After a colorless week characterized by Bitcoin, Ethereum, and Solana prices either dumping or transferring sideways, prices bounced off strongly by the stop of closing week.

Of uncover, losses in Ethereum were arrested as prices recovered, rising from spherical $3,000. On the identical time, Bitcoin and Solana pushed larger, closing in on $70,000 and $200, respectively.

Curiosity In Bitcoin, Ethereum, And Solana Spikes

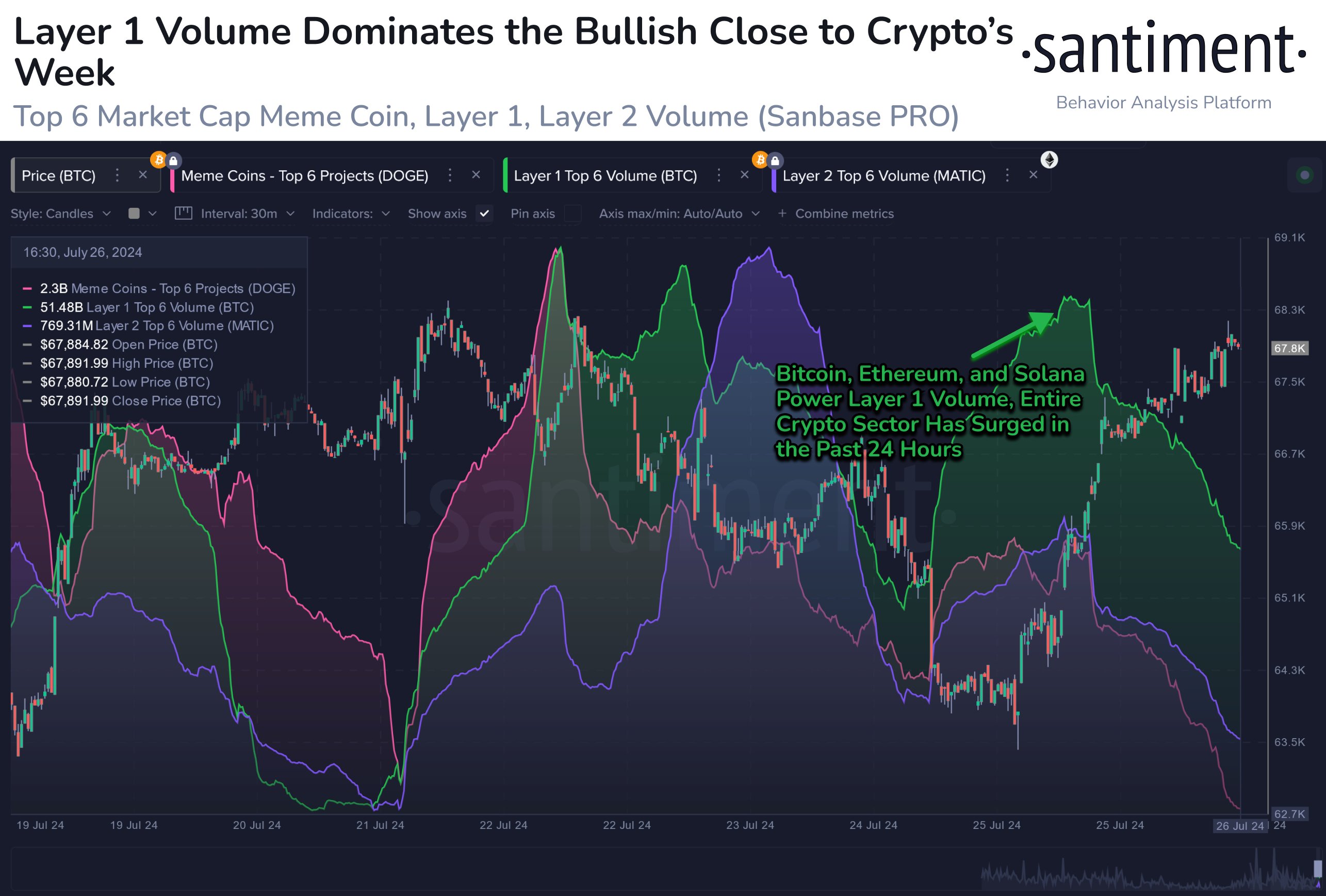

In step with Santiment data, despite weak point across the scene, there were hints of strength on the tail stop of closing week. Of uncover used to be renewed hobby, the assign Solana, Bitcoin, and Ethereum noticed a marked spike in procuring and selling volume.

When procuring and selling volume surges, it on the general suggests that market participants are animated and willing to earn interplay, particularly if prices are rising. Since these high cash were firm, rejecting losses, particularly from Friday, July 26, traders were in the equation, having a stare to capitalize.

As Santiment analysts eminent, how Bitcoin, Ethereum, and Solana fetch tends to impact the total market. If Ethereum rallies, as an illustration, it may maybe well maybe maybe earnings the broader layer-2 and 3 ecosystems. This can also push meme cash and even decentralized finance (DeFi) process even larger.

There earn been extra than one factors unhurried this hobby. In Bitcoin’s case, shifting regulatory level of view on the sphere’s most precious coin and increasing endorsement from politicians, particularly in the USA, can also uncover why extra are willing to get out relating to the coin.

The Influence Of Trump, Station Ethereum ETFs, And SOL Flipping BNB

Over the weekend, Donald Trump, the feeble president and the presidential candidate in the upcoming November election, delivered a keynote take care of on the recently concluded Bitcoin conference in Nashville. Trump expressed his give a enhance to for Bitcoin, announcing he would fetch The United States the house of crypto.

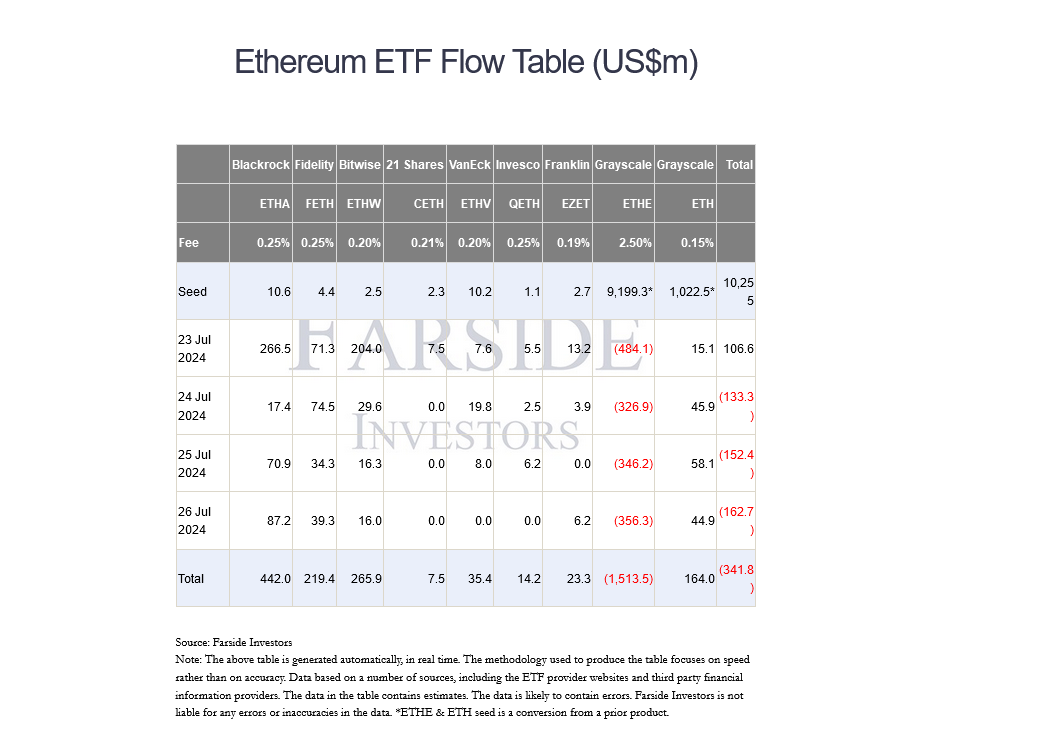

Meanwhile, eyes were on Ethereum following the approval of dwelling ETFs by the USA Securities and Alternate Commission (SEC). Despite the real fact that the by-product product began procuring and selling at leading bourses, including the NYSE and Cboe, inflows stay low.

If one thing, Farside data confirmed that by Friday, dwelling Ethereum ETFs had posted outflows for three consecutive days. Outflows from Grayscale’s ETHE chiefly drove this. Even amid this surprising pattern, BlackRock’s dwelling Ethereum ETF product noticed over $87 million inflows on July 26.

Traders additionally tracked Solana after the coin flipped BNB because the third most precious cryptocurrency, aside from stablecoins. In step with July 29, SOL commanded a market cap of $88.5 billion, whereas BNB stood at $86.5 billion, in step with CoinMarketCap data.

All the way thru the last few weeks, SOL has been edging larger. To assign in the numbers, SOL is up 56% from July lows. This can likely register unusual Q3 2024 highs if traders breach $200.