Bitcoin’s recent rally faces obstacles with bearish signals in China and low retail participation, despite a 7% accomplish in September.

Key Takeaways

- Bitcoin’s recent stamp surge is essentially driven by institutional traders, not retail.

- In spite of geopolitical tensions and market uncertainty, Bitcoin recorded a 7% accomplish in September.

Despite Bitcoin’s rally advance $66,000, key indicators counsel it’s not ready for a new all-time high. China-focused stablecoin records and low retail participation attach a slowdown, whereas broader world curiosity remains muted.

Even supposing institutional traders personal fueled Bitcoin’s recent stamp surge, the area in China paints a clear enlighten. Stablecoins admire USDT personal been procuring and selling at a bargain in China, which most continuously signifies bearish sentiment. This lack of query contrasts with US put ETFs’ inflows, suggesting that broader world investor curiosity in crypto have to aloof aloof be muted.

Interestingly, China has been some degree of curiosity for world markets, with the Chinese language executive’s recent financial stimulus ensuing in a historic buying for spree in shares.

In accordance with a tweet by Kobeissi Letter, Chinese language ETF call quantity hit 3.4 million contracts closing week, the absolute top since 2020. ETFs admire $FXI and $KWEB surged 18.5% and 26.8%, whereas China’s CSI 300 index posted its handiest week since 2008 with a 15.7% spike. Despite this boost in Chinese language equities, Bitcoin’s stamp aloof faces challenges in aligning with broader market optimism.

Retail investor participation, a key indicator of market euphoria, remains subdued. In previous bull markets, retail exercise surged, with Coinbase ranking as the quantity 1 downloaded app. Currently, the Coinbase app ranks 417th, a long way beneath its height positions trusty through outdated rallies.

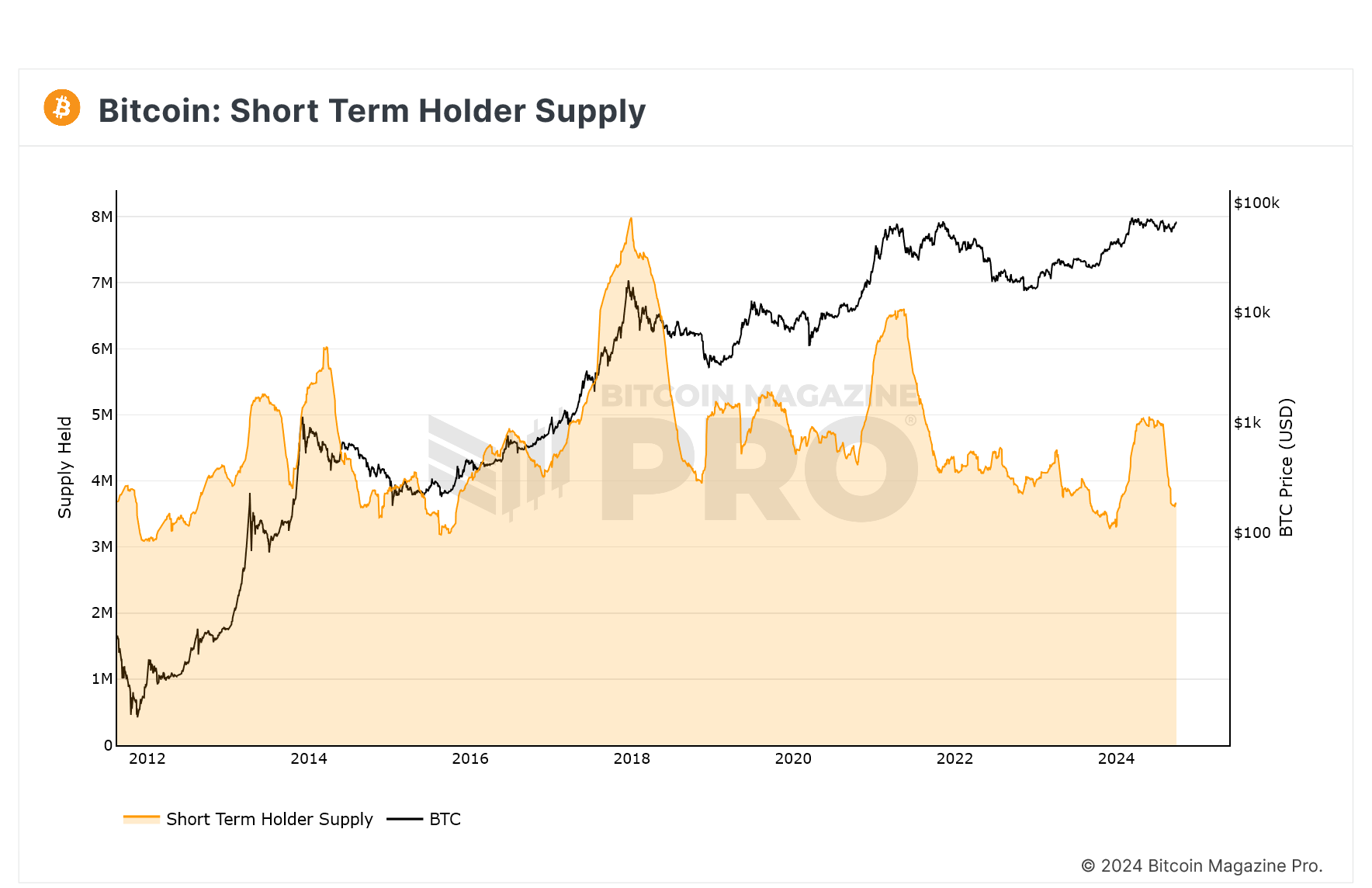

On-chain records shows quick-term holder provide is moreover declining, indicating that retail traders are usually not yet piling in. Decrease retail exercise would possibly indicate that Bitcoin’s rally have to aloof aloof personal room to grow earlier than hitting the tip.

BTC: Immediate Term Holder Provide (Bitcoin Journal)

Bitcoin’s stamp dropped by nearly 3% on the modern time as escalating tensions in the Center East, particularly Israel’s airstrike on Beirut, despatched shockwaves through world markets. In times of heightened geopolitical uncertainty, traders are likely to note safer sources admire gold and executive bonds, warding off dangerous investments admire crypto.

Additionally, US traders are making ready for key financial updates, including jobs records and Fed Chair Jerome Powell’s guidance on curiosity rates, delivered earlier on the modern time. Powell pressured that the Fed isn’t on a mounted direction and can assess conditions as they evolve, with seemingly fee cuts looking out on incoming records. With traders gazing for a seemingly 25-basis-point fee prick, this cautious skill has left the market in limbo, contributing to the continuing uncertainty.

No topic Bitcoin’s recent dip, the token is aloof region to shut September with a 7% accomplish, its handiest efficiency since 2013, according to CoinGlass metrics. Historically, October has been a trusty month for Bitcoin, earning the nickname “Uptober” as a consequence of its consistent clear returns.