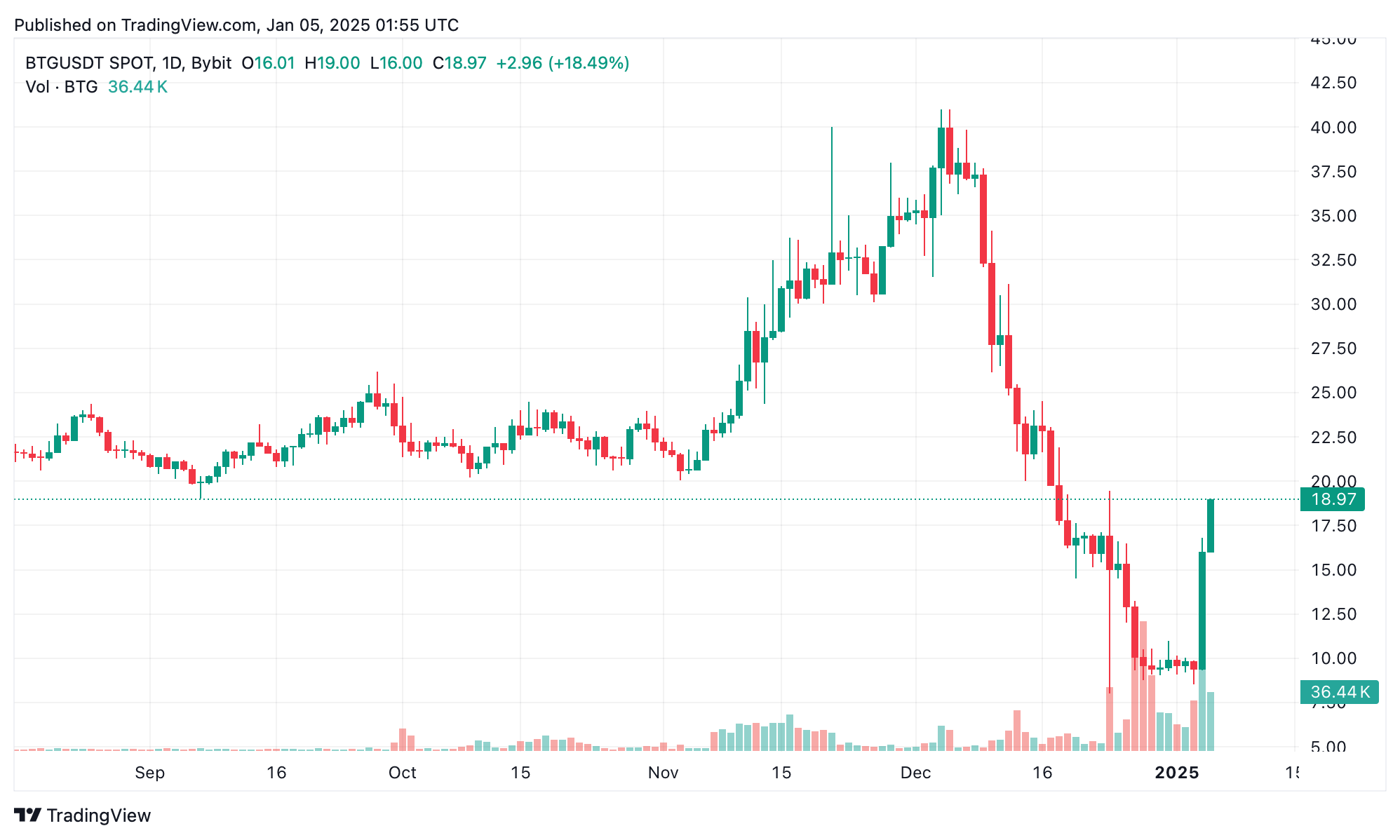

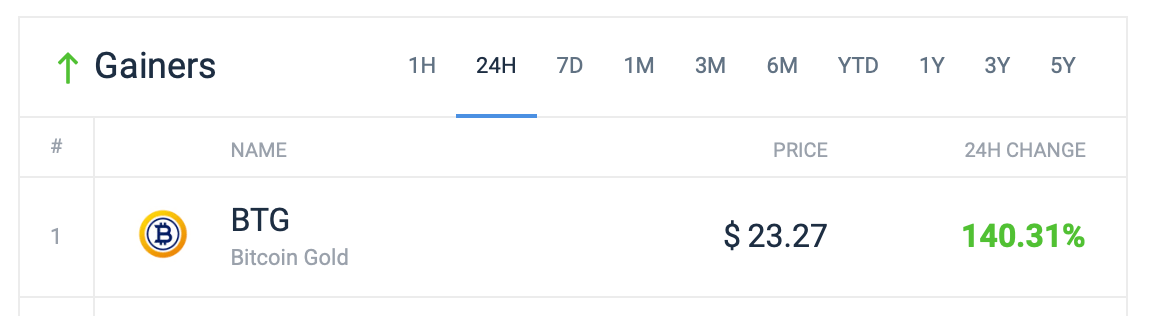

While plenty of so-known as ‘dino’ cryptocurrencies delight in begun to reawaken, the Bitcoin fork is named bitcoin gold (BTG) has skilled an improbable upward push of 140.31% within the closing 24 hours. On Saturday, this digital asset oscillated between an intraday low of $9.30 and a excessive of $23.27.

South Korea’s Upbit Drives Bitcoin Gold Mania

Years within the past, on Oct. 24, 2017, a collective of participants bifurcated the Bitcoin instrument, birthing a brand contemporary asset and blockchain christened Bitcoin Gold (BTG). The initial intent on the support of BTG became as soon as to foster elevated decentralization, enabling proponents to mine the cryptocurrency utilizing GPUs (graphics processing devices). On the different hand, the community has suffered from extra than one 51% assaults in 2018 and 2020, casting a shadow over its recognition, equivalent to other networks like Vertcoin, Verge, and Bitcoinsv that delight in continued identical assaults.

This weekend, bitcoin gold (BTG), the native cryptocurrency of its community, rose 140.31% against the U.S. greenback. The token emerged as the day’s supreme performer when it involves general percentage gains at some level of the last 24 hours, standing on my own as the finest cryptocurrency to manufacture triple-digit recount. Spirited certainly, this climb coincides with Upbit’s announcement to delist BTG on Jan. 23. Upbit, a South Korean procuring and selling platform, is at point out witnessing critical procuring and selling process and a top class on BTG.

To illustrate, the weighted world substitute rate for BTG stands at $19.01, yet on Upbit, it fetches $24.75. As of 9:00 p.m. Eastern Time on Saturday, it reigns as the leading coin on Upbit. Interestingly, on the rival substitute Bithumb, BTG trades at $18.90 with out a top class, yet it gentle holds the title of essentially the most traded coin there. No doubt, the vast majority of BTG’s procuring and selling volume originates from South Korea, with Upbit recording $1.31 billion in BTG transactions over the closing day, whereas Bithumb seen $232 million

Bitcoin gold’s (BTG) short resurgence, fueled by speculative procuring and selling in South Korea, highlights its fading relevance within the broader cryptocurrency ecosystem. The stark distinction between its meteoric 24-hour gains and Upbit’s forthcoming delisting underscores a grim actuality: BTG’s yarn has shifted from innovation to obsolescence. Despite the fleeting spike, the mission appears to be like to be a relic of a bygone crypto period.