Bitcoin endured rising in model over the weekend, reaching a high of $98,300 after discovering main strengthen at $91,405.

The ultimate crypto by market cap has risen for six consecutive days, coinciding with ongoing count on and supply dynamics.

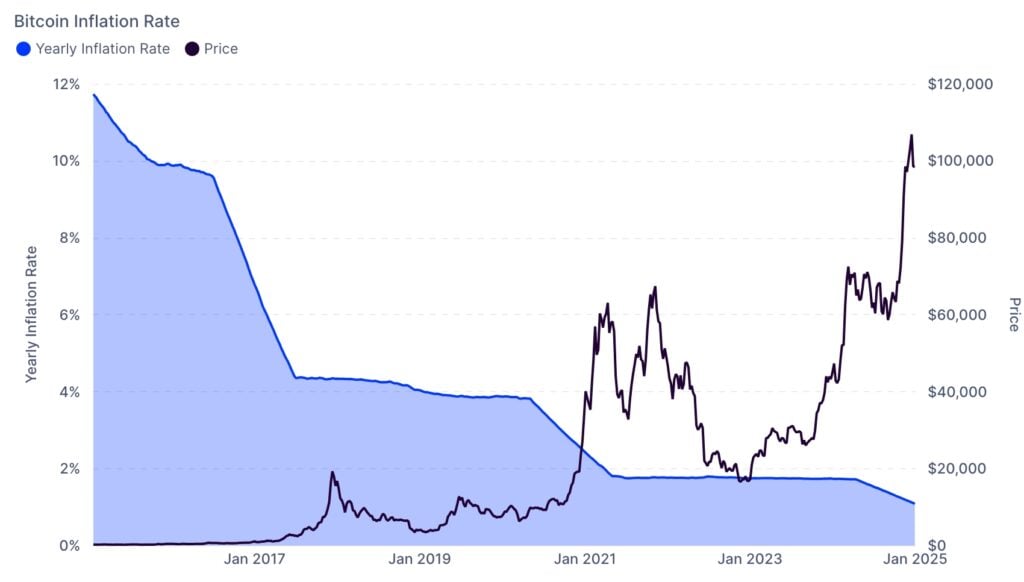

On the availability side, the mining disadvantage and hash rate metrics pick up jumped to their file highs for the reason that closing halving event in April. This pattern has pushed the coin’s inflation rate to 1.11%, worthy lower than the US user model index figure of two.7%.

It’s furthermore lower than 12%, when compared to 2016, whereas the amount of Bitcoin (BTC) in exchanges has endured falling.

On the completely different hand, count on is rising as ETF inflows continue. These funds pick up accrued over $128 billion in belongings, with BlackRock’s IBIT having over $54 billion.

MicroStrategy has furthermore endured its shopping spree and now holds over 450 coins. Polymarket customers assign a question to that the firm will pick up over 500,000 coins by March.

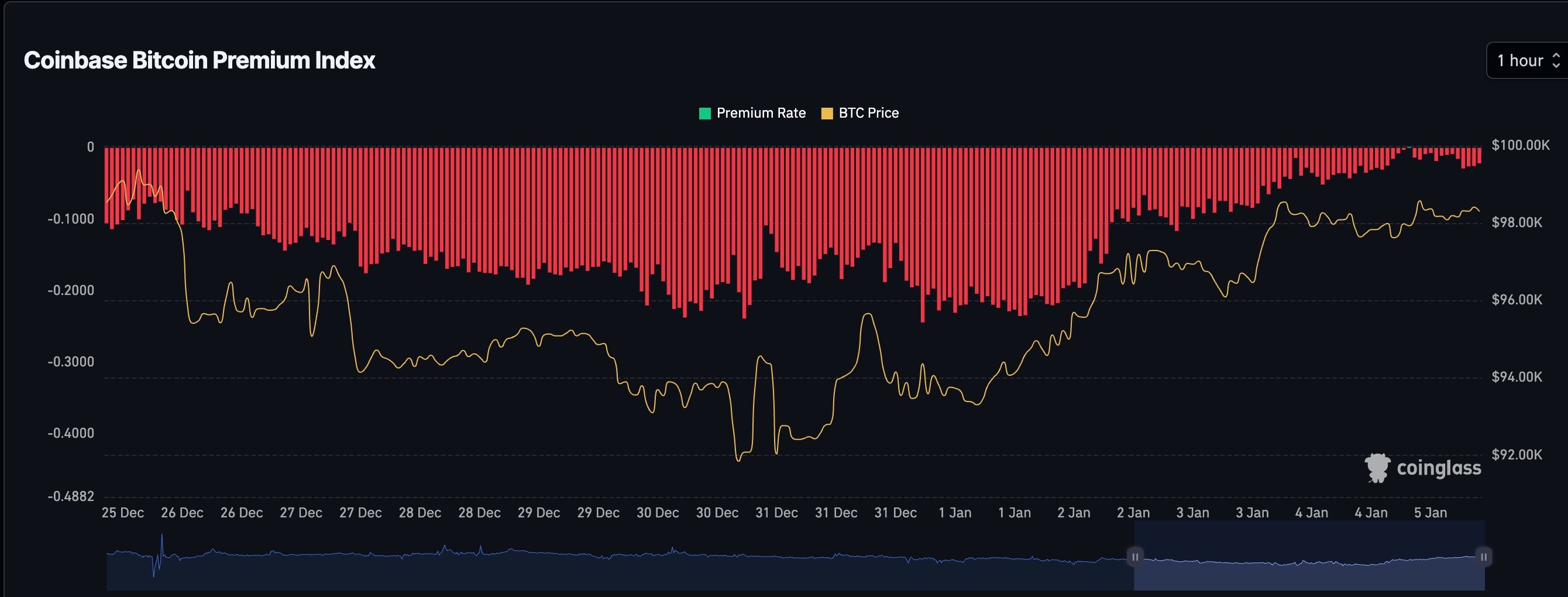

There are indicators that American customers are shopping extra Bitcoins. As effectively as to their ETF purchases, records presentations that the Coinbase Premium Index has recovered after falling sharply in December.

In line with CoinGlass, it has moved to minus 0.021, up from minus 0.24 in December.

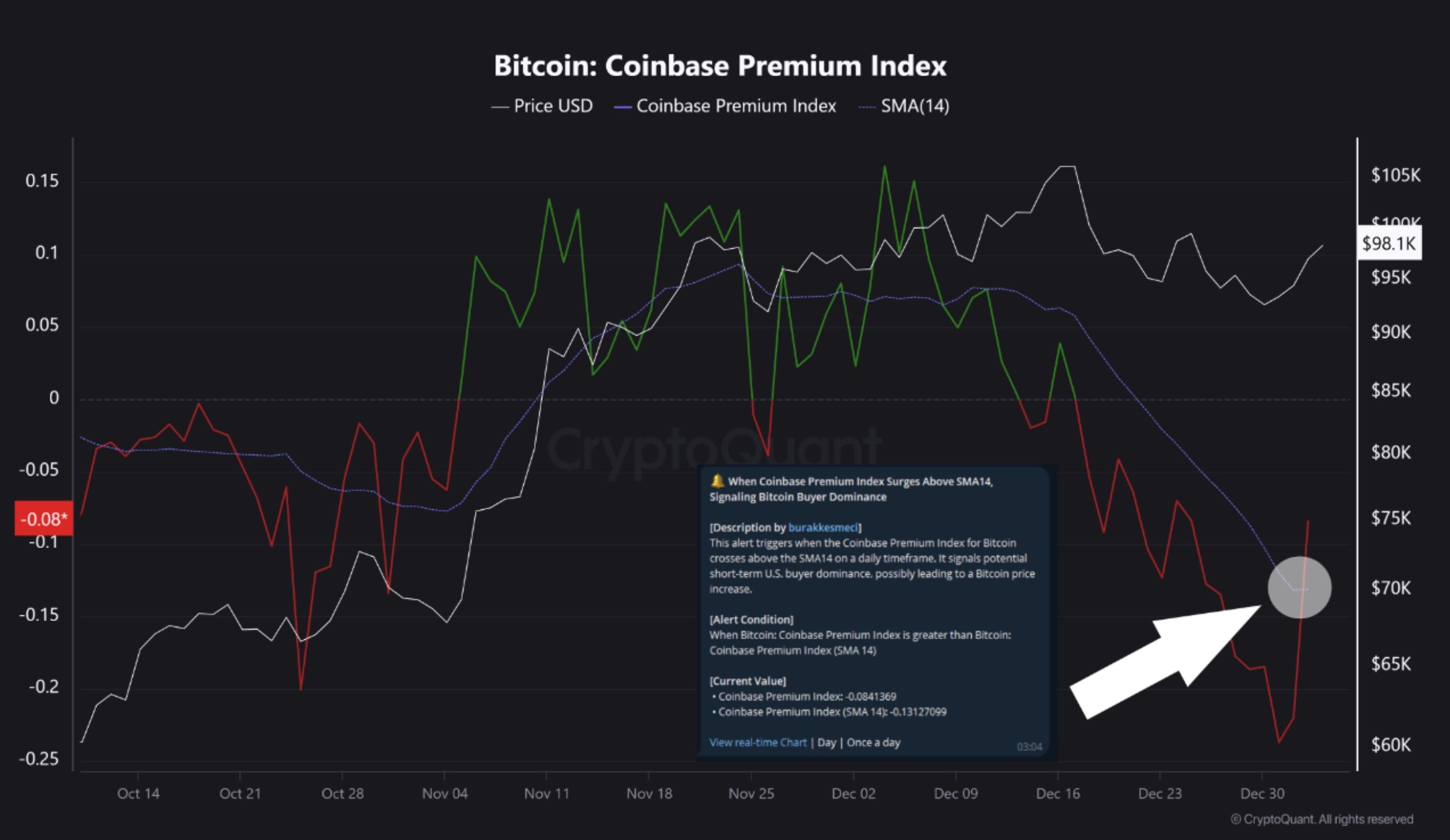

One other records by CryptoQuant presentations that the index has damaged above the 14-day Easy Transferring Moderate after 26 days — a obvious sign for prices.

The Coinbase Premium Index is an main figure that examines purchases by American customers, including institutions. Coinbase is basically the most extensively used exchange in the United States, so when it rises, it indicates that the final be conscious pool of capital is presumably collecting.

Additionally, Bitcoin faces completely different elementary catalysts forward, including President-elect Donald Trump’s inauguration and the upcoming FTX $16 billion distributions.

There are chances that some of the recipients of those funds will spend money on Bitcoin and completely different coins. Also, as crypto.news reported closing week, Bitcoin’s MVRV ratiois mild low — a sign that it’s a ways undervalued.

Bitcoin model prognosis

The each day chart presentations that BTC has rebounded in the previous few days. It has risen in the previous six straight days and consistently remained above the 50-day transferring realistic.

Bitcoin has furthermore chanced on tall strengthen on the most main strengthen at $91,400, the put it did no longer pass under a few times since December.

Ensuing from this reality, there are chances that this can continue rising as bulls draw the all-time high of $108,000. A pass above that level will point to extra good points, doubtlessly to the 38.2% Fibonacci Retracement point at $114,000.

On the opposite hand, forming a head and shoulders sample is unhealthy. This would well even merely lead to a bearish breakdown under $91,400.

Analyst’s bearish rob

Analyst Jacob King of WhaleWire no longer too lengthy up to now issued a stark warning about Bitcoin and the broader crypto market, citing indicators of a doubtless undergo market.

In a put up on social media, King highlighted a few developments, including MicroStrategy reducing its Bitcoin purchases, El Salvador seemingly transferring a ways flung from crypto-focused insurance policies, and BlackRock selling main BTC holdings.

MicroStrategy’s BTC buys are getting smaller and smaller, going through indecent dangers. El Salvador is reversing its Bitcoin insurance policies, BlackRock is dumping file-high amounts of BTC, and Tether mysteriously hasn’t minted one thing original in over 20 days, inflicting BTC to stagnate.

It’s miles the…

— Jacob King (@JacobKinge) January 3, 2025

King criticized MicroStrategy’s diagram as a “giant scam” and unsustainable. He furthermore pointed to Tether (USDT) pausing original minting for over 20 days, coinciding with the coin’s most contemporary model stagnation.

Labeling the put as “the peaceable forward of the storm,” King warned that a crypto downturn would maybe well align with a broader stock market shatter, urging customers to reassess their dangers.

At closing test Sunday, BTC became once shopping and selling at $98,035.