Contemporary files from a market intelligence firm has affirmed that practically all wallets holding Bitcoin are in profit because the asset breaks a original yearly excessive.`

In accordance with files from market tracking sources, Bitcoin has printed a 10.5% rally in the last 24 hours from a low of $51,238. This rally has seen Bitcoin bring together a original multi-twelve months excessive at $57,416 on the reporting time.

Following this style, the pool of Bitcoin investors holding the asset at a profit has equally broken a multi-twelve months excessive. Market intelligence platform IntoTheBlock referred to as attention to this outcome in a contemporary put up on X.

95% of Bitcoin Wallets Now Profitable

IntoTheBlock illustrious that 95% of Bitcoin wallets are no doubt worthwhile. It added that this level of worthwhile addresses has now now not been seen since the halt of the 2021 bull market.

95% of Bitcoin addresses are no doubt in profit!

The last time we saw this level of worthwhile addresses used to be during the halt of the 2021 bull market, with prices over $60k pic.twitter.com/MBq95tTKAA— IntoTheBlock (@intotheblock) February 27, 2024

Furthermore, files from IntoTheBlock means that, technically, no Bitcoin address is at this time holding Bitcoin at a loss. The diversified half of of the profitability spectrum, comprising correct 5%, represents Bitcoin investors at break-even ingredients, the keep neither profit nor loss is incurred.

Moreover, the statistics from IntoTheBlock model that most of Bitcoin investors in profit are long-term holders, with 69% of them having held BTC for bigger than a twelve months.

In distinction, 24% have faith held for decrease than a twelve months, and simplest 6% have faith bought Bitcoin inner the last month.

With Bitcoin hovering round $56,866 at press time, the asset is barely a 20% rally to reclaim its 2021 ATH of round $69k.

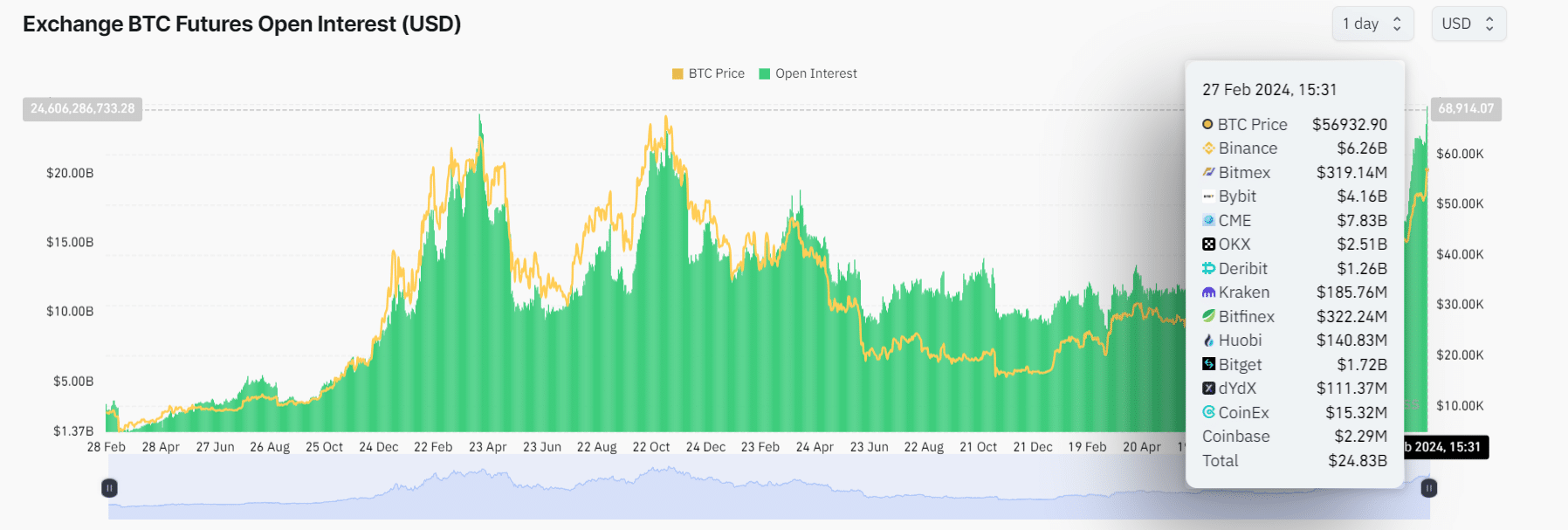

BTC Open Passion Breaks ATH

Within the period in-between, Bitcoin futures open pastime has broken an all-time excessive in the last 24 hours. Per Coinglass files, Bitcoin’s open web is now $24.78 billion, surpassing the 2021 epic of $24.27 billion.

Bitcoin ETFs See File $6.11B flows

Within the period in-between, Bitcoin’s persevered uptrend since this month has been attributed to inflows to the lately listed U.S. Bitcoin space exchange-traded funds (ETFs).

Latest statistics model that a minimum of $6 billion has adopted thru U.S. Bitcoin ETF since January 10. On Monday on my own, the ETFs saw a procure inflow of $520 million, striking the one-week settle tremendously at $1.10 billion.

🔎 Latest files shows US Position #Bitcoin ETFs with a total procure inflow of US$6.11B, with US$520M inflow on 26 Feb pic.twitter.com/3RRsqCS4JC

— Crypto.com Be taught & Insights (@cryptocom_rni) February 27, 2024

Main the worth on this inflow comprise BlackRock’s IBIT, Fidelity, Ark Make investments, and Bitcwise. Whereas these eminent asset managers register certain inflows, Grayscale has persevered to search detrimental flows.