Bitcoin continues to alternate sluggishly round the $110,000 stage and remains under stress compared to gold.

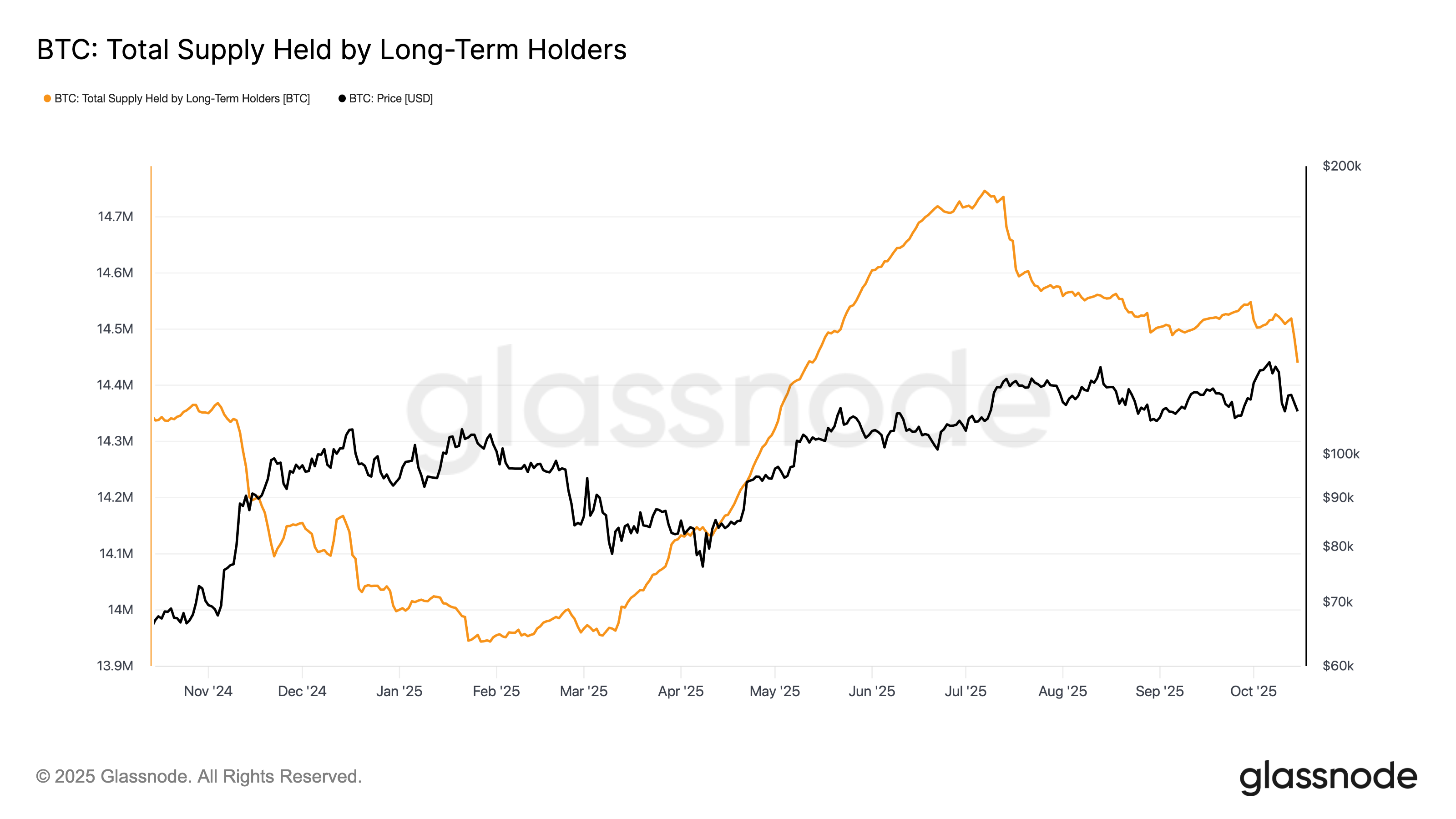

Onchain recordsdata from Glassnode shows that selling stress from long-term holders (LTHs) is intensifying. Glassnode defines LTHs as traders who fetch held bitcoin for 155 days or more.

For the time being, LTHs collectively defend roughly 14.5 million BTC, however they proceed to in the good deal of their positions. Within the previous few days alone, this cohort has supplied round 100,000 BTC. For the reason that peak of their holdings, they fetch offloaded more than 300,000 BTC for the reason that live of June.

Provided that in relation to all LTHs are on the 2d in profit, the records means that important profit-taking has been underway for the reason that starting of October.

There are several theories as to why this selling is occurring. Historically, Q4 has been a seasonally genuine period for bitcoin, and roughly 18 months after a halving event is mostly thought regarding the most bullish allotment of the cycle. Nonetheless, with the latest cycle not following this historical pattern, some traders will be exiting positions amid concerns that the four-year cycle theory which has done out in outdated cycles won’t defend this time.

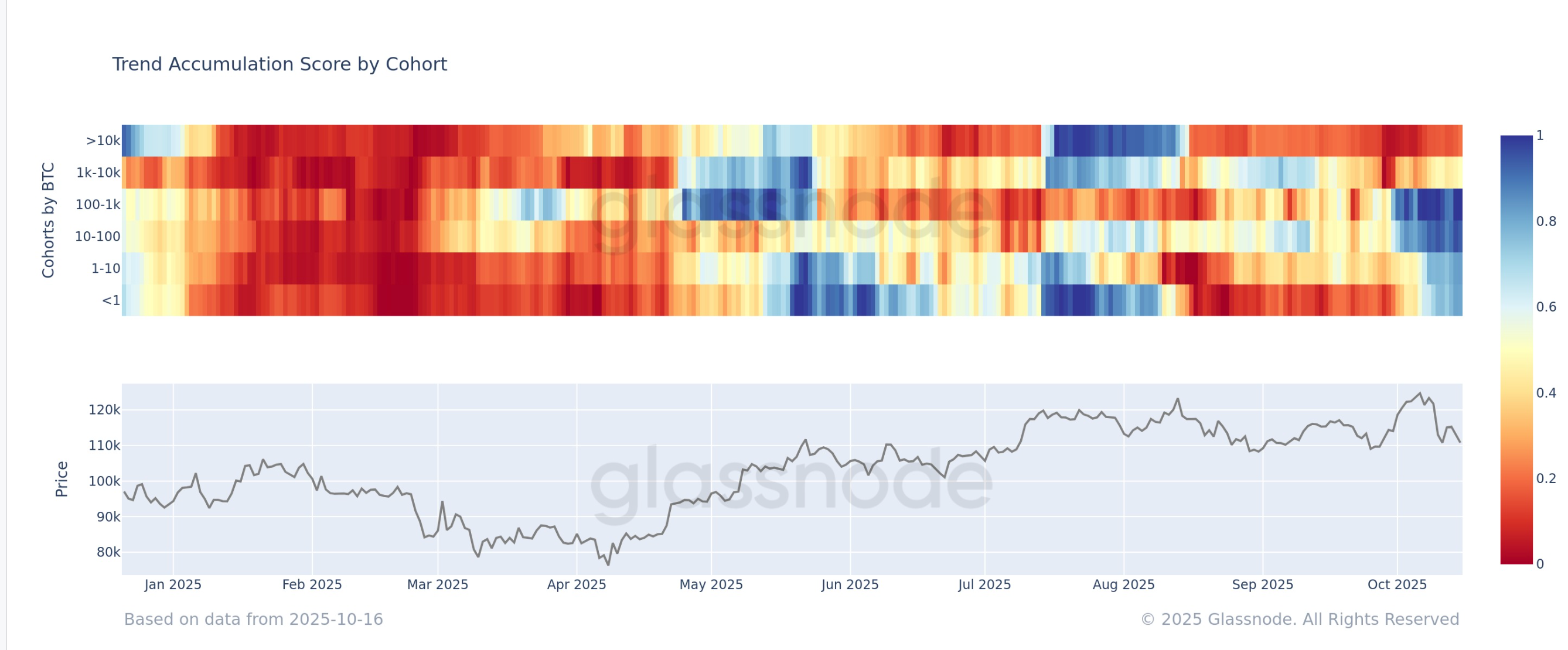

Glassnode recordsdata also highlights that whales are the principle distributors of bitcoin at latest. Per the buildup pattern bag by cohort, entities maintaining more than 10,000 BTC are in heavy distribution. Cohorts maintaining between 1,000 and 10,000 BTC fetch a unbiased stance with a bag of 0.5, whereas all cohorts maintaining fewer than 1,000 BTC are catch accumulators. Whales fetch continuously been catch sellers since August.