In a single in every of the most striking moments of this cycle, gold has lost trillions in market capitalization, a drawdown increased than the general charge of Bitcoin itself. The steel that after symbolized balance is now showing cracks, while BTC, the asset branded as unstable, has remained remarkably resilient.

What It Technique For Bitcoin Next Market Cycle

For decades, gold has been hailed as the final safe-haven, and it has been rock-staunch. On the opposite hand, a seasoned financial analyst, Tom Tucker, has revealed on X that Gold, the sector’s oldest retailer of charge, has lost $2.5 trillion in market charge, which is extra than the general Bitcoin market capitalization.

Within the period in-between, the crypto Apprehension and Greed Index is flashing grievous concern, signaling that sentiment across digital sources is approach dismay ranges. Tom Tucker warns that merchants must peaceful stop cautious, as BTC could perchance apply the gold direction.

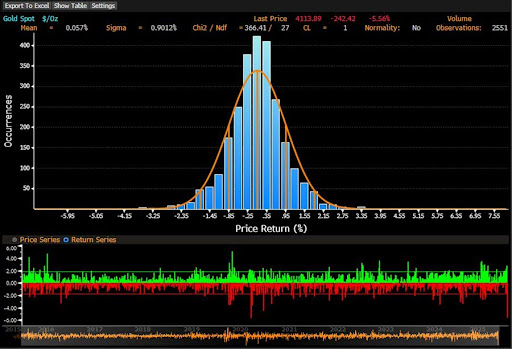

CryptoMichNL, the CIO and Founder of MNFund and MNCapital, has noticed that gold has printed a harsh transfer, because it corrected by extra than 8% in a single day. At the identical time, Bitcoin moved up massively, nonetheless later gave support most of its beneficial properties.

In retaining with CryptoMichNL, this turbulence in gold isn’t very a prolonged-lasting pattern. The volatility of gold is amazingly excessive, which is a impart consequence of its reputation as a giant outlier with a improbable parabolic wander over most recent months. If gold has certainly topped out, that would originate the door for capital rotation towards other sources.

On the opposite hand, a tender Particular person Designate Index (CPI) print on the horizon must peaceful trigger the skill rate cuts and the stay of the US authorities shutdown. Otherwise, BTC’s consolidation could perchance delivery operating as likelihood-on wander for food.

Why Bitcoin Will Extend Above Its Most modern Consolidation

Traditionally, Gold has considered interesting drawdowns. Senior Analyst at CoinDesk and Consultant at Coinsilium Community and ForzaBitcoin, James Van Straten, explained that the final major gold correction took position in August 2020. On August 6, gold hit an all-time excessive of $2,035, simplest to descend 5% on August 11, and then enter a 20% correction that lasted roughly seven months.

In the end of that identical length, Bitcoin used to be consolidating below $10,000 sooner than surging to new highs that yr, a transfer largely fueled by COVID-19-know-how stimulus, which acted as a strong accelerant.

Like a flash forward to at the present time, James Van Straten believes that as BTC’s most recent section is consolidating above $100,000, it could prolong mid-cycle. Right here is which capability that of staunch parallels that gold has over all over again entered a major correction, crypto liquidation events, the specter of a US authorities shutdown, looming rate cuts, and AI-pushed capex expenditure, which continues to shape market sentiment and liquidity dynamics.