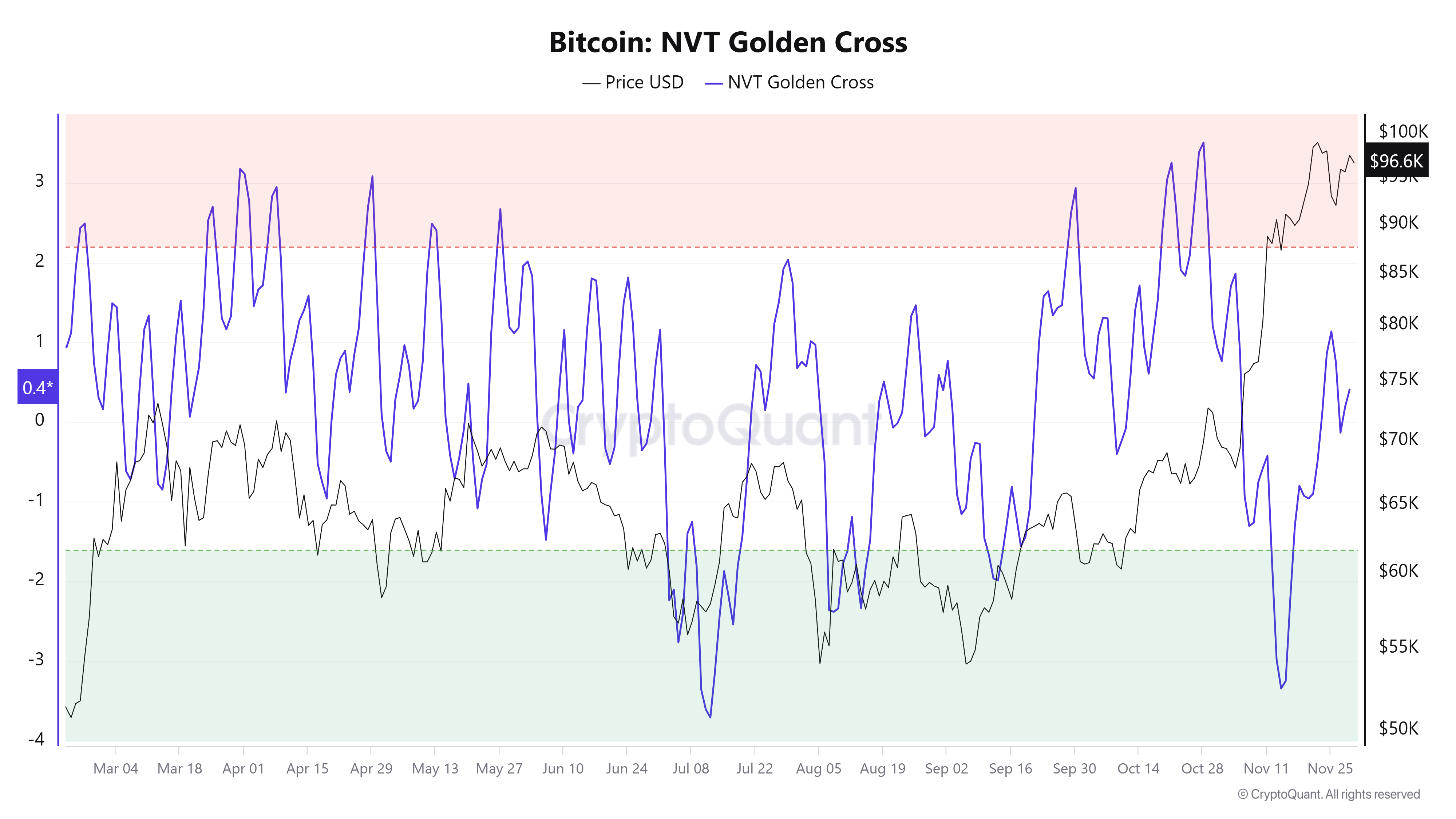

The broader macro momentum for Bitcoin stays tough despite the short-term bearish sentiment among LTHs. A key indicator to appear is the Bitcoin Network Price to Transactions (NVT) Golden Defective, which is for the time being sitting within the fair zone.

Whereas it’s no longer yet within the bullish territory (below -1.6), the NVT Golden Defective is a in fact fundamental signal for Bitcoin’s future designate actions. Historically, when the NVT indicator enters the bearish zone (above 2.2), it has in total been in point of fact apt a transient signal for the market.

On the opposite hand, Bitcoin has no longer yet reached this bearish zone, giving it room for additonal enhance. The NVT Golden Defective is soundless a distinct value, indicating that Bitcoin has sufficient momentum to rise extra earlier than any attainable downturn.

As prolonged as the indicator stays within the fair zone, Bitcoin has the opportunity to push in direction of $100,000 without facing rapid well-known bearish stress.

BTC Mark Prediction: Making History

Bitcoin’s designate is appealing at $96,572, inching closer to the ancient $100,000 designate. The cryptocurrency has considered well-known upward motion in contemporary weeks, spurred by institutional interest and increased adoption. If primarily the most up-to-date pattern continues, Bitcoin is poised to destroy through this psychological barrier, reaching a new all-time high of $Ninety nine,595.

Would possibly perhaps soundless Bitcoin destroy the $100,000 designate, the next purpose will be $120,000. A profitable push above $100,000 would most likely dwelling off extra procuring stress from each retail and institutional traders. On the opposite hand, the likelihood of income-taking from LTHs stays an enviornment, as any well-known promoting can even dwelling off a non everlasting pullback.

Irrespective of the short-term issues, Bitcoin’s total pattern stays distinct, and the new NVT Golden Defective means that the trudge to $100,000 is soundless achievable. As prolonged as Bitcoin maintains its enviornment above key pork up phases, the prolonged-term outlook stays bullish.

Whereas LTH promoting can even manufacture some volatility, Bitcoin is most likely to continue its upward trajectory within the upcoming months, barring any fundamental market disruptions.