Knowledge reveals the Bitcoin market sentiment has damaged into the phenomenal greed territory following the cryptocurrency’s new high above $111,000.

Bitcoin Distress & Greed Index Has Shot Up Now not too long ago

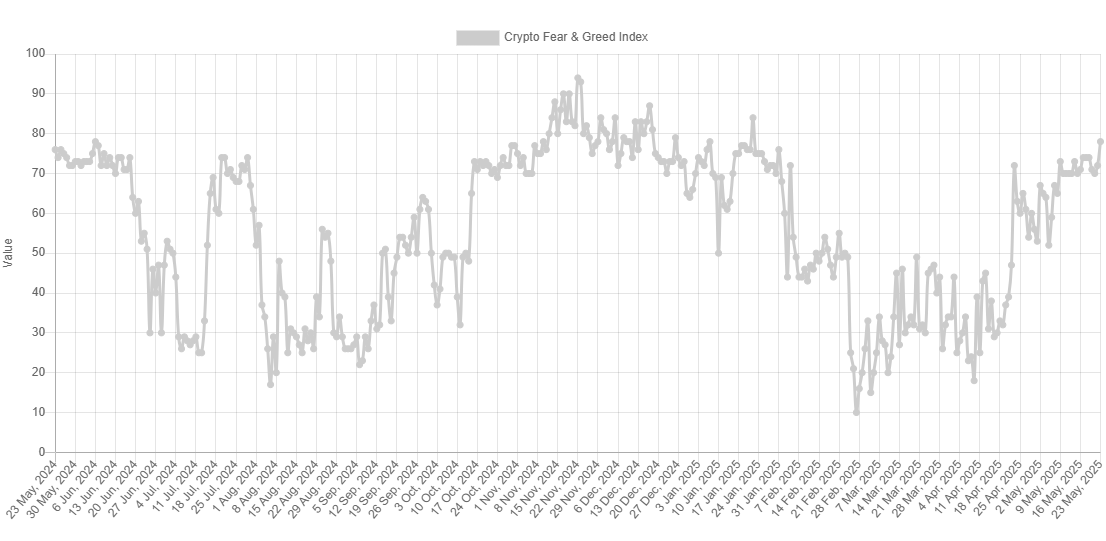

The “Distress & Greed Index” refers to an indicator created by Different that tells us about the sentiment held by the fashioned trader within the Bitcoin and wider cryptocurrency markets. The metric uses a numerical scale operating from 0-100 in deliver to symbolize the sentiment. All values above fifty three represent greed amongst the merchants, whereas those below 47 demonstrate terror. The index mendacity between these two cutoffs implies a get impartial mentality.

Besides these three major zones, there are additionally two ‘excessive’ regions called the phenomenal greed (above 75) and excessive terror (below 25). At this time, the market sentiment is contained within the previous of the 2, fixed with essentially the latest worth of the Distress & Greed Index.

Historically, the phenomenal sentiments agree with held a lot significance for Bitcoin and other digital sources, as they’ve been where major tops and bottoms agree with tended to originate. The relationship has been an inverse one, nonetheless, that formulation that an overly bullish atmosphere makes tops seemingly and an arrangement more than despair bottoms.

Some merchants exploit this truth in deliver to time their buy and promote moves. This buying and selling formulation is popularly identified as contrarian investing. Warren Buffet’s essential quote sums up the core concept: “be timorous when others are greedy, and greedy when others are timorous.”

With the Bitcoin sentiment now making a return into the phenomenal greed situation, it’s imaginable that followers of this philosophy is also starting to explore in opposition to the exit.

That said, the Distress & Greed Index has a worth of ‘unbiased’ 78 for the time being. For comparability, the December top came about at around 87 and the January one at 84. Earlier within the rally, the metric even hit an even bigger height of 94 in November.

As such, it’s imaginable that essentially the latest market is perhaps no longer moderately that overheated when it comes to sentiment unbiased but, assuming ask from the merchants doesn’t let off. It handiest stays to be considered, even though, how Bitcoin and other cryptocurrencies would evolve below this excessive greed.

Speaking of ask, whales agree with unbiased made a prime quantity of withdrawals from the Binance platform, as CryptoQuant neighborhood analyst Maartunn has pointed out in an X put up.

The indicator displayed within the chart is the “Change Netflow,” which tells us about the get quantity of Bitcoin that’s getting into into or out of the wallets associated to a centralized alternate, which, in this case, is Binance.

Clearly, the Binance Change Netflow has seen a colossal detrimental worth, implying that the merchants agree with shifted a distinguished quantity of money out of the alternate. More particularly, get outflows for the platform agree with stood at 2,190 BTC or about $237 million.

This can also potentially demonstrate ask from the immense-cash merchants for HODLing the cryptocurrency in self-custodial wallets.

BTC Trace

On the time of writing, Bitcoin is floating around $108,400, up over 4% within the closing seven days.