Bitcoin has returned to a key technical stage that has played a central role in earlier rallies. The 50-week Easy Transferring Moderate (SMA), in overall called the bull market baseline by merchants, has acted as a legitimate strengthen zone since early 2023.

As of press time, Bitcoin is trading at around $111,200, exhibiting a modest day-to-day produce while tranquil down over the past week.

Bitcoin Retests Lengthy-Term Serve

The chart shared by Merlijn The Seller reveals that at any time when Bitcoin has retested the 50-week SMA since 2023, it has long past on to gain novel highs. The intriguing moderate has was a key stage for identifying changes in style. In early 2022, Bitcoin broke below it, marking the begin of a broader correction.

Since then, on the opposite hand, the value has again and again returned to this line earlier than persevering with greater. Basically the most contemporary contact of the SMA has all as soon as more attracted attention from merchants looking at for signs of a novel upward drag. Merlijn mentioned:

BITCOIN JUST RETESTED THE BULL MARKET BASELINE.

The 50-week SMA marked every essential liftoff since 2023.

Natty cash buys the retest.

Retail buys the breakout.This chart separates merchants from vacationers. pic.twitter.com/hw8hWmOKPJ

— Merlijn The Seller (@MerlijnTrader) October 20, 2025

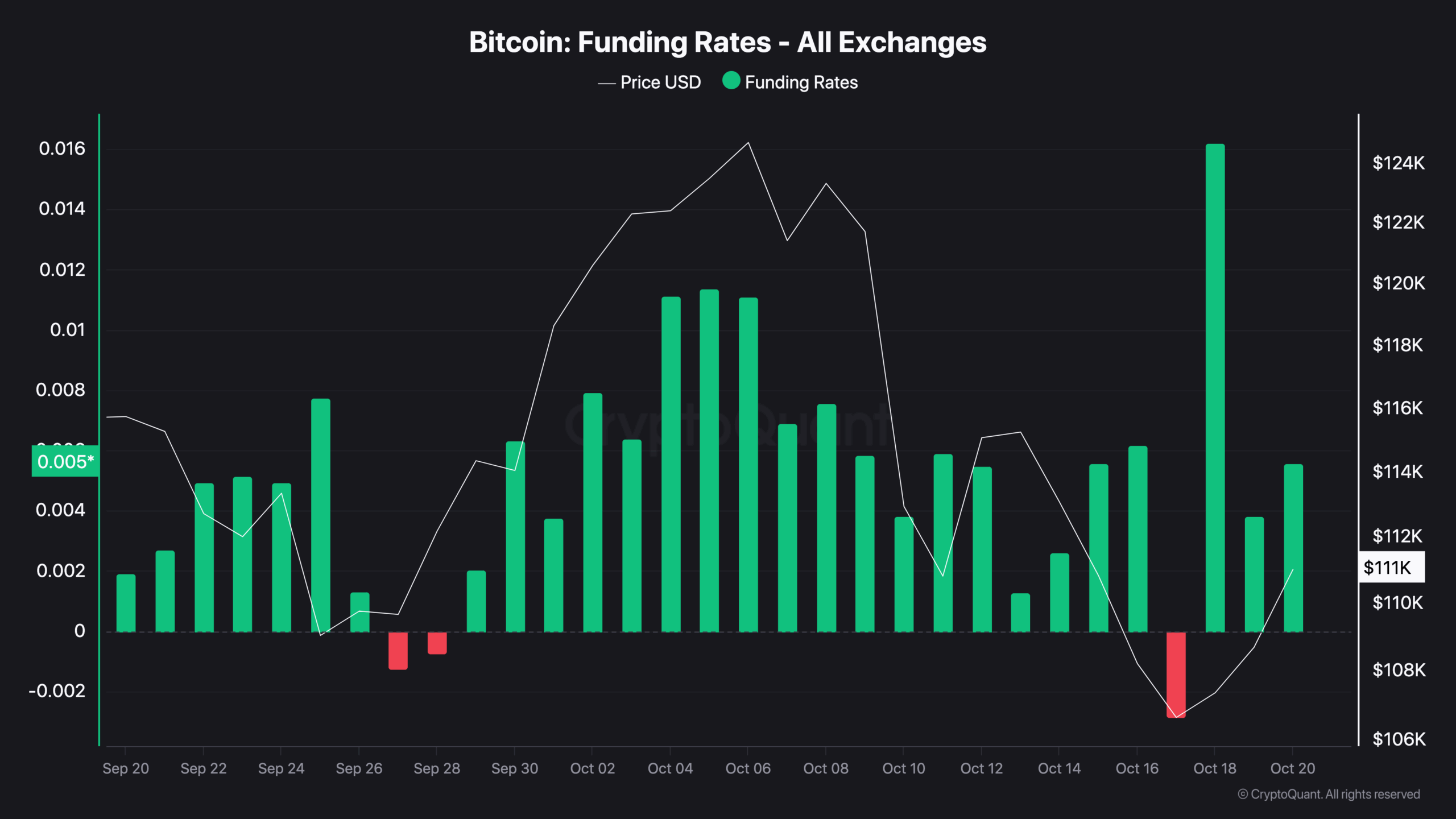

Sentiment Quiet Unsettled After Liquidation

Market self assurance stays low following a powerful liquidation tournament on October 10. Funding rates, which replicate the value of maintaining long or short positions in the futures market, dropped into detrimental territory on October 17. This suggests that many merchants were leaning in direction of short positions, making a wager on additional declines.

Since then, funding rates glean recovered and for the time being are help above 0.005. Even supposing this shift reveals some return of trying to search out curiosity, the caution in the derivatives market reveals that merchants are no longer yet fully gratified by the rebound. This extra or much less hesitation is overall after a stable pullback, particularly when losses were surprising.

It is most likely you’ll also just moreover like:

- Analyst: Bitcoin Drop Advance $101,700 May well well per chance Enlighten a Fresh Endure Market

- Right here’s the Vital Level to Gape for Bitcoin’s Rate This Week

- Bets on Polymarket Sign Bitcoin (BTC) $200K Odds Are Slimmer Than Alien Discovery

Key Rate Ranges in Play

Bitcoin is for the time being trading reach a resistance space at $111,440. This stage marked the begin of a earlier decline that took the value below $108,600. Per analyst Lennaert Snyder, breaking and maintaining above $111,440 could seemingly also initiate the formulation for a drag in direction of $115,800. If that stage is moreover cleared, impress could seemingly also just revisit $120,800, the set a like a flash selloff occurred earlier.

Bitcoinsensus reported that the weekly candle closed above the $107,200 low, a drag that can seemingly also strengthen a persevered push greater. They moreover renowned that the Bitcoin liquidity index has began to upward push for the essential time since July, a that you could shriek of label that novel capital is getting into the market.

Broader Inclinations and External Rigidity

EGRAG CRYPTO renowned that Bitcoin looks to be following a recurring sample. The analyst instant that the market could seemingly also be getting into the final stage of an upward cycle. Suggesting that a pointy reversal could seemingly also follow after retail participation will increase, EGRAG added,

“Every person will shriek we’re in the end glean… but that’s the set the real twist comes.”

Notably, the novel correction modified into partly pushed by political files, as we reported. A drop at the tip of ultimate week followed comments from veteran US President Donald Trump about novel tariffs on China. This created uncertainty in the path of monetary markets and added stress on crypto resources.

As reported by CryptoPotato, files from prediction platform Polymarket confirmed some skepticism in the retail space. Their most up-to-date odds gave a 6% likelihood of aliens being confirmed this three hundred and sixty five days, when compared to actual 5% for Bitcoin reaching $200,000. Whereas intended to entertain, it reflects how cautious merchants glean was in atmosphere reach-term expectations.