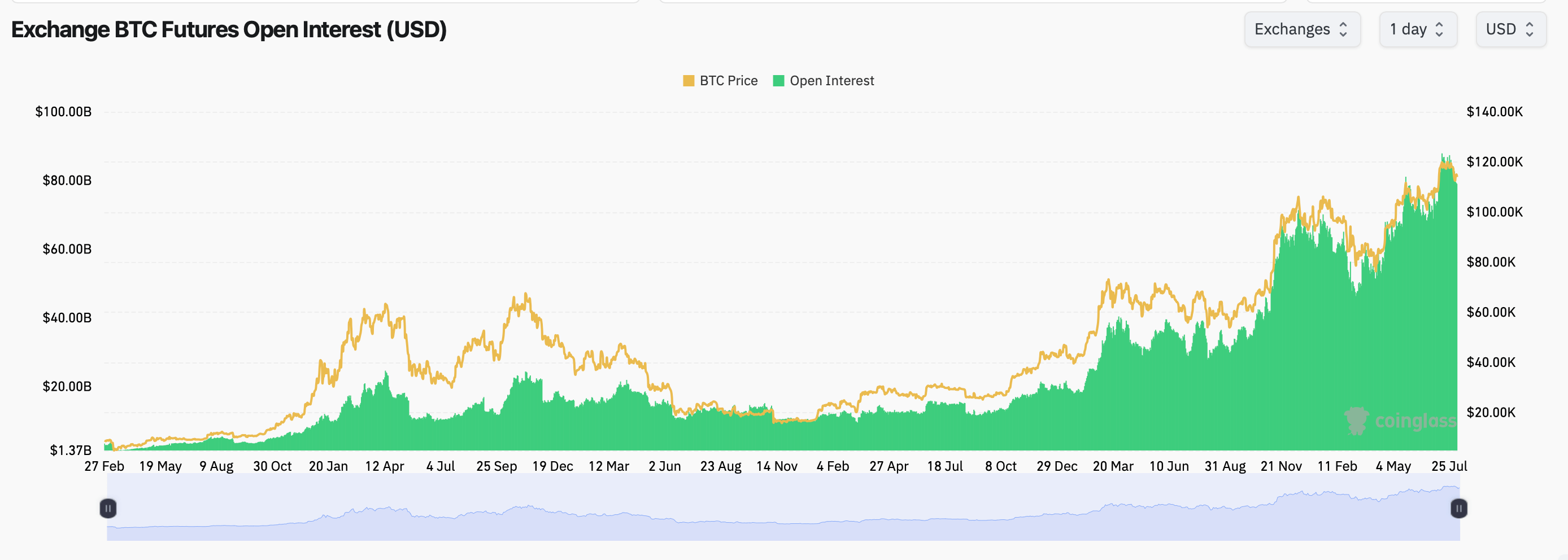

Bitcoin derivatives dispute has climbed to unprecedented ranges, with futures start hobby throughout predominant exchanges reaching $seventy nine billion and choices positioning signaling a heavy tilt toward calls.

Bitcoin Derivatives Market at Checklist Ranges as Merchants Role for Moves

In accordance with Coinglass knowledge, total BTC futures start hobby (OI) stands at 692,490 BTC, similar to $seventy nine billion. CME leads with 139,350 BTC ($15.88 billion), capturing 20.1% of the market.

Binance follows closely with 121,580 BTC ($13.87 billion), representing 17.55% of total OI. Bybit holds seventy nine,250 BTC ($9.04 billion), OKX maintains 37,480 BTC ($4.27 billion), and Gate commands 69,010 BTC ($7.87 billion). Kucoin, Bitget, WhiteBIT, BingX, and MEXC spherical out the tip ten exchanges.

Futures OI has been on a steep climb in 2025 alongside bitcoin’s label, now hovering spherical 5% below the $120,000 vary. CME’s institutional-heavy contracts and Binance’s retail-driven flows stay key drivers of the buildup, with CME’s OI alternate flat on the hour nevertheless up 0.20% over four hours, whereas Bybit noticed a modest 0.02% uptick within the rest hour.

On the selections front, start hobby is equally elevated. Total BTC choices OI sits end to $60 billion, reflecting 232,476 BTC in calls (61.43%) and 145,957 BTC in locations (38.57%). This bullish skew suggests merchants are positioning for doable additional upside.

Nonetheless, the rest 24 hours possess seen more defensive flows. Alternate choices quantity presentations 39.64% in calls (19,711 BTC) and 60.36% in locations (30,018 BTC), indicating short-length of time hedging dispute whatever the longer-length of time bullish bias.

Deribit commands the bitcoin choices market. Its single very best location is a December 26, 2025 call giving merchants the honest to aquire BTC at $140,000; that contract holds about 10,727 BTC in start hobby. Shut within the support of are a Sept. 26, 2025 call on the an identical $140,000 strike (9,912 BTC) and a December 26, 2025 call at $200,000 (8,614 BTC). On the bearish facet, merchants possess stacked roughly 6,489 BTC into an Aug. 8 build that protects them if prices hasten below $110,000.

At some stage within the previous 24 hours, Deribit’s busiest trades had been short-dated build choices—contracts that repay if bitcoin falls. The Aug. 29 contract with a $112,000 strike changed fingers for roughly 2,068 BTC, and the Aug. 15 $115,000 build traded roughly 1,632 BTC. Heavy ask for these draw back hedges has pushed end to-length of time implied volatility greater, displaying merchants are making ready for a doable pullback.

Alternate choices expiry knowledge finds focus spherical Aug. 29, Sept. 26, and Dec. 26, with vital notional charge stacked in each calls and locations. Aug. 29 holds the heaviest balance, heavily weighted toward locations nevertheless with tough call hobby at $120,000 and $124,000 strikes.

Deribit’s choices quantity vogue has been rising gradually, with valuable spikes all over present label surges. The alternate has maintained a dominant piece of world BTC choices dispute, followed by Binance’s emerging presence.

Market watchers existing that elevated OI throughout each futures and choices recurrently precedes sessions of heightened volatility. With BTC’s label consolidating end to all-time highs, merchants seem split between hedging beneficial properties and pressing for additional upside.

The derivatives market’s present configuration — high notional publicity, bullish OI skew, and end to-length of time build-heavy volumes — suggests that whereas prolonged-length of time sentiment stays optimistic, merchants are positioning for imaginable short-length of time turbulence.