Bitcoin’s newest rally comes as two bullish narratives converge: In lower than eight weeks, the halving will minimize novel provide in half of, meanwhile declare funds already gobble up coins faster than they’re mined.

Newly-stumbled on ask from declare ETFs aside, halvings are in most cases considered as catalysts for astronomical increase for bitcoin’s designate.

But over the previous two cycles, it’s crypto, no longer bitcoin, which has benefitted the most. Starting from one yr sooner than each outdated halving, bitcoin peaked at:

- 50,000% one yr after the 2012 halving.

- 8,500% almost one and a half of years after the 2016 halving.

- 1,000% one and a half of years after the 2020 halving.

(For the fractal-minded, interestingly bitcoin peaks are divided by between six and eight each cycle. If that repeats, the head for bitcoin this time around will be lower than 170% — with bitcoin already securing most of those features.)

Read extra: How the halving might perhaps perhaps affect bitcoin’s designate

All that is to be anticipated pondering how huge bitcoin’s market cost is already, previous $1 trillion. It’s feasibly no longer doable for bitcoin’s designate to multiply by 500 times in two years, as changed into once the case in 2012 when its capitalization changed into once under $200 million.

Bitcoin (BTC) makes up about half of of the total crypto market factual now, but there are tens of thousands of other cryptocurrencies obtainable, and on the final they are inclined to affix a breeze when bitcoin rallies hardest.

Essentially, all the pieces that isn’t bitcoin stands to originate powerful extra from bitcoin bull runs than bitcoin itself.

Crypto apart from for bitcoin changed into once altogether price $64.9 million one yr sooner than the 2016 halving.

One yr after the match, on the height of the 2017-2018 bull trot, that settle had multiplied larger than 6,000 times to $421 million, largely attributable to the successes of XRP, Ethereum and Bitcoin Cash.

In a similar model exact thru crypto’s outdated cycle, between 2019 and 2021, crypto exterior of bitcoin changed into once valued at $71.6 billion one yr sooner than the 2020 halving.

A yr and a half of later, when bitcoin changed into once advance yarn highs, all other crypto changed into once price $1.6 billion — increase of larger than 2,000% to bitcoin’s 1,000%.

Four yr cycles aren’t weird to Bitcoin

Three halvings, it’s price repeating, is much too small a sample size to earn any plan of serious diagnosis.

This kind of small sample size system components aside from halvings are handsome as likely to play a job in forming what look like bitcoin’s unstoppable four-yr market cycles.

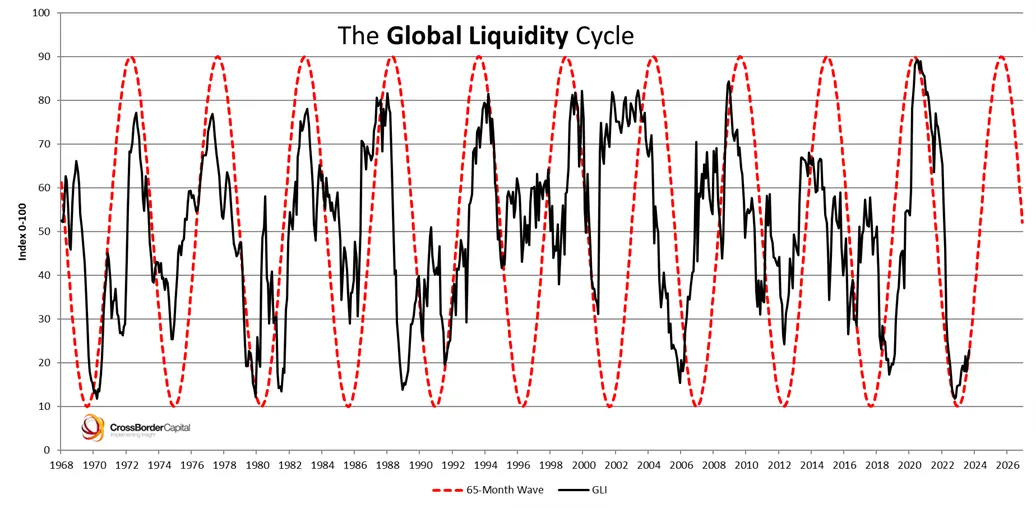

The worldwide liquidity cycle, which tracks how powerful money is sloshing around the worldwide financial system for one, correlates with bitcoin rallies to most likely an even tighter stage than halvings.

As it turns out, global liquidity additionally runs on four yr cycles.

Proving waves of global liquidity precipitated bitcoin’s explosive increase is peaceful practically no longer doable — same with halvings.

It’s likely a mixture of every: Supply decreases as global liquidity deepens to a degree where it spills over into speculative asset classes love crypto, driving up ask.

No longer counting in the future last week when declare ETFs had been receive sellers, physically-backed bitcoin funds in the US receive altogether sold nearly 6,350 BTC ($362 million) per shopping and selling session, on moderate.

Bitcoin miners are on moderate discovering 147 blocks per day and each comes with a 6.25 BTC ($356,600) reward, the community’s map of distributing current coins.

So, miners are pulling lower than 920 BTC ($52.5 million) out of the blockchain per day. Bitcoin funds are shopping up almost six times that quantity on behalf of shareholders, led by BlackRock, Fidelity and Ark-21Shares.

Read extra: 20% of bitcoin community hash charge might perhaps perhaps shuffle offline after halving: Galaxy

Many parts of the bitcoin market outpace bitcoin provide. About 35,000 BTC ($2 billion) has flowed into crypto exchanges every day this yr on moderate, for one, indicating doable bitcoin sales as much as 37 times larger than is mined day to day.

Even factoring in bitcoin’s newest designate soar, if handiest a small percentage of the bitcoin miners despatched to exchanges ends up sold, there’s hypothetically ample provide obtainable to meet ask with out prices straight away going parabolic.

Aloof, with the halving around the corner — anticipated on April 19 or 20 — it’s straightforward to undercover agent how they’ve captured imaginations across the market. Crypto native companies love Bitwise, Bitfinex and CoinShares receive establish out attempts at unpacking their mystique, as receive finance gamers along with JPMorgan and Traditional Chartered.

Read extra: Bitcoin halving anticipated to hit on 4/20

On a tangible stage, the bitcoin halving will radically overhaul the economics of bitcoin mining, to the purpose CoinShares expects quite a lot of major operators to combat if bitcoin doesn’t protect above $40,000 (to this point, so handsome).

Traditional Chartered, known for its bombastic crypto designate predictions in contemporary times, meanwhile maintains a call for $100,000 per coin by the end of this yr, in half attributable to how some distance the halving might perhaps perhaps skew provide and ask toward the latter.

It’s tempting to plan bitcoin designate action after outdated halvings (there receive handiest been three, in 2012, 2016 and 2020). In spite of all the pieces, bitcoin’s preferrred bull runs receive peaked between a yr and a yr and a half of after halvings.

Why this time will be any different is any individual’s wager, aside from to remark that “previous efficiency doesn’t guarantee future results.”

Irrespective of what affect halvings receive (or don’t receive) on prices, having a gaze assist on the solutions displays bitcoin market cycles are dampening over time despite the gigantic capital injections every four years.