Bitcoin (BTC) broke above a brand unusual all-time high of $109,000 earlier than facing arresting resistance and pulling support. The hastily reversal underscored the psychological weight of the $110,000 stage, which now stands as a key hurdle for bulls.

Despite the rejection, whale accumulation has quietly elevated, signaling that exquisite holders would be positioning for every other leg up. Blended with bullish Ichimoku Cloud indicators, BTC appears to be building a technical foundation—though observe-via above resistance remains a really significant.

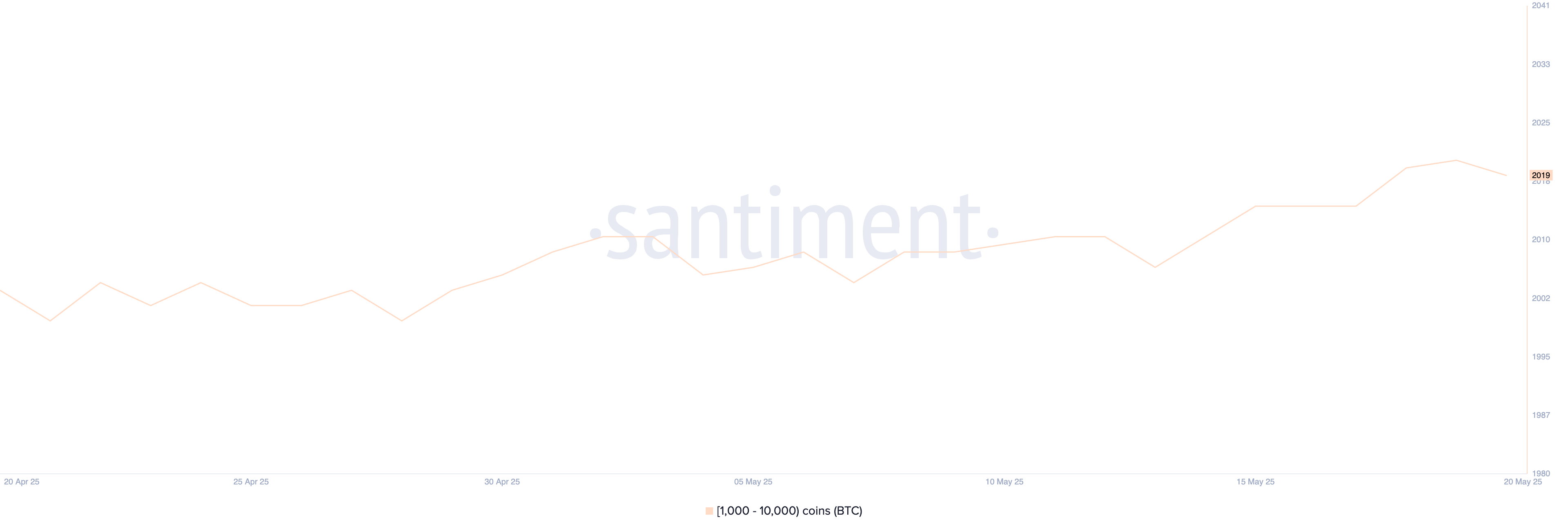

Whale Assignment Picks Up: What 2,019 Immense BTC Holders Would possibly Mean for the Market

The replacement of Bitcoin whales—wallets retaining between 1,000 and 10,000 BTC—elevated from 2,007 to 2,021 between Would possibly 13 and Would possibly 19, earlier than a diminutive dipping to 2,019 the day prior to this.

While the fetch alternate is little, the upward motion suggests renewed accumulation among exquisite holders all the arrangement via the unusual imprint vary. Fluctuations in this metric in overall think shifts in institutional or high-fetch-price investor sentiment, making it a indispensable signal for broader market trends.

Even a modest upward thrust in whale addresses can exhibit growing self assurance, critically all the arrangement via unsure or consolidating imprint motion.

Tracking Bitcoin whales is serious because these entities bear passable capital to persuade the market greatly.

Their habits in overall precedes indispensable imprint movements, both by providing liquidity pork up all the arrangement via pullbacks or riding rallies via exquisite-scale accumulation.

The unusual whale count suggests underlying pork up, with exquisite holders both positioning for a breakout or reinforcing lengthy-length of time conviction. If this kind of accumulation holds or resumes, it will also signal a bullish foundation forming beneath the outside, although imprint remains vary-sure within the rapid length of time.

Bitcoin’s Ichimoku Cloud Flashes Bullish Continuation Imprint

Bitcoin’s Ichimoku Cloud construction remains strongly bullish. The imprint is positioned effectively above the cloud, which is thick and inexperienced—indicating accurate pork up and a continuation of the upward type.

The Main Span A (the upper edge of the cloud) is rock climbing above Main Span B, confirming a particular momentum outlook.

This upward-sloping cloud suggests that the bulls are on top of things and the path of least resistance is peaceful to the upside.

The Tenkan-sen (blue line) is above the Kijun-sen (red line), sustaining a healthy bullish unfold between the 2. This alignment is a fundamental affirmation of non everlasting bullish strength.

Meanwhile, the Chikou Span (inexperienced lagging line) is effectively above the price candles, reinforcing the kind from a historic standpoint.

As lengthy as imprint remains above the blue and red lines—and the cloud remains supportive—the bullish scenario is probably to continue building strength.

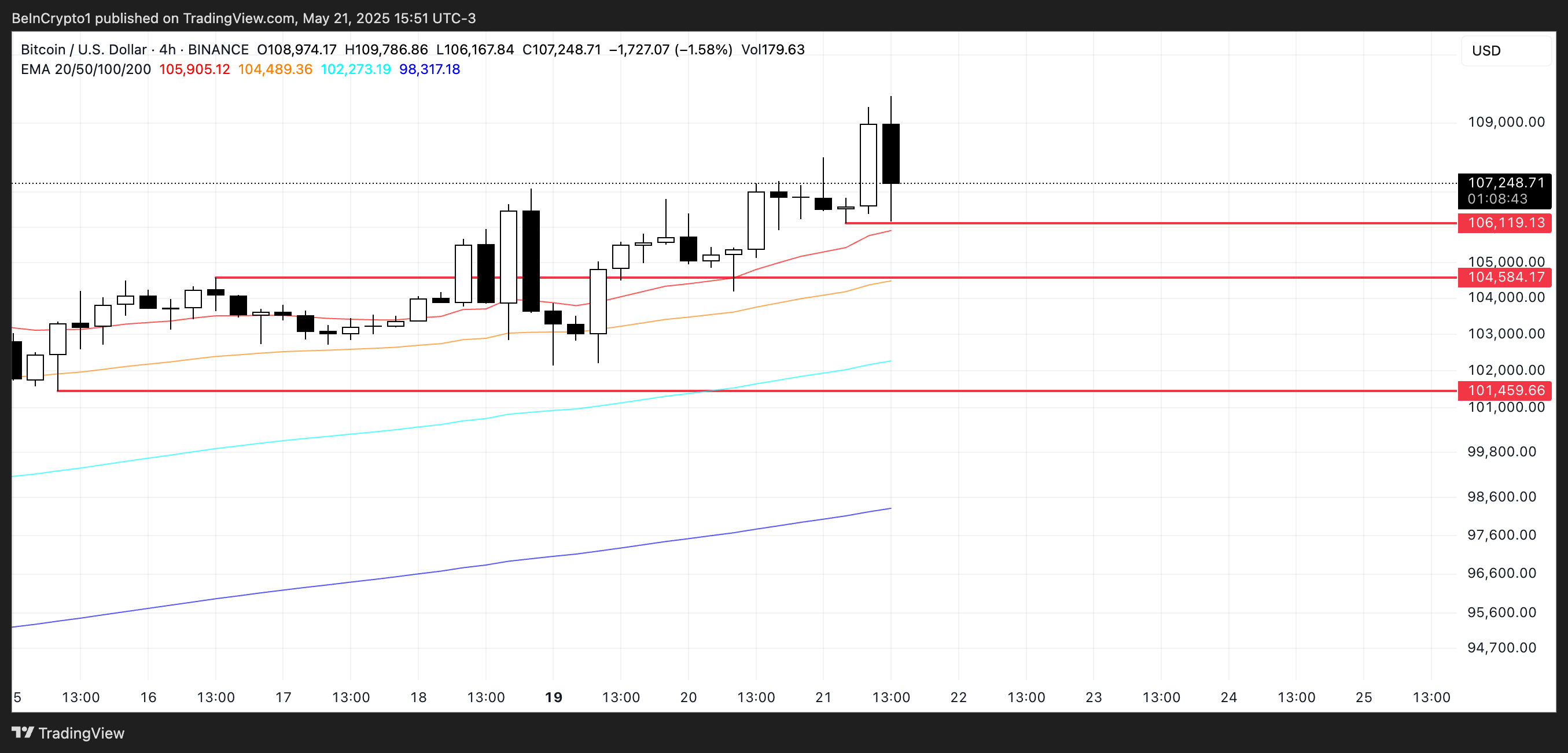

BTC Pulls Support After $109K Breakout — Will $106K Achieve?

Bitcoin hasty surged to a brand unusual all-time high above $109,000, however the breakout used to be hasty met with resistance.

The imprint retraced over 3% after touching the milestone, signaling that the $110,000 stage is acting as a indispensable psychological and technical barrier.

This pullback highlights how future bullish momentum can even hinge on BTC’s imprint skill to firmly conclude above that threshold. Unless that happens, imprint motion can even remain uneven or vary-sure conclude to unusual ranges.

On the plan back, Bitcoin’s nearest pork up lies spherical the $106,119 zone. If that stage fails to maintain, it will also situation off a deeper correction toward the next pork up conclude to $104,584.

A stronger bearish shift can even initiate the door to a bigger retracement toward the $101,549 order.

Total, the unusual rejection suggests bulls peaceful need stronger observe-via to flip key resistances into pork up and maintain the uptrend.