Like a flash Scheme shut

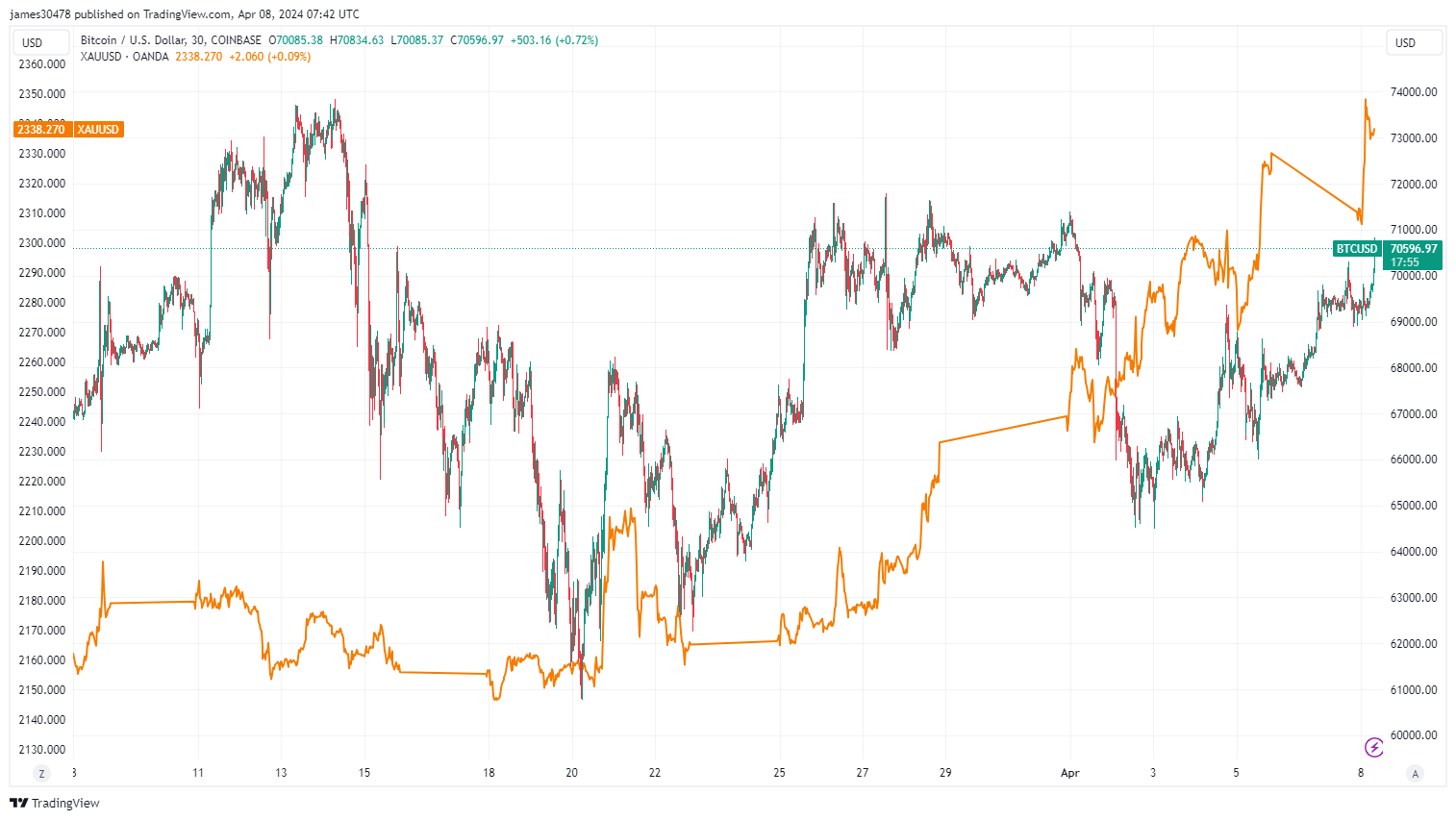

Within the course of economic uncertainty, Bitcoin continues to dance across the the largest $70,000 stage, demonstrating its resilience despite the DXY index step by step ice climbing in direction of 106 and US yields on the upward thrust. As traders query stable-haven resources, many want to gold for guidance, hoping that Bitcoin, in overall called “digital gold,” will follow go neatly with.

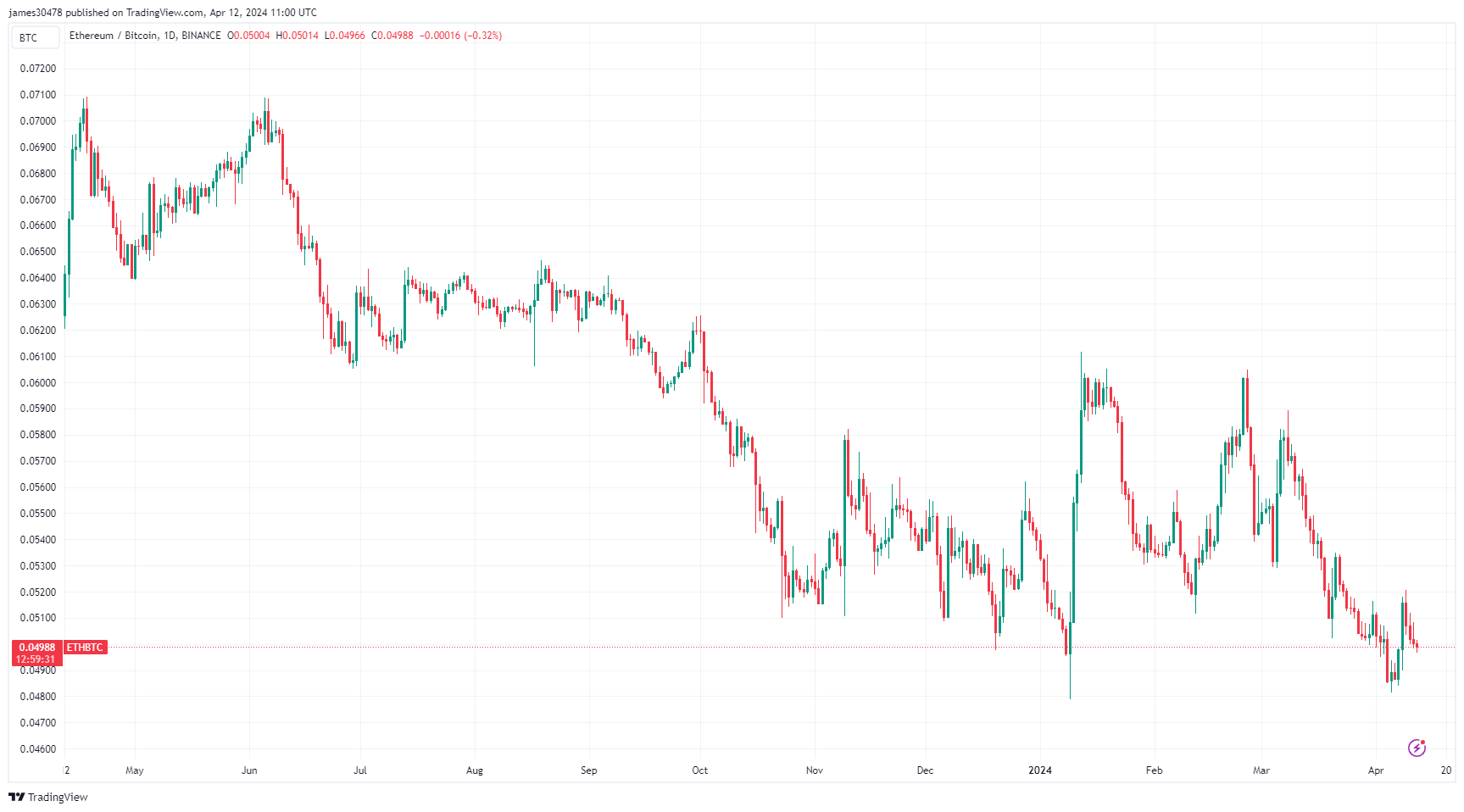

Despite a itsy-bitsy dip in the starting up of April, Bitcoin’s dominance within the digital asset market remains stable, within the intervening time at 54.6%, fair below the cycle highs of 55.2%. This boost in dominance, up 6% 365 days-to-date, indicates that traders, on combination, are favoring Bitcoin over other digital resources.

Yet any other grand model is the ETH/BTC ratio, which remains below the severe 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% 365 days-to-date and 20% over the previous 365 days. Because the DXY index continues to surge, market observers are keeping a shut query on Bitcoin and gold, expecting that they might well perchance also continue to shield their ground or even follow the upward model, offering a likely hedge against economic instability.