Bitcoin’s push relieve towards approach the $90,000 brand is giving the crypto market a non everlasting lift, nonetheless few analysts stare it as a well-known turning level after one of many weakest 2nd halves in most modern years.

Main tokens remained fluctuate-sure prior to now 24 hours, with xrp, ether, Solana’s SOL, Cardano’s ada and DOGE$0.1316 rising to boot-known as 2%. A decline in Aave’s AAVE persisted as its governance tussle rages on, leaving it as the worst performing token with a 7% plunge.

Total crypto market capitalization has as soon as again moved above $3 trillion, a psychologically well-known level that has acted as a key zone between investors and sellers at some level of the past month. Whereas prices are greater on the day, analysts warning that the rebound reflects exhaustion somewhat than renewed conviction.

Alex Kuptsikevich, chief market analyst at FxPro, said the market’s most modern strength is basically technical and pushed by a low deplorable after weeks of advertising.

“The crypto market is making a fresh strive at negate, nonetheless that is now now not but a recovery,” Kuptsikevich said, noting that sentiment has improved easiest modestly. The market’s fright and greed index has climbed to 25, suggesting merchants shall be stepping faraway from wrong pessimism, nonetheless now now not embracing anguish.

Bitcoin became as soon as trading approach $88,000 in Asian morning hours Tuesday, urgent against the upper terminate of a range that has held since early glorious week. Kuptsikevich warned that non everlasting momentum would possibly well say misleading, in particular given the broader context. Bitcoin stays roughly 30% below its 2025 peak and is trading below ranges considered in the initiating of the three hundred and sixty five days.

“Attempts to elevate three hundred and sixty five days-to-date efficiency relieve to zero are little consolation,” he said in an e mail, including that disappointment has replaced the optimism that dominated markets earlier this three hundred and sixty five days.

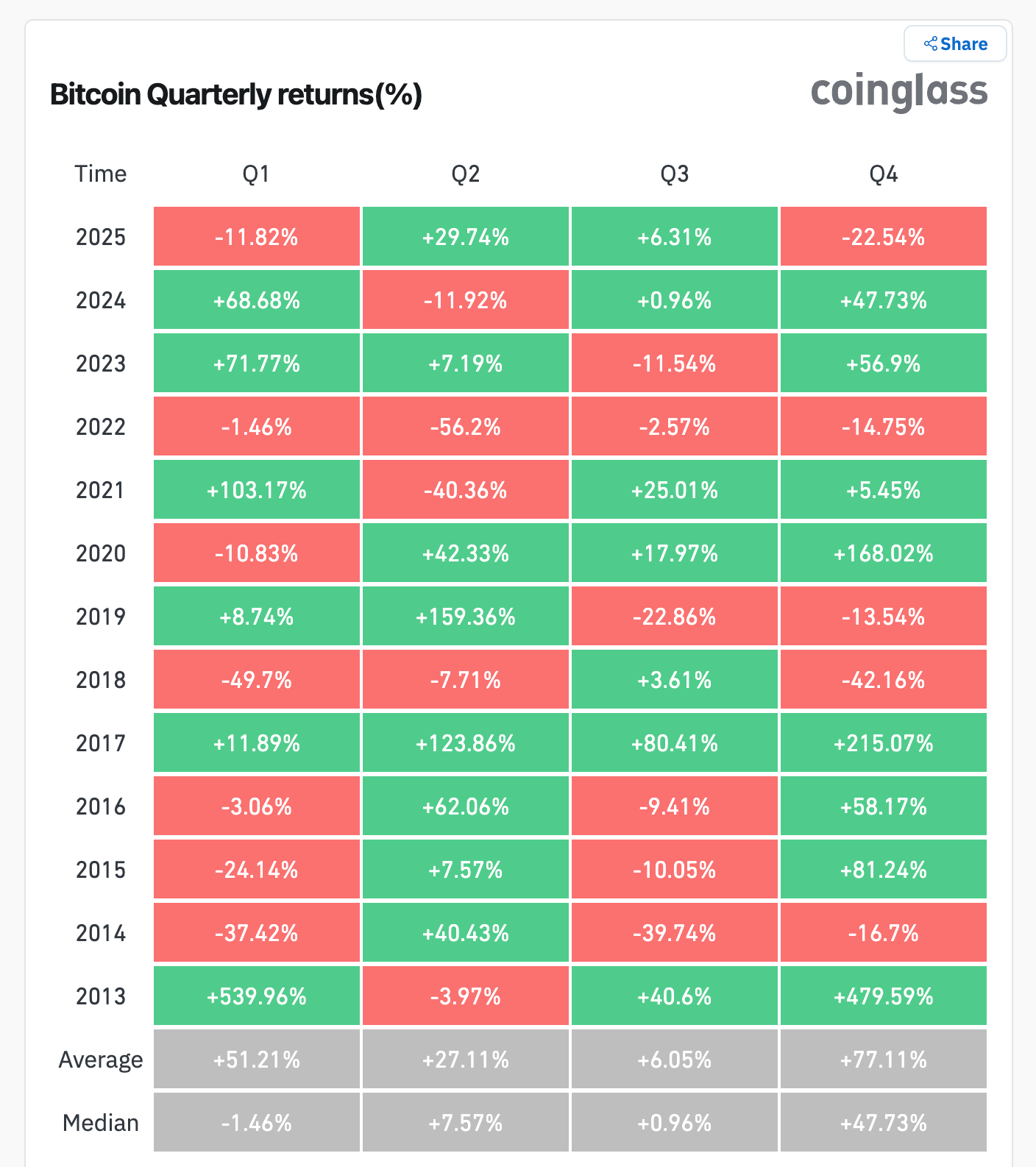

Seasonal patterns give a enhance to that warning. Files from CoinGlass reveals bitcoin is down more than 22% to this level in the fourth quarter, making 2025 one of many weakest three hundred and sixty five days-terminate durations out of doors of well-known indulge in markets.

Whereas the fourth quarter has historically produced some of bitcoin’s strongest rallies, it has moreover delivered exciting drawdowns at some level of years marked by tightening liquidity and macro uncertainty.

The market stays at anguish of exciting reversals, in particular at some level of U.S. trading hours. Most up-to-date sessions comprise frequently considered tag beneficial properties from Asian and Europe sessions go as North American markets initiate.